HS302 Duel Residents Claim Form Claim as a Non Resident for Relief from UK Tax under the Terms of a Double Taxation Agreement DT 2023

What is the HS302 Duel Residents Claim Form?

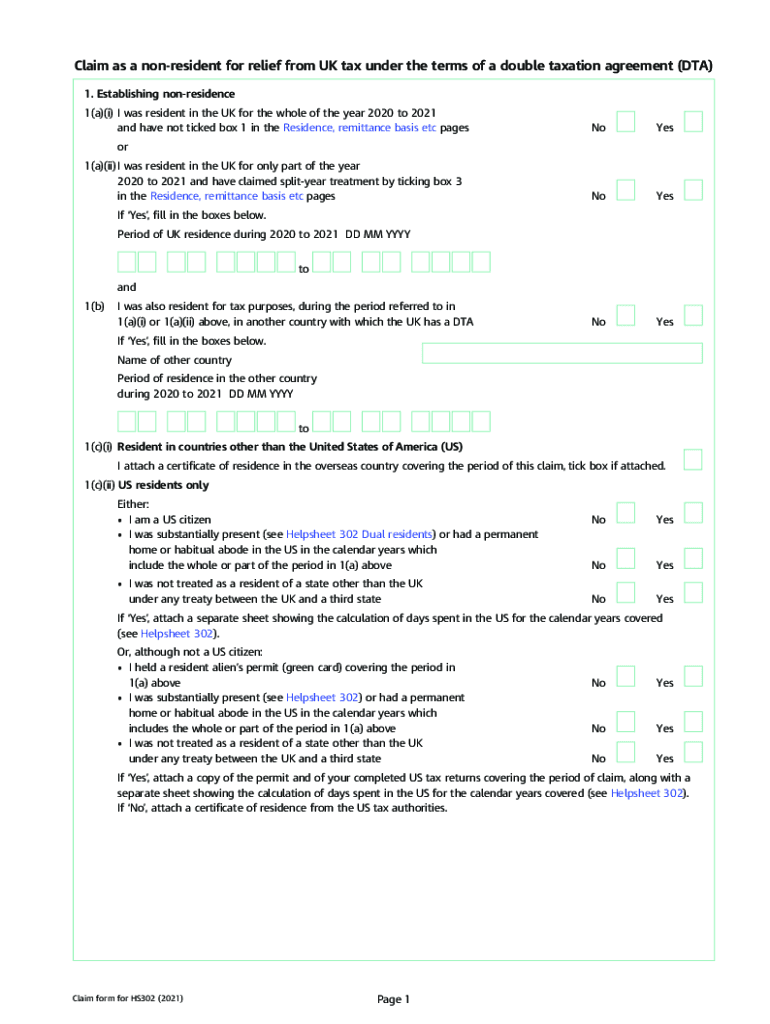

The HS302 Duel Residents Claim Form is a specific document used by individuals who reside in multiple countries and seek relief from UK tax obligations under the terms of a Double Taxation Agreement (DTA). This form is particularly relevant for U.S. residents who earn income in the UK and wish to avoid being taxed on the same income in both jurisdictions. By filing this form, individuals can claim tax relief and ensure compliance with international tax laws.

Steps to Complete the HS302 Duel Residents Claim Form

Completing the HS302 form involves several important steps to ensure accurate submission and eligibility for tax relief. First, gather all necessary personal information, including your tax identification number and details of your residency status. Next, provide information regarding your income sources in both the UK and the U.S. It is crucial to clearly indicate the specific provisions of the DTA that apply to your situation. After filling out the form, review it thoroughly for any errors or omissions before submitting it to the appropriate tax authority.

Required Documents for the HS302 Duel Residents Claim Form

When submitting the HS302 form, certain documents are typically required to support your claim. These may include proof of residency in both the U.S. and the UK, such as utility bills or tax returns. Additionally, you may need to provide documentation of your income sources, including pay stubs or bank statements. Ensure that all supporting documents are clear and legible, as this will facilitate the processing of your claim.

Eligibility Criteria for the HS302 Duel Residents Claim Form

To be eligible to use the HS302 form, individuals must meet specific criteria outlined in the relevant Double Taxation Agreement. Generally, you must be a resident of one country while earning income in another. It is essential to demonstrate that you are subject to taxation in both jurisdictions on the same income. Additionally, you should not have previously claimed the same relief under another provision of the DTA. Understanding these criteria will help ensure that your claim is valid and increases the likelihood of approval.

Form Submission Methods for the HS302 Duel Residents Claim Form

The HS302 form can be submitted through various methods, depending on the requirements of the tax authorities involved. Typically, you can submit the form by mail to the appropriate tax office. Some jurisdictions may also allow electronic submission through their online portals. It is important to check the specific submission guidelines for both the UK and the U.S. to ensure compliance and avoid delays in processing your claim.

Legal Use of the HS302 Duel Residents Claim Form

The HS302 form is legally recognized as a valid claim for tax relief under the Double Taxation Agreement between the UK and the U.S. Proper use of this form helps individuals avoid double taxation on income earned in both countries. It is essential to ensure that all information provided is accurate and truthful, as any discrepancies may lead to penalties or denial of the claim. Consulting with a tax professional can provide additional guidance on the legal implications of filing this form.

Create this form in 5 minutes or less

Find and fill out the correct hs302 duel residents claim form claim as a non resident for relief from uk tax under the terms of a double taxation agreement

Create this form in 5 minutes!

How to create an eSignature for the hs302 duel residents claim form claim as a non resident for relief from uk tax under the terms of a double taxation agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the HS302 Duel Residents Claim Form?

The HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA is a document that allows individuals to claim relief from UK tax. This form is specifically designed for dual residents who may be subject to taxation in both the UK and another country.

-

How can I complete the HS302 Duel Residents Claim Form?

To complete the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA, you need to gather your personal information, details of your residency, and income sources. You can fill out the form online or download it for manual completion.

-

What are the benefits of using the HS302 form?

Using the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA can help you avoid double taxation on your income. This form ensures that you are only taxed in the appropriate jurisdiction, potentially saving you a signNow amount of money.

-

Is there a fee to submit the HS302 Duel Residents Claim Form?

There is no fee to submit the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA. However, you may want to consult a tax professional for assistance, which could incur additional costs.

-

How long does it take to process the HS302 form?

The processing time for the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA can vary. Typically, it may take several weeks for HMRC to review and respond to your claim, depending on their workload.

-

Can I submit the HS302 form online?

Yes, you can submit the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA online through the HMRC website. This method is often quicker and more efficient than mailing a paper form.

-

What information do I need to provide with the HS302 form?

When completing the HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DTA, you will need to provide personal identification details, residency status, and information about your income sources. Accurate information is crucial for a successful claim.

Get more for HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DT

- Marathi target 10th pdf english medium form

- Pwd certificate form

- Pharmacy technician performance evaluation sample

- Make up consultation sheet form

- Law society complaint form pdf

- My family booklet pdf form

- Punchline algebra book a answer key form

- 21 xlsx level of care loc digital scoring form childyouth info

Find out other HS302 Duel Residents Claim Form Claim As A Non resident For Relief From UK Tax Under The Terms Of A Double Taxation Agreement DT

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF