C Form 2015

What is the C Form

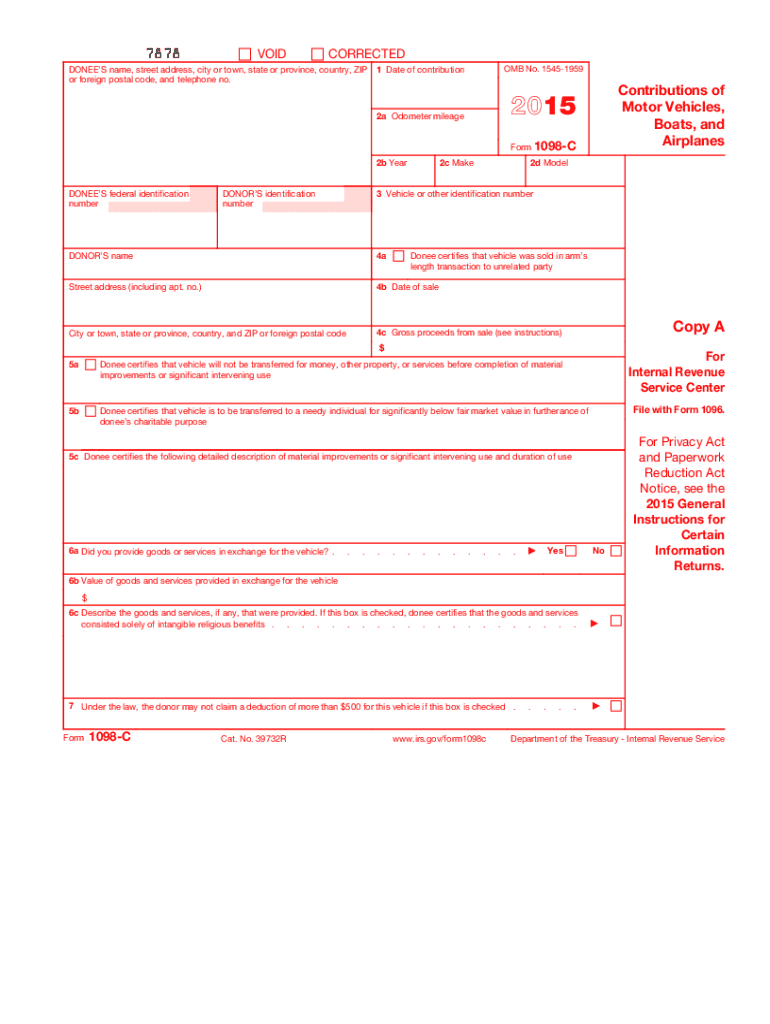

The C Form is a crucial document used primarily for tax purposes in the United States. It is specifically designed for reporting income and is typically utilized by self-employed individuals and certain business entities. This form helps taxpayers accurately disclose their earnings to the Internal Revenue Service (IRS) and ensures compliance with federal tax regulations. Understanding the C Form is essential for individuals and businesses to maintain proper tax records and fulfill their legal obligations.

How to use the C Form

Using the C Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial information, including income from various sources, expenses, and deductions. Next, fill out the form by entering your details in the designated sections, ensuring that all figures are precise. Once completed, review the form for any errors or omissions. Finally, submit the C Form to the IRS by the appropriate deadline, either electronically or via mail, depending on your preference.

Steps to complete the C Form

Completing the C Form requires careful attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, such as income statements and receipts for expenses.

- Start filling out the form by entering your personal information, including your name, address, and Social Security number.

- Report your income by listing all sources of earnings, ensuring to include any applicable deductions.

- Review your entries for accuracy, checking that all calculations are correct.

- Sign and date the form before submission, confirming that the information provided is truthful and complete.

Legal use of the C Form

The C Form must be used in accordance with IRS regulations to ensure its legal validity. It is essential to provide accurate and truthful information, as submitting false information can lead to penalties or audits. The form serves as an official record of income and expenses, making it vital for tax compliance. Additionally, retaining copies of submitted forms and related documents is advisable for future reference and potential audits.

Filing Deadlines / Important Dates

Timely submission of the C Form is critical to avoid penalties. The IRS typically sets specific deadlines for filing, which may vary based on your tax situation. Generally, the C Form must be filed by April 15 of the following tax year. However, if you require an extension, you may file for one, but ensure that any taxes owed are paid by the original deadline to avoid interest and penalties.

Examples of using the C Form

The C Form is commonly used in various scenarios, such as:

- A self-employed individual reporting income from freelance work.

- A small business owner detailing earnings and expenses for the fiscal year.

- A contractor disclosing income received from multiple clients.

These examples highlight the versatility of the C Form in capturing diverse income sources and ensuring compliance with tax obligations.

Quick guide on how to complete 2015 c form

Complete C Form effortlessly on any device

Web-based document management has become popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the correct document and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle C Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign C Form with ease

- Find C Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your modifications.

- Select your preferred method for sending your form, be it via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your preferred device. Modify and eSign C Form and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 c form

Create this form in 5 minutes!

How to create an eSignature for the 2015 c form

The best way to make an eSignature for a PDF online

The best way to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

How to generate an eSignature for a PDF document on Android

People also ask

-

What is a C Form and how is it used?

A C Form is a legal document used for various business purposes, primarily for the transfer of goods and services. In the context of airSlate SignNow, it can be electronically signed and sent, streamlining the approval process. This ensures that your business transactions are compliant and documented efficiently.

-

How does airSlate SignNow facilitate the signing of a C Form?

With airSlate SignNow, you can easily create, send, and eSign a C Form from any device. Our platform provides an intuitive interface that simplifies the signing process, allowing users to complete the document in just a few clicks. This enhances workflow efficiency and reduces turnaround time.

-

What features does airSlate SignNow offer for managing C Forms?

airSlate SignNow offers a variety of features designed to make managing C Forms easier, including customizable templates, status tracking, and automated reminders. These tools help ensure that C Forms are completed promptly and accurately, keeping your business organized and compliant.

-

Is airSlate SignNow cost-effective for sending C Forms?

Yes, airSlate SignNow is a cost-effective solution for sending C Forms. With transparent pricing models, businesses can access essential eSigning features at an affordable rate. This helps organizations save on paper costs and improves overall efficiency.

-

Can I integrate airSlate SignNow with other software solutions for C Form management?

Absolutely! airSlate SignNow integrates seamlessly with a wide range of software applications, enabling businesses to manage their C Forms in conjunction with their existing tools. This compatibility enhances your workflow and ensures that all systems work cohesively.

-

What are the benefits of using airSlate SignNow for C Forms?

Using airSlate SignNow for C Forms provides numerous benefits, including enhanced security, faster processing times, and improved compliance. The software also allows for easy tracking of documents, ensuring that all parties are kept informed throughout the signing process.

-

Is there a mobile app for eSigning C Forms with airSlate SignNow?

Yes, airSlate SignNow offers a mobile app that lets you eSign C Forms on-the-go. The app maintains all the robust features of the web platform, allowing users to create, sign, and send documents anytime, anywhere, ensuring flexibility and accessibility.

Get more for C Form

- The official web site for the state of new jerseyagency form

- Form pi e notification of change to qualified facilities tceq

- Form ac2709 fill online printable fillable blankpdffiller

- Va form 3288 request for and consent to

- Repayment assistance plan application sde0080e form

- This application form is to be used by individuals who are

- Immigrant investorstuart investments form

- Umich housing assignment form

Find out other C Form

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF