C Form 2016

What is the C Form

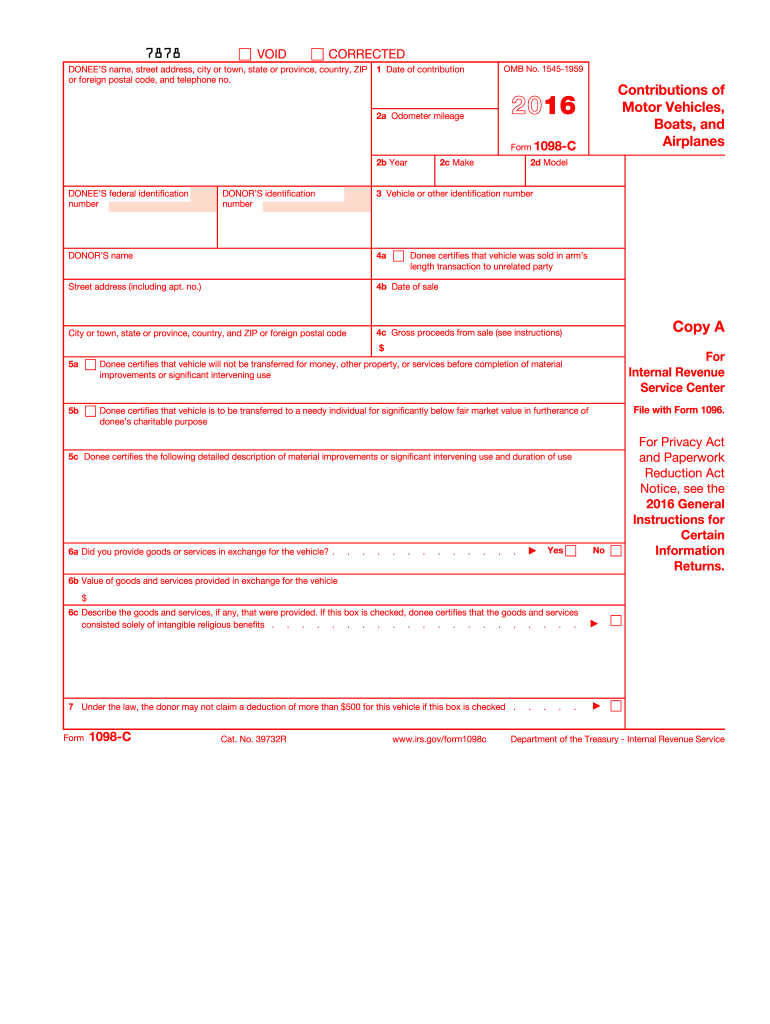

The C Form is a crucial document used primarily for tax purposes in the United States. It serves as a means for taxpayers to report specific types of income or transactions to the Internal Revenue Service (IRS). Understanding the C Form is essential for individuals and businesses to ensure compliance with tax regulations. It typically includes details about income sources, deductions, and credits that may apply to the taxpayer's situation.

How to use the C Form

Using the C Form involves several steps to ensure accurate reporting. Taxpayers must first gather all necessary financial documents, such as income statements and receipts for deductible expenses. Once the relevant information is collected, individuals can complete the form either digitally or by hand. After filling out the form, it is important to review all entries for accuracy before submission to avoid potential penalties. The completed C Form can then be submitted electronically or mailed to the IRS, depending on the taxpayer's preference.

Steps to complete the C Form

Completing the C Form requires attention to detail. Here are the key steps:

- Gather all financial documents, including income statements and expense receipts.

- Fill out the form, ensuring that all income sources and deductions are accurately reported.

- Double-check all entries for accuracy, including Social Security numbers and financial figures.

- Sign and date the form to validate it.

- Submit the form electronically or mail it to the appropriate IRS address.

Legal use of the C Form

The C Form must be used in accordance with IRS guidelines to ensure its legal validity. This means that all information reported must be truthful and complete. Misrepresentation or failure to report income can lead to legal consequences, including fines or audits. It is advisable to consult a tax professional if there are uncertainties regarding the completion or submission of the C Form to ensure compliance with all applicable laws.

Required Documents

To accurately complete the C Form, certain documents are required. These typically include:

- W-2 forms from employers, reporting wages and tax withheld.

- 1099 forms for other income sources, such as freelance work or interest earned.

- Receipts for deductible expenses related to the income reported.

- Previous year's tax return for reference.

Filing Deadlines / Important Dates

Filing deadlines for the C Form are crucial to avoid penalties. Generally, the form must be submitted by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply if they need more time to file their returns.

Quick guide on how to complete 2016 c form

Effortlessly Prepare C Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Work on C Form using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to Edit and Electronically Sign C Form with Ease

- Find C Form and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome searches for forms, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign C Form to ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 c form

Create this form in 5 minutes!

How to create an eSignature for the 2016 c form

How to create an eSignature for your 2016 C Form in the online mode

How to generate an eSignature for the 2016 C Form in Google Chrome

How to generate an electronic signature for putting it on the 2016 C Form in Gmail

How to generate an eSignature for the 2016 C Form straight from your mobile device

How to make an eSignature for the 2016 C Form on iOS

How to generate an electronic signature for the 2016 C Form on Android OS

People also ask

-

What is a C Form and why is it important?

A C Form is a crucial document used in the context of tax compliance for interstate sales in India. It serves as a declaration that enables the seller to charge a lower tax rate for goods sold to registered dealers. Understanding the C Form and its importance can help businesses save on tax and streamline their purchasing processes.

-

How can airSlate SignNow help with C Form management?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign C Forms quickly and securely. With our user-friendly interface, you can easily manage multiple C Forms, ensuring compliance and reducing the risk of errors. This makes handling C Forms a hassle-free experience for your business.

-

Is there a cost associated with using airSlate SignNow for C Forms?

Yes, airSlate SignNow offers a range of pricing plans to accommodate different business needs, including options for managing C Forms. Our pricing is competitive and designed to provide great value for the features offered. You can choose a plan that best fits your requirements and budget.

-

What features does airSlate SignNow offer for C Form processing?

airSlate SignNow includes features like customizable templates, automated workflows, and real-time tracking for C Form processing. These tools enhance efficiency and ensure that your documents are managed effectively. Additionally, our eSigning capabilities allow for quick approvals, saving you time.

-

Can I integrate airSlate SignNow with other software for C Form handling?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your C Form handling process. Whether you use CRM systems, accounting software, or document management tools, our platform can connect with them to optimize your workflow.

-

How secure is my data when using airSlate SignNow for C Forms?

At airSlate SignNow, we prioritize the security of your data, especially when handling sensitive documents like C Forms. Our platform employs industry-standard encryption and compliance measures to protect your information. You can trust us to keep your data safe while you manage your C Forms.

-

What are the benefits of using airSlate SignNow for C Forms compared to traditional methods?

Using airSlate SignNow for C Forms offers numerous benefits over traditional paper-based methods. You’ll experience faster processing times, reduced paperwork, and easier tracking of document status. Plus, our eSigning feature allows for quick approvals, making the entire process more efficient.

Get more for C Form

- Dog tag requisition form

- Ifta 100 mn 2006 form

- Form representative

- Emory university hospital midtown pre registration form

- Federal form 5227 split interest trust information return

- Tempus unlimited new hire paperwork 479115469 form

- Transaction form bullion and local the perth mint

- Unsatisfied judgment instructions dsd sr17 13ill form

Find out other C Form

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure