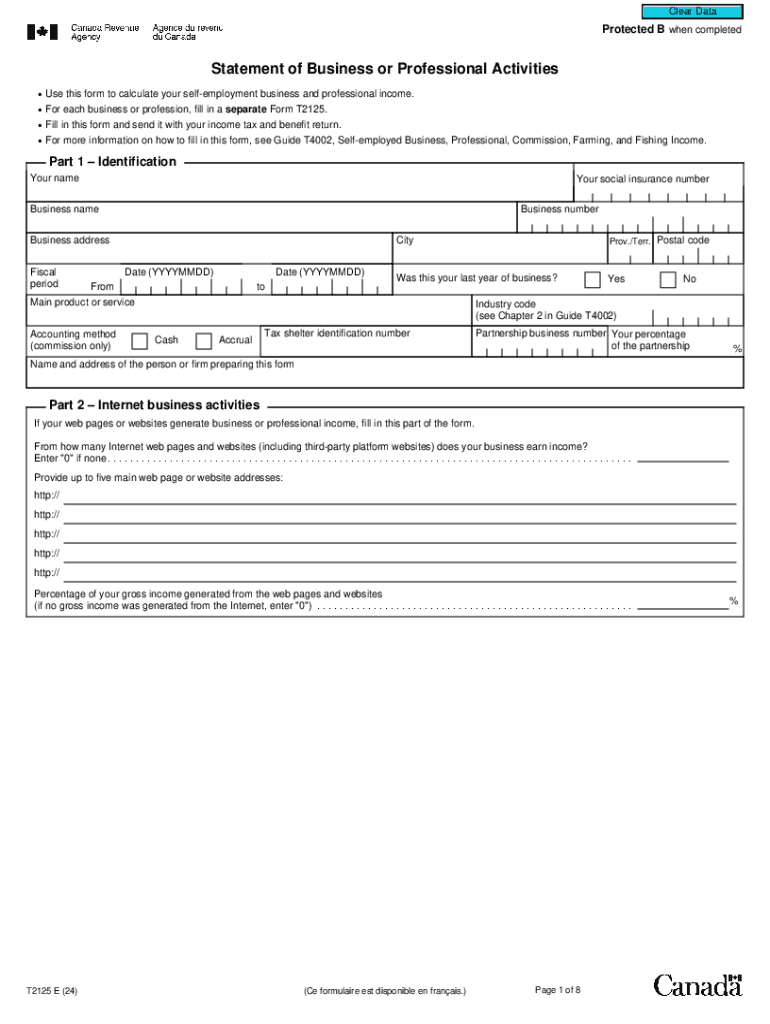

Statement of Business or Professional Activities 2023

What is the Statement Of Business Or Professional Activities

The Statement Of Business Or Professional Activities is a crucial document for individuals and businesses engaged in self-employment or professional activities. This form is primarily used for reporting income and expenses to the Internal Revenue Service (IRS) for tax purposes. It provides a detailed overview of the business operations, including types of services rendered, revenue generated, and costs incurred. By accurately completing this form, taxpayers can ensure compliance with federal tax regulations and potentially maximize deductions related to their business activities.

How to use the Statement Of Business Or Professional Activities

Using the Statement Of Business Or Professional Activities involves several steps. First, gather all relevant financial documents, such as invoices, receipts, and bank statements. Next, accurately report your income by listing all sources of revenue generated from your business activities. Following this, detail your expenses, categorizing them into appropriate sections, such as supplies, travel, and utilities. Finally, review the completed form for accuracy before submitting it with your tax return. This process helps ensure that you present a clear and comprehensive picture of your business operations to the IRS.

Steps to complete the Statement Of Business Or Professional Activities

Completing the Statement Of Business Or Professional Activities requires careful attention to detail. Start by entering your personal information, including your name and Social Security number. Then, follow these steps:

- List your business name and address.

- Document all income earned during the tax year.

- Itemize your business expenses, ensuring to categorize them correctly.

- Calculate your net profit or loss by subtracting total expenses from total income.

- Sign and date the form to certify its accuracy.

Each step is essential for providing a complete and accurate representation of your business activities.

Key elements of the Statement Of Business Or Professional Activities

The Statement Of Business Or Professional Activities includes several key elements that are critical for accurate reporting. These elements consist of:

- Business Information: Name, address, and type of business.

- Income Reporting: Detailed listing of all income sources.

- Expense Categories: Breakdown of expenses into specific categories such as advertising, rent, and utilities.

- Net Profit or Loss: Calculation of income minus expenses.

Understanding these elements is vital for ensuring that the form is completed correctly and that all necessary information is included.

Legal use of the Statement Of Business Or Professional Activities

The legal use of the Statement Of Business Or Professional Activities is primarily for tax reporting purposes. It serves as an official document submitted to the IRS, detailing the financial activities of a business. Accurate completion of this form is essential to comply with federal tax laws. Failure to provide truthful and complete information can result in penalties, including fines or audits. Therefore, understanding the legal implications of this form is crucial for any business owner or self-employed individual.

Filing Deadlines / Important Dates

Filing deadlines for the Statement Of Business Or Professional Activities align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If you require additional time, you can file for an extension, which generally provides an additional six months. However, any taxes owed must still be paid by the original deadline to avoid interest and penalties. Keeping track of these important dates is essential for maintaining compliance and avoiding unnecessary fees.

Handy tips for filling out Statement Of Business Or Professional Activities online

Quick steps to complete and e-sign Statement Of Business Or Professional Activities online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents could be. Get access to a HIPAA and GDPR compliant solution for optimum efficiency. Use signNow to e-sign and send out Statement Of Business Or Professional Activities for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct statement of business or professional activities

Create this form in 5 minutes!

How to create an eSignature for the statement of business or professional activities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Statement Of Business Or Professional Activities?

A Statement Of Business Or Professional Activities is a document that outlines the income and expenses related to a business or professional activity. It is essential for tax reporting and helps in determining the net income for tax purposes. Understanding this statement is crucial for business owners to ensure compliance with tax regulations.

-

How can airSlate SignNow help with the Statement Of Business Or Professional Activities?

airSlate SignNow simplifies the process of creating and signing your Statement Of Business Or Professional Activities. With our platform, you can easily generate, send, and eSign this document, ensuring that all necessary information is accurately captured. This streamlines your workflow and saves you valuable time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a freelancer or a large enterprise, you can choose a plan that suits your budget while providing access to features necessary for managing your Statement Of Business Or Professional Activities. Visit our pricing page for detailed information on each plan.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features designed to enhance document management, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your Statement Of Business Or Professional Activities is handled efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, including CRM systems and accounting tools. This allows you to easily incorporate your Statement Of Business Or Professional Activities into your existing workflows. Integrations enhance productivity by reducing the need for manual data entry.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for your documents. By streamlining the process of managing your Statement Of Business Or Professional Activities, you can focus more on growing your business. Our platform is designed to be cost-effective, making it accessible for businesses of all sizes.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including the Statement Of Business Or Professional Activities. We utilize advanced encryption and security protocols to protect your data. You can trust that your sensitive information is safe with us.

Get more for Statement Of Business Or Professional Activities

- Lease purchase agreements package new york form

- Satisfaction cancellation or release of mortgage package new york form

- Premarital agreements package new york form

- Painting contractor package new york form

- Framing contractor package new york form

- Foundation contractor package new york form

- Plumbing contractor package new york form

- Brick mason contractor package new york form

Find out other Statement Of Business Or Professional Activities

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed