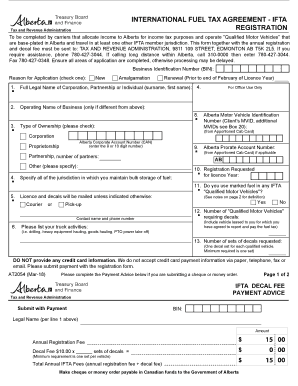

International Fuel Tax Agreement IFTA Regsitration Registration Form for International Fuel Tax Agreement IFTA 2021

Understanding the International Fuel Tax Agreement Registration Form

The International Fuel Tax Agreement (IFTA) Registration Form is a critical document for commercial vehicle operators who travel across state lines in the United States and Canada. This form allows businesses to report and pay fuel taxes to the appropriate jurisdictions. By participating in IFTA, operators simplify their tax obligations, as they only need to file one quarterly fuel tax report instead of multiple reports for each state. This agreement is designed to ensure fair taxation and compliance across different regions, making it essential for interstate trucking operations.

How to Use the IFTA Registration Form

Using the IFTA Registration Form involves several key steps. First, ensure that your business meets the eligibility criteria, which typically includes operating qualified motor vehicles. Next, gather all necessary documentation, such as your business license and vehicle information. Once you have the required details, fill out the form accurately, providing information about your business and the vehicles you operate. After completing the form, submit it to your state’s IFTA authority, either online or by mail, depending on the submission methods available in your state.

Steps to Complete the IFTA Registration Form

Completing the IFTA Registration Form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including your business license and vehicle registration details.

- Fill in the business information section, including the legal name and address of your business.

- Provide details about each vehicle that qualifies for IFTA, such as the vehicle identification number (VIN) and type of fuel used.

- Review the form for accuracy to avoid delays in processing.

- Submit the completed form to your state’s IFTA authority.

Required Documents for IFTA Registration

When applying for IFTA registration, several documents are typically required to ensure compliance and proper processing. These documents may include:

- Proof of business registration, such as a business license.

- Vehicle registration documents for each vehicle operating under IFTA.

- Identification numbers, including your Employer Identification Number (EIN).

- Any previous IFTA account information, if applicable.

Eligibility Criteria for IFTA Registration

To be eligible for IFTA registration, your business must meet specific criteria. Generally, you must operate qualified motor vehicles that travel in two or more jurisdictions. A qualified motor vehicle is defined as a vehicle that:

- Has two axles and a gross vehicle weight exceeding 26,000 pounds.

- Has three or more axles, regardless of weight.

- Is used in combination with a trailer or other vehicle, with a combined weight exceeding 26,000 pounds.

Form Submission Methods

Submitting the IFTA Registration Form can be done through various methods, depending on your state’s requirements. Common submission methods include:

- Online submission via the state’s IFTA portal, if available.

- Mailing the completed form to the appropriate state authority.

- In-person submission at designated state offices for immediate processing.

Create this form in 5 minutes or less

Find and fill out the correct international fuel tax agreement ifta regsitration registration form for international fuel tax agreement ifta

Create this form in 5 minutes!

How to create an eSignature for the international fuel tax agreement ifta regsitration registration form for international fuel tax agreement ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

The International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA is a document required for commercial vehicle operators to report fuel use across multiple jurisdictions. This form simplifies the tax reporting process, ensuring compliance with IFTA regulations. By using this form, businesses can streamline their fuel tax reporting and avoid penalties.

-

How can I obtain the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

You can easily obtain the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA through our airSlate SignNow platform. Simply visit our website, navigate to the IFTA section, and download the form. Our user-friendly interface makes it simple to access and fill out the necessary information.

-

What are the benefits of using the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

Using the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA helps businesses ensure compliance with fuel tax regulations while saving time and reducing errors. The form is designed to be straightforward, allowing for quick completion and submission. Additionally, it helps avoid costly penalties associated with incorrect reporting.

-

Is there a cost associated with the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

The International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA is available at no cost through our airSlate SignNow platform. We believe in providing accessible resources to help businesses comply with IFTA regulations without incurring additional expenses. However, there may be fees associated with filing or processing depending on your jurisdiction.

-

Can I eSign the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

Yes, you can eSign the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA using our airSlate SignNow platform. Our solution allows for secure electronic signatures, making it easy to finalize and submit your forms without the need for printing or scanning. This feature enhances efficiency and ensures your documents are legally binding.

-

What features does airSlate SignNow offer for managing the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

airSlate SignNow offers a variety of features for managing the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA, including customizable templates, secure storage, and tracking capabilities. These features help you stay organized and ensure that your forms are completed accurately and on time. Additionally, our platform integrates seamlessly with other business tools for enhanced workflow.

-

How does airSlate SignNow ensure the security of the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA?

airSlate SignNow prioritizes the security of your documents, including the International Fuel Tax Agreement IFTA Registration Registration Form For International Fuel Tax Agreement IFTA. We utilize advanced encryption and secure cloud storage to protect your sensitive information. Our platform complies with industry standards to ensure that your data remains safe and confidential throughout the signing process.

Get more for International Fuel Tax Agreement IFTA Regsitration Registration Form For International Fuel Tax Agreement IFTA

- Penetration testing rules of engagement template form

- Annexure 1 form

- Michigan cna reciprocity form

- Annuity 1035 exchange and transferrollover form

- Form 4835 702546905

- Informed consent form for hip injection brad boyd do

- Form ca std 204 fill online printable fillable

- In transit permittitle application 776475905 form

Find out other International Fuel Tax Agreement IFTA Regsitration Registration Form For International Fuel Tax Agreement IFTA

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors