Www Gov UkgovernmentpublicationsSelf Assessment Tax Return for Trustees of Registered 2023

What is the Self Assessment Tax Return for Trustees of Registered Charities?

The Self Assessment Tax Return for Trustees of Registered Charities is a specific form designed for trustees managing registered charities in the United Kingdom. This form allows trustees to report the charity's income and expenses to ensure compliance with tax regulations. It is essential for maintaining transparency and accountability in the financial operations of the charity. The information reported can affect the charity's tax status and eligibility for certain tax reliefs.

Steps to Complete the Self Assessment Tax Return for Trustees of Registered Charities

Completing the Self Assessment Tax Return involves several key steps:

- Gather all relevant financial documents, including income statements, expense receipts, and previous tax returns.

- Access the appropriate form, ensuring it is the correct version for the tax year in question.

- Fill out the form accurately, providing detailed information about the charity's financial activities.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline to avoid penalties.

Required Documents for the Self Assessment Tax Return

To accurately complete the Self Assessment Tax Return, trustees should prepare the following documents:

- Income statements detailing all sources of revenue.

- Expense receipts for all expenditures related to the charity's operations.

- Previous tax returns for reference and consistency.

- Bank statements reflecting the charity's financial transactions.

Filing Deadlines for the Self Assessment Tax Return

Trustees must be aware of the important deadlines associated with the Self Assessment Tax Return. Typically, the deadline for submitting the return is January 31 of the following tax year. It is crucial to adhere to this timeline to avoid incurring penalties or interest on unpaid taxes.

Penalties for Non-Compliance

Failure to submit the Self Assessment Tax Return on time can result in significant penalties. The first late submission may incur an automatic fine, while continued delays can lead to increased charges. It is essential for trustees to understand these consequences and ensure timely compliance with tax obligations.

Who Issues the Self Assessment Tax Return?

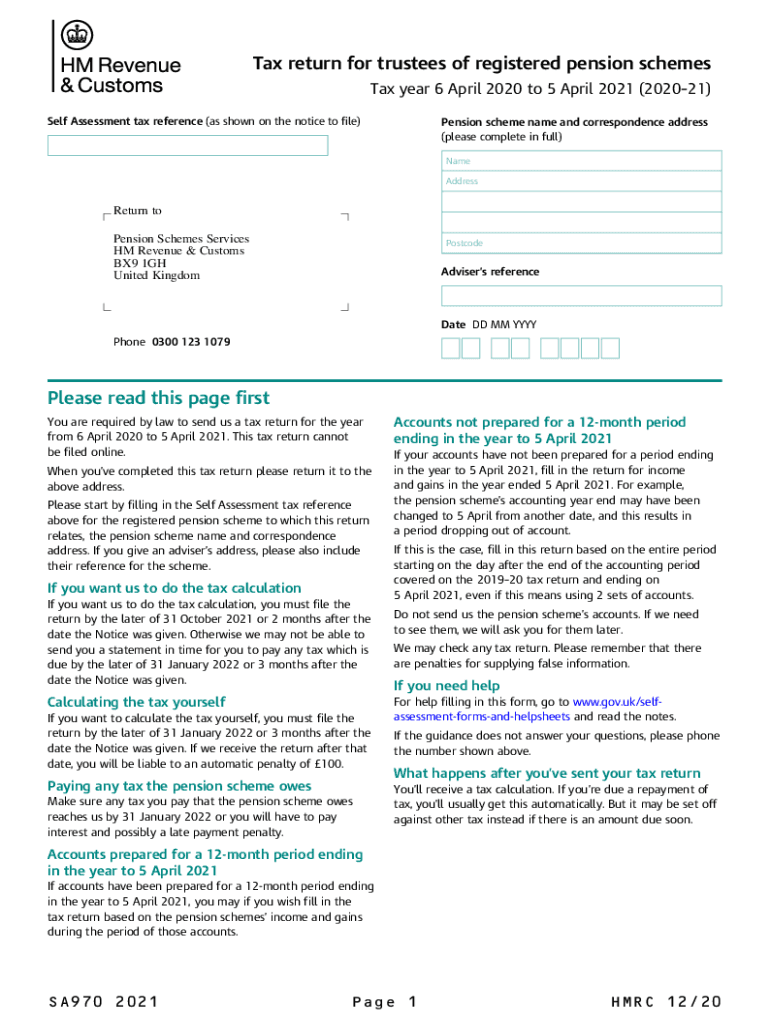

The Self Assessment Tax Return for Trustees of Registered Charities is issued by HM Revenue and Customs (HMRC) in the UK. HMRC is responsible for overseeing tax compliance and ensuring that charities adhere to the necessary regulations. Trustees should ensure they are using the most current version of the form as provided by HMRC.

Create this form in 5 minutes or less

Find and fill out the correct www gov ukgovernmentpublicationsself assessment tax return for trustees of registered

Create this form in 5 minutes!

How to create an eSignature for the www gov ukgovernmentpublicationsself assessment tax return for trustees of registered

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered?

The Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered is a specific tax return form required for trustees managing registered trusts. It ensures compliance with UK tax regulations and helps trustees report income and gains accurately. Understanding this form is crucial for effective trust management.

-

How can airSlate SignNow assist with the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered?

airSlate SignNow simplifies the process of completing and submitting the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered by allowing users to eSign documents securely. Our platform streamlines document management, making it easier for trustees to handle their tax obligations efficiently. This reduces the risk of errors and enhances compliance.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered. These features help ensure that all necessary information is included and that documents are signed and submitted on time.

-

Is airSlate SignNow cost-effective for trustees handling tax returns?

Yes, airSlate SignNow provides a cost-effective solution for trustees managing the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered. Our pricing plans are designed to accommodate various budgets, ensuring that even small trusts can access essential document management tools without overspending.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, enhancing the workflow for completing the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered. This integration allows for easy data transfer and ensures that all financial information is accurately reflected in the tax return.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered, offers numerous benefits. These include improved efficiency, reduced paperwork, and enhanced security for sensitive information. Our platform also provides a user-friendly interface that simplifies the document signing process.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents like the Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered. Our platform ensures that all data is securely stored and transmitted, giving users peace of mind when managing their tax obligations.

Get more for Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered

- Hawaii humane society complaint form

- Cdphp rehabilitation and snf continued stay review form

- Test method validation template form

- Salvage permit bc form

- Workers compensation intake form spine institute of new york

- Fuel return massachusetts form

- Medical record release form hazelden betty ford foundation

- Gc 325 form

Find out other Www gov ukgovernmentpublicationsSelf Assessment Tax Return For Trustees Of Registered

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form