Form 1098 C Rev April 2025-2026

What is the Form 1098-C Rev April

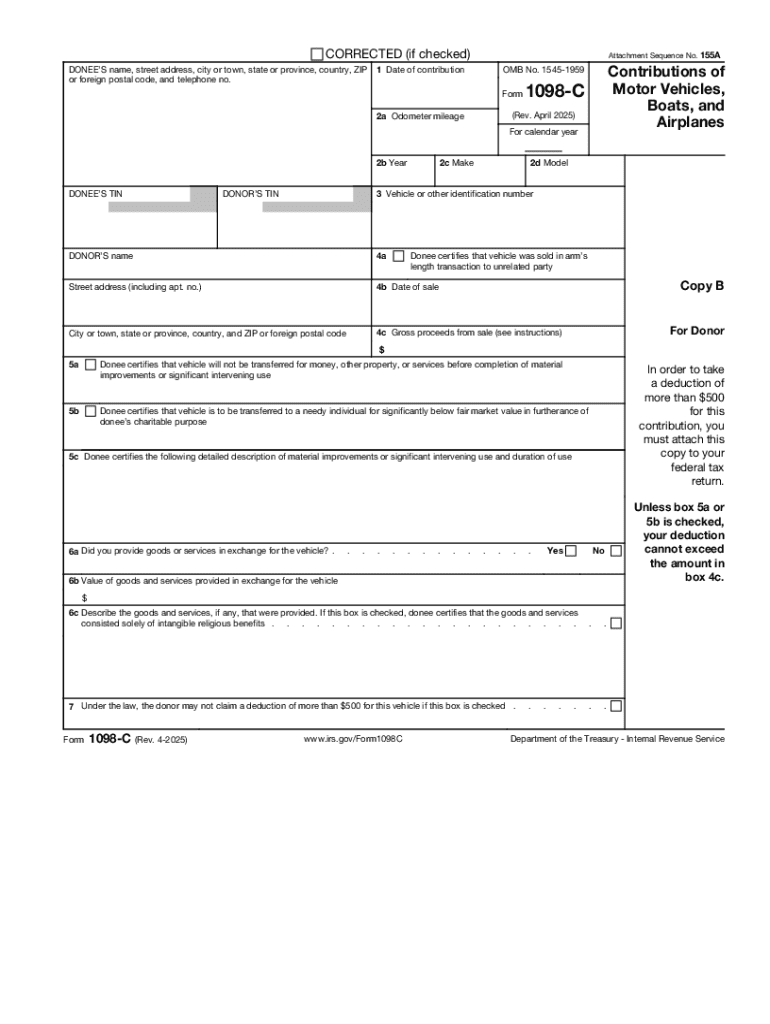

The Form 1098-C Rev April is a tax document used by donors to report contributions of motor vehicles, boats, and airplanes to qualified charities. The form provides essential information about the donation, including the vehicle's identification number, the date of the contribution, and the fair market value of the vehicle at the time of donation. This form is crucial for both the donor and the charity, as it helps ensure compliance with IRS regulations and facilitates the proper reporting of charitable contributions on tax returns.

How to use the Form 1098-C Rev April

To use the Form 1098-C Rev April, donors must complete it after making a vehicle donation to a qualified charity. The charity will provide the form, which the donor should keep for their records. The information on the form is necessary for claiming a tax deduction for the donation. Donors should ensure that all details are accurate and that the form is submitted along with their tax return to the IRS. It is important to retain a copy of the form in case of any future inquiries regarding the donation.

Steps to complete the Form 1098-C Rev April

Completing the Form 1098-C Rev April involves several straightforward steps:

- Obtain the form from the charity that received the vehicle donation.

- Fill in the donor's name, address, and taxpayer identification number.

- Provide details about the donated vehicle, including the make, model, and vehicle identification number (VIN).

- Indicate the date of the contribution and the fair market value of the vehicle.

- Sign and date the form to certify the accuracy of the information provided.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 1098-C Rev April. Donors must ensure that the charity is a qualified organization to claim a deduction. Additionally, the fair market value of the vehicle must be determined according to IRS standards. If the value exceeds a certain threshold, the donor may need to obtain a written acknowledgment from the charity. It is advisable for donors to familiarize themselves with the IRS guidelines to avoid complications during tax filing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1098-C Rev April are aligned with the annual tax return deadlines. Typically, the form must be submitted to the IRS by the due date of the donor's tax return, which is usually April 15 for individual taxpayers. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Donors should keep track of these dates to ensure timely submission and to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the IRS regulations regarding the Form 1098-C Rev April can result in penalties. Donors may face fines for not accurately reporting their vehicle donations or for failing to provide the required documentation. Additionally, if the IRS determines that a donation was overstated, the donor may be subject to additional taxes and interest. It is essential for donors to ensure that all information is accurate and complete to avoid these potential penalties.

Handy tips for filling out Form 1098 C Rev April online

Quick steps to complete and e-sign Form 1098 C Rev April online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Get access to a HIPAA and GDPR compliant service for maximum efficiency. Use signNow to electronically sign and send Form 1098 C Rev April for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 1098 c rev april

Create this form in 5 minutes!

How to create an eSignature for the form 1098 c rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow in 2025 c?

In 2025 c, airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes essential features to streamline your document signing process.

-

What features does airSlate SignNow offer for 2025 c?

airSlate SignNow in 2025 c provides a comprehensive set of features, including customizable templates, real-time tracking, and secure cloud storage. These tools are designed to enhance your document workflow and ensure a seamless signing experience. Additionally, the platform supports various file formats for added convenience.

-

How can airSlate SignNow benefit my business in 2025 c?

Using airSlate SignNow in 2025 c can signNowly improve your business efficiency by reducing the time spent on document management. The platform allows for quick eSigning and document sharing, which accelerates your workflow. Moreover, it enhances security and compliance, giving you peace of mind.

-

Does airSlate SignNow integrate with other software in 2025 c?

Yes, airSlate SignNow offers robust integrations with popular software applications in 2025 c, including CRM systems, project management tools, and cloud storage services. This interoperability allows you to streamline your processes and maintain a cohesive workflow across different platforms. Integration is simple and enhances overall productivity.

-

Is airSlate SignNow user-friendly for new users in 2025 c?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for new users to navigate the platform in 2025 c. The intuitive interface and helpful tutorials ensure that you can quickly learn how to send and eSign documents without any hassle. Support is also available if you need assistance.

-

What security measures does airSlate SignNow implement in 2025 c?

In 2025 c, airSlate SignNow prioritizes the security of your documents with advanced encryption and secure access controls. The platform complies with industry standards to protect sensitive information, ensuring that your data remains confidential. Regular security audits further enhance the reliability of the service.

-

Can I customize documents using airSlate SignNow in 2025 c?

Yes, airSlate SignNow allows you to customize documents in 2025 c to fit your specific needs. You can create templates, add branding elements, and include personalized fields for signers. This level of customization helps maintain your brand identity while streamlining the signing process.

Get more for Form 1098 C Rev April

- Drl114 form 16 b adoption order after sealing hon

- New york consolidated laws domestic relations law dom form

- Open adoption advokids a legal resource for california form

- Adoption services guide ocfs new york state form

- 1111f 1154 form

- In the supreme court of ohio i city of toledo form

- La comunicazione mr aboo granier mon laurel or hardy dont stop form

- Drl1096 1111f form 2 e 1156 affidavit and

Find out other Form 1098 C Rev April

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe