Form 4835 2023

What is the Form 4835

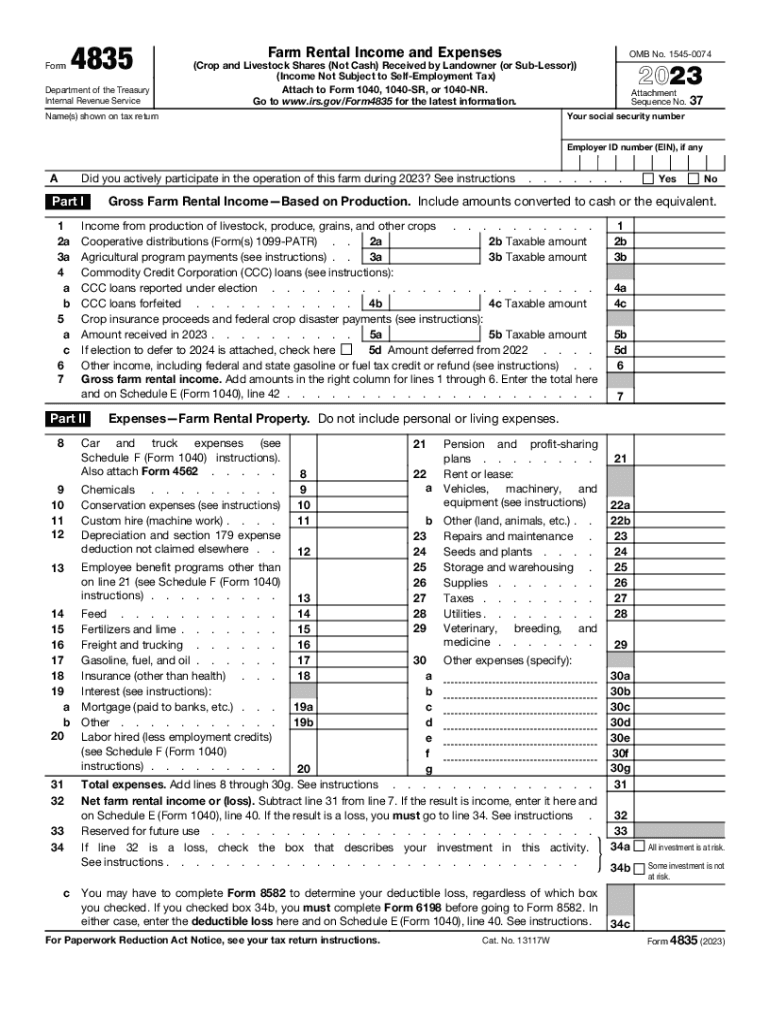

The Form 4835 is a tax document used by individuals who receive rental income from farm property. This form allows taxpayers to report income and expenses related to farming activities, specifically for those who do not materially participate in the farming operation. It is essential for accurately calculating taxable income derived from farm rentals, ensuring compliance with IRS regulations.

How to use the Form 4835

To use the Form 4835, taxpayers must accurately report their rental income and associated expenses from farm properties. This includes detailing income received, such as cash rent, and expenses incurred, such as maintenance costs and property taxes. The form helps in determining the net income or loss from the rental activities, which is then reported on the taxpayer's income tax return.

Steps to complete the Form 4835

Completing the Form 4835 involves several key steps:

- Gather all necessary documentation, including records of rental income and expenses.

- Fill out the form by providing personal information, such as your name and Social Security number.

- Report the total rental income received from the farm property.

- List all allowable expenses related to the farm rental, including repairs, utilities, and depreciation.

- Calculate the net income or loss by subtracting total expenses from total income.

- Sign and date the form before submission.

IRS Guidelines

The IRS provides specific guidelines for using the Form 4835. Taxpayers must adhere to these rules to ensure proper reporting. The IRS outlines which expenses are deductible and how to report income accurately. Familiarizing oneself with IRS Publication 225 can provide additional insights into farming income and expenses, helping taxpayers navigate the complexities of farm rental income reporting.

Filing Deadlines / Important Dates

Filing deadlines for the Form 4835 typically align with the general tax return deadlines. Taxpayers must submit the form by April 15 of the following year, unless an extension has been granted. It is crucial to stay informed about any changes to deadlines that may arise due to tax law updates or IRS announcements.

Required Documents

To complete the Form 4835 accurately, taxpayers should gather several key documents:

- Records of rental income received from farm properties.

- Receipts or invoices for expenses related to the property.

- Any relevant tax documents from previous years that may impact current reporting.

- Documentation supporting any deductions claimed on the form.

Quick guide on how to complete form 4835 702546905

Complete Form 4835 effortlessly on any gadget

Online document handling has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can locate the right form and securely keep it online. airSlate SignNow provides all the resources you require to create, alter, and eSign your documents swiftly without delays. Manage Form 4835 on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The optimal method to modify and eSign Form 4835 without hassle

- Find Form 4835 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Modify and eSign Form 4835 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4835 702546905

Create this form in 5 minutes!

How to create an eSignature for the form 4835 702546905

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how can it benefit my farm?

airSlate SignNow is an easy-to-use eSignature solution designed to streamline document processes for businesses, including farms. By adopting our platform, your farm can save time, reduce paper usage, and enhance efficiency in managing contracts and agreements. This allows you to focus more on your core farming activities.

-

How much does airSlate SignNow cost for farms?

The pricing for airSlate SignNow is competitive and tailored to meet the needs of various businesses, including farms. We offer different plans, ensuring you find an option that fits your budget while providing essential features that enhance your farm's document management capabilities. You can also explore our free trial to see how it works for your farm without any commitments.

-

What features does airSlate SignNow offer for farms?

airSlate SignNow offers several features that are beneficial for farms, such as eSigning, customizable templates, and document tracking. These features allow you to easily create, send, and manage documents related to your farm efficiently. Additionally, our user-friendly interface means that anyone on your team can quickly become proficient in using the platform.

-

Can airSlate SignNow integrate with other tools used on my farm?

Yes, airSlate SignNow offers integrations with a variety of tools and software commonly used in the farming industry. Whether you are using accounting software or project management tools, our platform can seamlessly connect with them to enhance your farm's overall efficiency. This means you can manage everything from one central hub.

-

Is airSlate SignNow secure for handling sensitive farm documents?

Absolutely! airSlate SignNow prioritizes your security with advanced encryption and compliance with industry standards. We understand that farms handle sensitive information and ensure that all your documents are safely stored and transmitted. This way, you can have peace of mind knowing your farm's data is protected.

-

How does airSlate SignNow improve productivity for farms?

By incorporating airSlate SignNow into your farm's operations, you can signNowly improve productivity. The platform automates routine document processes, allowing your team to focus on critical farming tasks instead of manual paperwork. This efficiency can lead to faster decision-making and a more agile farm workflow.

-

Can I access airSlate SignNow on mobile devices while managing my farm?

Yes, airSlate SignNow is designed to be mobile-friendly, allowing farm managers and team members to access the platform on-the-go. Whether you are in the field or at the office, you can easily send, receive, and sign documents from your mobile device. This flexibility helps you stay organized and responsive to your farm's needs.

Get more for Form 4835

- Payable on death form 34051058

- Form drs pw

- Premier pediatrics new patient history form

- Petition by owner for restitution new mexico form

- Aed departmental inspection report form b inspection checklist

- Cr 410 form

- Real estate investment partnership agreement template form

- Real estate partnership agreement template form

Find out other Form 4835

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe