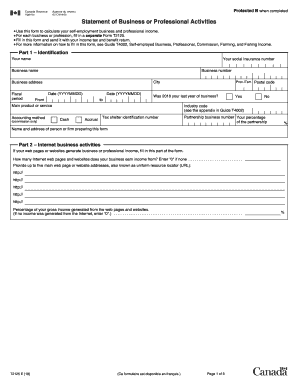

Form T2125, Statement of Business or Professional Activities 2023-2026

What is the Form T2125, Statement Of Business Or Professional Activities

The Form T2125, also known as the Statement of Business or Professional Activities, is a critical document used by self-employed individuals in the United States to report their business income and expenses. This form is essential for accurately calculating taxable income and ensuring compliance with tax regulations. It provides a comprehensive overview of the financial activities of a business, allowing the Internal Revenue Service (IRS) to assess the taxpayer's financial situation effectively.

How to use the Form T2125, Statement Of Business Or Professional Activities

Using the Form T2125 involves several steps to ensure accurate reporting of business income and expenses. Taxpayers must gather all relevant financial records, including income statements, receipts, and invoices. The form requires detailed information about the nature of the business, including gross income, allowable expenses, and any applicable deductions. Once completed, the form is submitted along with the individual’s tax return, ensuring all business activities are reported in compliance with IRS guidelines.

Steps to complete the Form T2125, Statement Of Business Or Professional Activities

Completing the Form T2125 involves a systematic approach:

- Gather all necessary financial documents, including income and expense records.

- Fill out the personal information section, including name, address, and Social Security number.

- Detail the business income, including sales and other revenue sources.

- List all business expenses, categorizing them appropriately to maximize deductions.

- Calculate the net income by subtracting total expenses from total income.

- Review the form for accuracy before submission.

Key elements of the Form T2125, Statement Of Business Or Professional Activities

The Form T2125 includes several key elements that are crucial for accurate reporting. These elements consist of:

- Business Information: Details about the business type and its activities.

- Income Section: A comprehensive breakdown of all income sources.

- Expense Section: Categories for various business expenses, such as utilities, rent, and supplies.

- Net Income Calculation: The final figure that determines taxable income.

Legal use of the Form T2125, Statement Of Business Or Professional Activities

The Form T2125 is legally required for self-employed individuals to report their income and expenses accurately. Failure to complete and submit this form can lead to penalties, including fines and interest on unpaid taxes. It is essential for taxpayers to adhere to IRS regulations when using this form to ensure compliance and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form T2125 typically align with the general tax return deadlines. Taxpayers must submit their completed forms by April 15 of the following tax year. If additional time is needed, individuals can apply for an extension, but they must still pay any taxes owed by the original deadline to avoid penalties.

Quick guide on how to complete form t2125 statement of business or professional activities

Effortlessly Prepare Form T2125, Statement Of Business Or Professional Activities on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Form T2125, Statement Of Business Or Professional Activities on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Form T2125, Statement Of Business Or Professional Activities with Ease

- Obtain Form T2125, Statement Of Business Or Professional Activities and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information using the tools that airSlate SignNow has specifically designed for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form - via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from any preferred device. Modify and eSign Form T2125, Statement Of Business Or Professional Activities to ensure superb communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form t2125 statement of business or professional activities

Create this form in 5 minutes!

How to create an eSignature for the form t2125 statement of business or professional activities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the t2125 2012 form and how does it relate to airSlate SignNow?

The t2125 2012 form is used for reporting business income and expenses in Canada. With airSlate SignNow, you can easily eSign and send your t2125 2012 documents securely, ensuring compliance and efficiency in your business operations.

-

How can airSlate SignNow help me with my t2125 2012 filing?

airSlate SignNow streamlines the process of preparing and submitting your t2125 2012 form. By allowing you to eSign documents electronically, it reduces the time spent on paperwork and helps you focus on your business.

-

What are the pricing options for airSlate SignNow when dealing with t2125 2012 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those who frequently handle t2125 2012 forms. You can choose a plan that fits your budget while enjoying the benefits of efficient document management.

-

Are there any features specifically designed for managing t2125 2012 documents?

Yes, airSlate SignNow includes features such as templates and automated workflows that simplify the management of t2125 2012 documents. These tools help ensure that your forms are completed accurately and submitted on time.

-

Can I integrate airSlate SignNow with other software for my t2125 2012 needs?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, making it easier to manage your t2125 2012 forms alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for t2125 2012 eSigning?

Using airSlate SignNow for your t2125 2012 eSigning offers numerous benefits, including enhanced security, reduced turnaround time, and improved tracking of document status. This ensures that your business remains compliant and organized.

-

Is airSlate SignNow user-friendly for those unfamiliar with t2125 2012 forms?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those who are not familiar with t2125 2012 forms. The intuitive interface guides users through the eSigning process, ensuring a smooth experience.

Get more for Form T2125, Statement Of Business Or Professional Activities

Find out other Form T2125, Statement Of Business Or Professional Activities

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer