W 8ben 2023-2026

What is the W-8BEN?

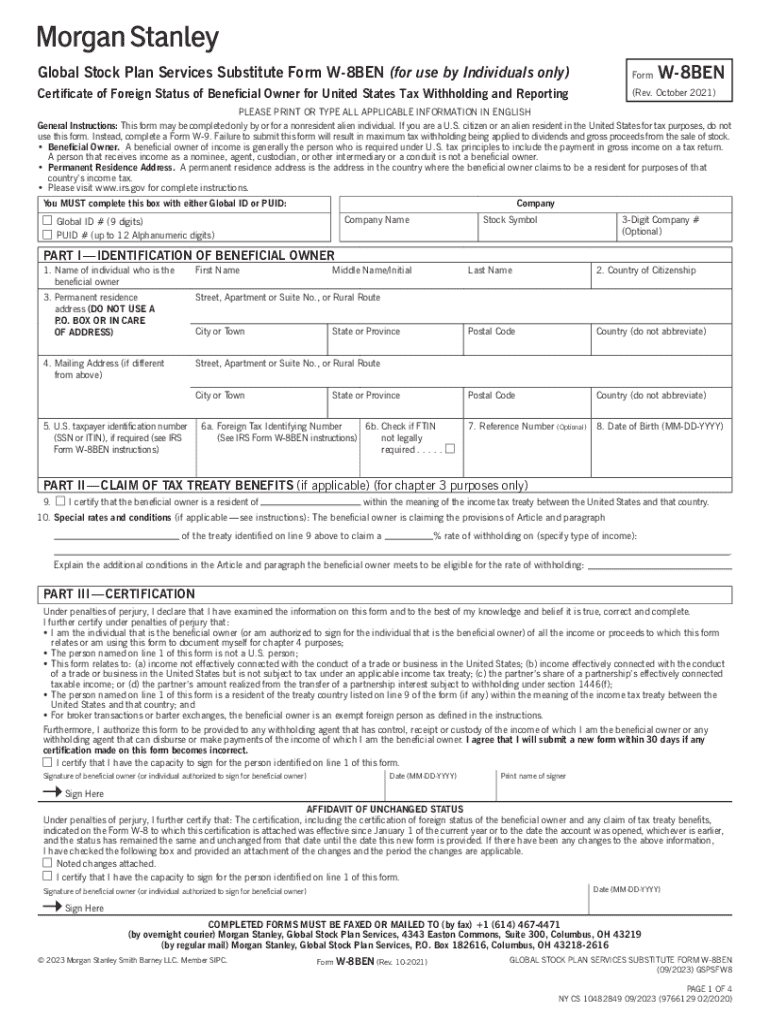

The W-8BEN form, officially known as the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals), is a crucial document for non-U.S. persons. It is primarily used to establish that the individual is a foreign entity and to claim a reduced rate of, or exemption from, U.S. tax withholding on certain types of income. This form is essential for anyone receiving income from U.S. sources, such as dividends, interest, or royalties, as it helps ensure compliance with U.S. tax laws.

How to obtain the W-8BEN

Obtaining the W-8BEN form is straightforward. It is available directly from the Internal Revenue Service (IRS) website as a downloadable PDF. Individuals can also request the form through financial institutions or other entities that require it for tax reporting purposes. It is important to ensure that the most current version of the form is used, as outdated versions may not be accepted.

Steps to complete the W-8BEN

Completing the W-8BEN involves several key steps:

- Provide personal information: Fill in your name, country of citizenship, and address.

- Claim tax treaty benefits: If applicable, indicate the country with which the U.S. has a tax treaty and the specific article that provides for reduced withholding rates.

- Sign and date the form: Ensure that you sign and date the form to validate it. An unsigned form is considered invalid.

After completing the form, it should be submitted to the withholding agent or financial institution requesting it, not to the IRS.

Legal use of the W-8BEN

The W-8BEN is legally binding and must be used in accordance with U.S. tax laws. By submitting this form, individuals affirm their foreign status and eligibility for any applicable tax treaty benefits. Misuse or incorrect completion of the form can lead to penalties, including higher withholding tax rates. It is advisable to consult a tax professional if there are uncertainties regarding eligibility or completion.

Key elements of the W-8BEN

Several key elements must be included in the W-8BEN to ensure it is valid:

- Identification of the beneficial owner: Full name and address.

- Claim of tax treaty benefits: Specific details regarding the tax treaty and the applicable article.

- Signature: The individual must sign and date the form, certifying that the information provided is accurate.

Each element is crucial for the form's acceptance and for determining the appropriate withholding tax rate.

Filing Deadlines / Important Dates

While the W-8BEN does not have a specific filing deadline like many other tax forms, it is important to submit it before receiving income subject to withholding. The form remains valid for three years from the date it is signed, but it must be updated if there are any changes to the information provided. Keeping track of these timelines is essential to ensure compliance and avoid unnecessary withholding taxes.

Create this form in 5 minutes or less

Find and fill out the correct w 8ben

Create this form in 5 minutes!

How to create an eSignature for the w 8ben

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 8ben form and why is it important?

The W 8ben form is a tax document used by foreign individuals to signNow their foreign status and claim tax treaty benefits. It is essential for non-U.S. residents receiving income from U.S. sources, as it helps avoid unnecessary withholding taxes. Understanding the W 8ben form can streamline your tax obligations and ensure compliance.

-

How can airSlate SignNow help with the W 8ben form?

airSlate SignNow simplifies the process of completing and signing the W 8ben form electronically. With our user-friendly interface, you can easily fill out the form, add your signature, and send it securely to the necessary parties. This saves time and reduces the risk of errors in your documentation.

-

Is there a cost associated with using airSlate SignNow for the W 8ben form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are cost-effective and provide access to features that streamline the signing process, including the W 8ben form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the W 8ben form?

airSlate SignNow provides features such as customizable templates, secure cloud storage, and real-time tracking for the W 8ben form. You can also integrate with other applications to enhance your workflow. These features ensure that managing your documents is efficient and secure.

-

Can I integrate airSlate SignNow with other software for handling the W 8ben form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to manage the W 8ben form alongside your existing tools. This integration capability enhances your productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the W 8ben form?

Using airSlate SignNow for the W 8ben form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and send documents quickly, ensuring that you meet deadlines without hassle. Additionally, electronic signatures are legally binding, making your process compliant.

-

Is airSlate SignNow secure for handling sensitive documents like the W 8ben form?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your sensitive documents, including the W 8ben form, are protected. We utilize advanced encryption and secure data storage to safeguard your information. You can trust that your documents are safe with us.

Get more for W 8ben

- Anf 2a application form for issuemodification in

- Un police division electronic application for seconded police non contracted selection and recruitment of seconded unpol form

- As in any essay the first paragraph of your argumentative essay should contain a form

- Transaction dispute form

- Where to submit your form i 589

- Form approved omb no 0938 1230

- I 765 application for employment authorization document form

- Des form 190 3 ampquotrequest for unescorted installation access to fort leeampquot

Find out other W 8ben

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament