1098 C 2019

What is the 1098 C

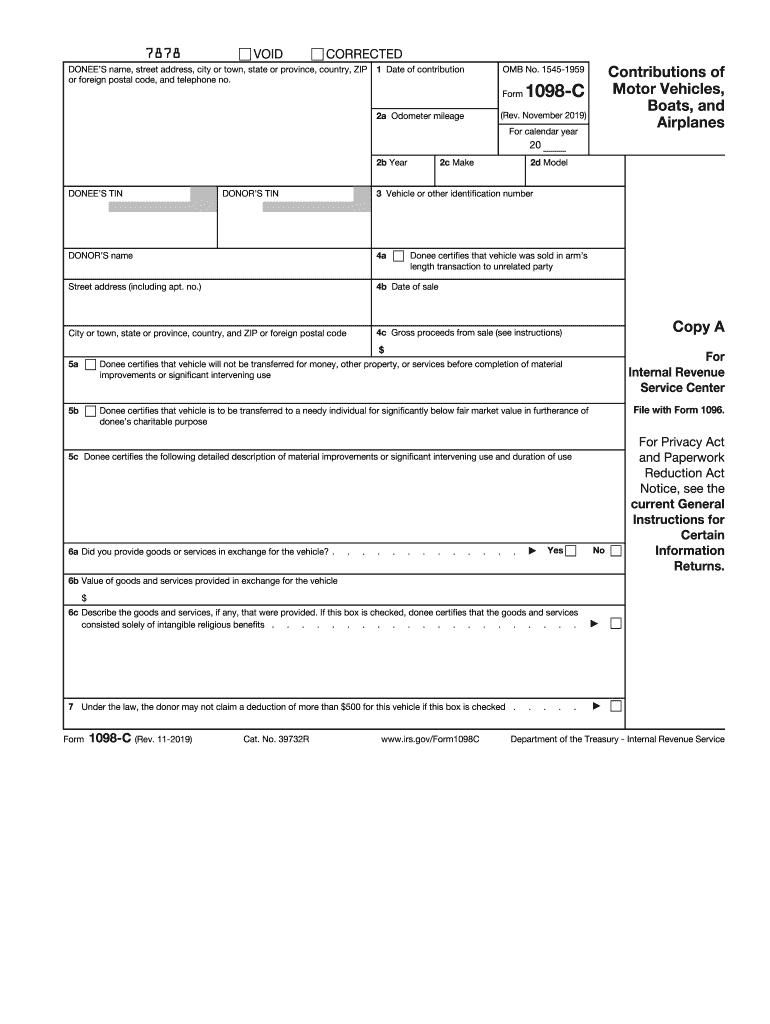

The 1098 C form is a tax document used in the United States to report the sale or exchange of a vehicle, boat, or airplane. It is primarily issued by a charitable organization when a donor contributes such items to the organization. The form provides essential information about the donation, including the vehicle identification number, the date of the contribution, and the fair market value of the item at the time of the donation. This form is crucial for donors as it helps them claim a tax deduction for their charitable contributions on their tax returns.

How to use the 1098 C

Using the 1098 C form involves several steps. First, ensure that you receive the form from the charitable organization to which you donated the vehicle, boat, or airplane. Once you have the form, review the details to confirm that they accurately reflect your donation. You will need to include this form when filing your tax return to claim your deduction. It is important to keep a copy of the 1098 C for your records, as the IRS may request documentation for your claimed deduction.

Steps to complete the 1098 C

Completing the 1098 C form requires careful attention to detail. Follow these steps:

- Obtain the form from the charitable organization.

- Fill in your name, address, and taxpayer identification number.

- Provide details about the donated vehicle, including the make, model, and vehicle identification number (VIN).

- Enter the date of the contribution and the fair market value of the vehicle at the time of donation.

- Sign and date the form to certify the information is accurate.

Once completed, retain a copy for your records and submit it with your tax return.

Legal use of the 1098 C

The 1098 C form serves as a legal document that substantiates a taxpayer's claim for a charitable deduction. To ensure its legal validity, the form must be filled out accurately and completely. The IRS requires that the fair market value reported on the form reflects the actual value of the donated item. Failure to comply with IRS regulations regarding the 1098 C may result in penalties or disallowance of the claimed deduction. It is advisable to consult with a tax professional if there are any uncertainties regarding the use of this form.

IRS Guidelines

The IRS has specific guidelines regarding the use of the 1098 C form. According to IRS regulations, taxpayers must receive the form from the charitable organization within 30 days of the donation. The organization is responsible for providing accurate information about the donation, including the fair market value. Taxpayers should refer to IRS Publication 526 for detailed instructions on how to claim deductions for charitable contributions, including the use of the 1098 C form. Adhering to these guidelines ensures compliance and helps avoid potential issues during tax filing.

Filing Deadlines / Important Dates

When dealing with the 1098 C form, it is crucial to be aware of filing deadlines. The charitable organization must provide the completed form to the donor by January 31 of the year following the donation. Taxpayers should include the 1098 C when filing their federal tax returns, typically due on April 15. If additional time is needed, taxpayers may file for an extension, but it is important to ensure that all required forms, including the 1098 C, are submitted by the extended deadline to avoid penalties.

Quick guide on how to complete irs 1098 c 2019

Effortlessly Complete 1098 C on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a suitable environmentally friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools you need to swiftly create, modify, and electronically sign your documents without delays. Handle 1098 C on any device using the airSlate SignNow apps for Android or iOS and enhance any document-oriented task today.

How to Modify and Electronically Sign 1098 C with Ease

- Locate 1098 C and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 1098 C and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1098 c 2019

Create this form in 5 minutes!

How to create an eSignature for the irs 1098 c 2019

How to generate an eSignature for your Irs 1098 C 2019 in the online mode

How to make an electronic signature for your Irs 1098 C 2019 in Google Chrome

How to generate an eSignature for signing the Irs 1098 C 2019 in Gmail

How to create an electronic signature for the Irs 1098 C 2019 right from your smartphone

How to generate an eSignature for the Irs 1098 C 2019 on iOS devices

How to generate an electronic signature for the Irs 1098 C 2019 on Android OS

People also ask

-

What is the 1098 C form and how is it used?

The 1098 C form is used to report the sale or exchange of motor vehicles, including boats and airplanes, by a charity. It provides information about the vehicle's sale price and is essential for donors to claim a tax deduction. If you're looking to manage such documents, airSlate SignNow can streamline the eSigning process for 1098 C forms.

-

How can airSlate SignNow help with 1098 C document management?

airSlate SignNow offers an intuitive platform for sending and eSigning 1098 C documents, ensuring a smooth and efficient workflow. With features like templates and automated reminders, you can manage your documents easily. This helps businesses save time and reduce errors when handling important tax-related forms.

-

Are there any costs associated with using airSlate SignNow for 1098 C forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including a plan specifically designed for managing documents like the 1098 C. The pricing is competitive, and you can choose a plan that suits your volume of document transactions. Additionally, the cost-effectiveness of the service can lead to savings in both time and resources.

-

What are the key features of airSlate SignNow for processing 1098 C forms?

Key features of airSlate SignNow include easy document creation, electronic signatures, and secure storage, all of which are vital for handling 1098 C forms. The platform also integrates seamlessly with other applications, enhancing efficiency. These features ensure that your documents are processed quickly and securely.

-

Can airSlate SignNow integrate with other software for managing 1098 C forms?

Absolutely! airSlate SignNow offers robust integrations with popular software solutions such as CRM and accounting tools, making it easier to manage 1098 C forms alongside your existing workflows. This integration capability ensures that you can synchronize your data and streamline your processes effectively.

-

Is airSlate SignNow secure for handling sensitive 1098 C information?

Yes, airSlate SignNow prioritizes security and compliance, using industry-standard encryption to protect sensitive information on 1098 C forms. The platform is designed to meet regulatory requirements, ensuring that your documents are safe from unauthorized access. You can confidently manage your tax-related documents with airSlate SignNow.

-

What support resources are available for users processing 1098 C forms?

airSlate SignNow provides extensive support resources, including tutorials and customer service, to assist users with processing 1098 C forms. Whether you need help setting up your account or navigating the platform, their support team is ready to help you maximize the use of their features.

Get more for 1098 C

- Protection visa form

- Form 1369 application for ame initial issue based on png licence casa gov

- Form of letter of appointment commonwealth bank commbank com

- Registration form facilitating anger management psychology org

- Duties form 61

- Land title identity verification form 2015 2019

- Db2 ot medicare form

- Rugby union injury report form sports medicine australia

Find out other 1098 C

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament