1098 C Form 2017

What is the 1098 C Form

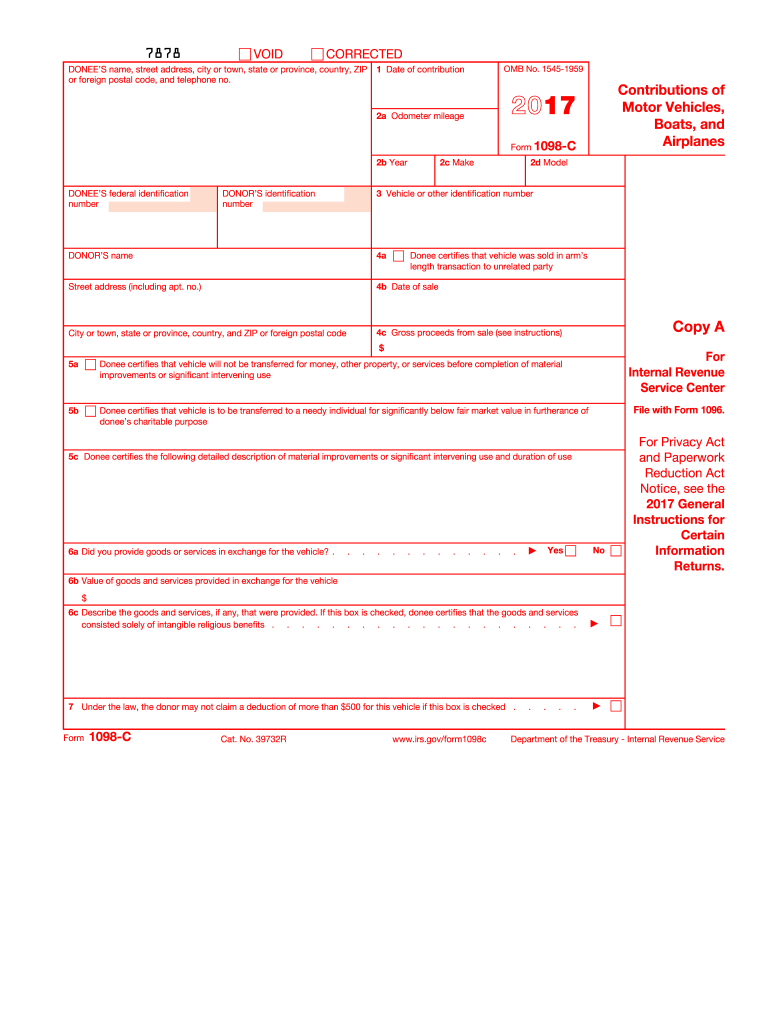

The 1098 C Form is an IRS tax document used to report the contribution of a vehicle, boat, or airplane to a charitable organization. This form provides essential details about the donated item, including its description, the date of the contribution, and the fair market value. It is crucial for taxpayers who wish to claim a deduction for their charitable donations, ensuring compliance with IRS regulations.

How to use the 1098 C Form

To effectively use the 1098 C Form, donors must fill it out accurately to reflect the details of their vehicle donation. This includes entering the donor's information, the charity's details, and specifics about the vehicle, such as its make, model, and VIN. After completing the form, it should be submitted along with the donor's tax return to claim the appropriate deduction. Retaining a copy for personal records is also advisable.

Steps to complete the 1098 C Form

Completing the 1098 C Form involves several key steps:

- Gather necessary information about the vehicle, including its VIN, make, model, and year.

- Obtain the charity's details, such as its name, address, and tax identification number.

- Fill in the donor's information, including name, address, and Social Security number.

- Provide the date of the contribution and the fair market value of the vehicle.

- Sign and date the form to validate the information provided.

Legal use of the 1098 C Form

The legal use of the 1098 C Form is essential for taxpayers seeking to deduct charitable contributions on their tax returns. To ensure compliance with IRS guidelines, the form must be completed accurately and submitted timely. The IRS requires that the form be issued by the charity to the donor, confirming the donation's legitimacy and the fair market value claimed. Failure to adhere to these legal requirements may result in penalties or disallowance of the deduction.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the 1098 C Form. Generally, the charity must provide the completed form to the donor by January 31 of the year following the donation. Donors should include the information from the 1098 C Form when filing their tax returns, typically due on April 15. Being mindful of these dates helps ensure compliance and maximizes potential tax benefits.

Who Issues the Form

The 1098 C Form is issued by the charitable organization that receives the vehicle donation. It is the responsibility of the charity to provide the donor with a completed form that details the donation. This ensures that the donor has the necessary documentation to claim a tax deduction. Charities must maintain accurate records of all donations and provide the 1098 C Form in a timely manner to comply with IRS regulations.

Quick guide on how to complete 1098 c form 2017

Prepare 1098 C Form seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It provides an ideal eco-friendly substitute to traditional printed and signed documentation, as you can access the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without delays. Handle 1098 C Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to adjust and electronically sign 1098 C Form effortlessly

- Obtain 1098 C Form and click Get Form to initiate.

- Utilize the resources we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 1098 C Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1098 c form 2017

Create this form in 5 minutes!

How to create an eSignature for the 1098 c form 2017

How to create an electronic signature for the 1098 C Form 2017 online

How to create an electronic signature for your 1098 C Form 2017 in Chrome

How to create an eSignature for signing the 1098 C Form 2017 in Gmail

How to generate an eSignature for the 1098 C Form 2017 from your mobile device

How to create an eSignature for the 1098 C Form 2017 on iOS

How to make an eSignature for the 1098 C Form 2017 on Android devices

People also ask

-

What is a 1098 C Form and why is it important?

The 1098 C Form is a tax document used to report contributions of motor vehicles, boats, and airplanes to charitable organizations. It is essential for donors as it provides proof of the donation for tax deduction purposes. Understanding the 1098 C Form helps ensure that you can accurately report your charitable contributions and maximize your tax benefits.

-

How can airSlate SignNow help with the 1098 C Form?

airSlate SignNow streamlines the process of preparing and signing the 1098 C Form electronically. Our platform allows you to fill out, eSign, and send the form quickly, saving you time and ensuring compliance with tax regulations. With airSlate SignNow, you can manage your tax documents efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for the 1098 C Form?

Yes, airSlate SignNow offers various pricing plans to fit your needs, including options for businesses that frequently handle documents like the 1098 C Form. Our pricing is competitive and designed to provide value through features that enhance productivity and document management. Check our website for the latest pricing details and choose a plan that suits your requirements.

-

What features does airSlate SignNow offer for managing the 1098 C Form?

airSlate SignNow provides a range of features for managing the 1098 C Form, including customizable templates, secure eSigning, and automated workflows. These features allow you to easily create, send, and track your tax documents, ensuring a smooth process from start to finish. Additionally, our user-friendly interface makes it simple for anyone to navigate and utilize these tools.

-

Can I integrate airSlate SignNow with other software for handling the 1098 C Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including CRM systems and cloud storage solutions, making it easier to manage the 1098 C Form. These integrations help streamline your workflow by connecting your existing tools and enhancing collaboration across your team. Explore our integration options to see how we can fit into your current setup.

-

Is airSlate SignNow secure for handling sensitive documents like the 1098 C Form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the 1098 C Form, are protected. We utilize advanced encryption and security measures to safeguard your data during transmission and storage. You can trust airSlate SignNow to handle your important tax documents securely.

-

How can I get started with airSlate SignNow for the 1098 C Form?

Getting started with airSlate SignNow for the 1098 C Form is simple! Just sign up for an account on our website, and you can access our powerful document management tools right away. Once you're set up, you can create and manage your 1098 C Form with ease.

Get more for 1098 C Form

Find out other 1098 C Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors