T2125 Form 2011

What is the T2125 Form

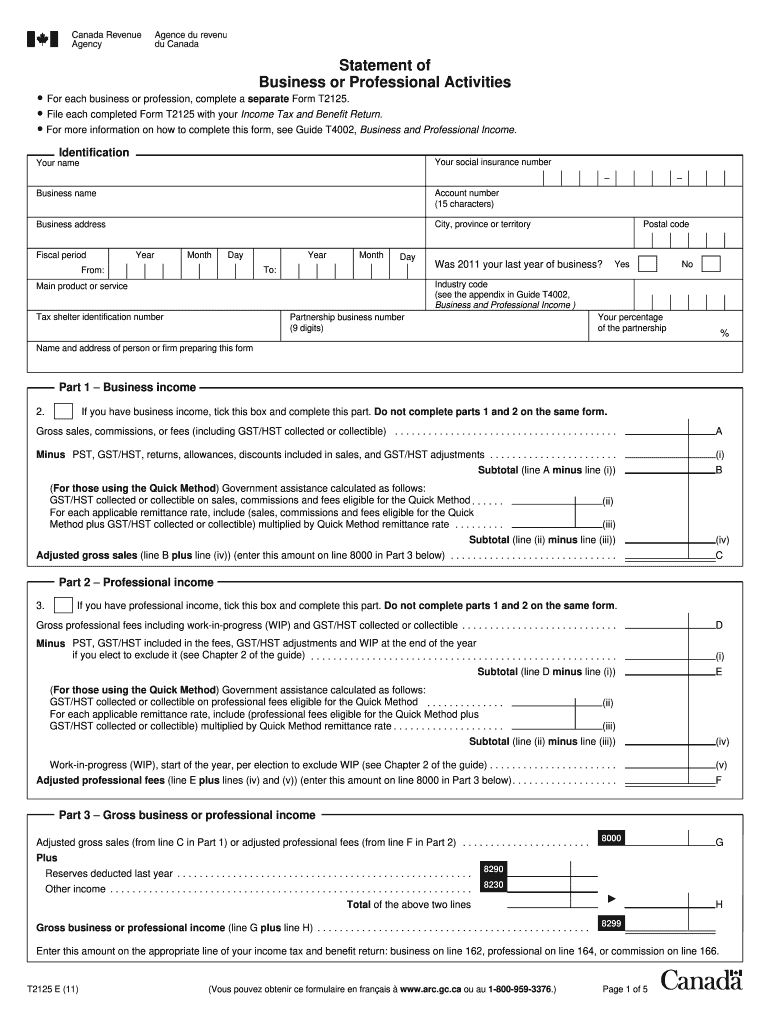

The T2125 Form, also known as the Statement of Business Activities, is a crucial document used by self-employed individuals in the United States to report their business income and expenses. This form is essential for accurately calculating net income for tax purposes. It provides a detailed overview of the financial activities of a business, allowing taxpayers to declare their earnings and claim eligible deductions. The T2125 Form is typically filed with the IRS as part of the annual tax return, ensuring compliance with federal tax laws.

How to use the T2125 Form

Using the T2125 Form involves several steps to ensure accurate reporting of business income and expenses. First, gather all relevant financial documents, including income statements, receipts, and invoices. Next, complete the form by entering your total business income, followed by detailed expense categories such as advertising, vehicle expenses, and supplies. It's important to keep thorough records to support each entry on the form. Once completed, the T2125 Form should be submitted along with your personal tax return, ensuring that all information is accurate and complete to avoid potential penalties.

Steps to complete the T2125 Form

Completing the T2125 Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all necessary financial records, including income and expense documentation.

- Start by filling out your business information, including your name, address, and business type.

- Report your total income from business activities in the designated section.

- List all allowable business expenses, categorizing them appropriately for clarity.

- Calculate your net income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the T2125 Form

The T2125 Form must be used in accordance with IRS regulations to ensure its legal validity. This includes accurately reporting all income and expenses, maintaining proper documentation, and filing the form by the designated deadlines. Failure to comply with these requirements can result in penalties or audits. It is essential to understand the legal implications of the information provided on the form, as it directly impacts your tax obligations and potential refunds.

Filing Deadlines / Important Dates

Filing the T2125 Form is subject to specific deadlines that vary based on your tax situation. Generally, self-employed individuals must file their tax returns, including the T2125 Form, by April 15 of each year. If you require additional time, you may file for an extension, which typically grants an extra six months. However, it is important to note that an extension to file does not extend the time to pay any taxes owed. Staying aware of these deadlines is crucial to avoid late fees and interest charges.

Required Documents

To complete the T2125 Form accurately, several documents are necessary. These include:

- Income statements detailing all earnings from self-employment.

- Receipts for business-related expenses, including materials, utilities, and travel.

- Bank statements that reflect business transactions.

- Any additional documentation that supports your income and expense claims.

Having these documents organized and readily available will streamline the process of completing the T2125 Form.

Quick guide on how to complete 2011 t2125 form

Effortlessly Prepare T2125 Form on Any Device

Digital document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage T2125 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Alter and eSign T2125 Form with Ease

- Obtain T2125 Form and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign T2125 Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 t2125 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 t2125 form

The best way to make an electronic signature for your PDF in the online mode

The best way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the T2125 Form and why do I need it?

The T2125 Form, also known as the Statement of Business Activities, is required for self-employed individuals in Canada to report their business income and expenses. Completing the T2125 Form accurately is crucial for tax purposes, ensuring you claim all eligible deductions. Using airSlate SignNow, you can easily eSign and submit your T2125 Form online, streamlining your tax filing process.

-

How can airSlate SignNow help me with the T2125 Form?

airSlate SignNow offers an intuitive platform that allows you to fill out, eSign, and manage your T2125 Form effortlessly. With features that enable document storage and easy sharing, airSlate SignNow simplifies the entire process of preparing and submitting your T2125 Form. This ensures that you can focus on your business rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the T2125 Form?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. While there is a cost involved, the investment provides signNow value by saving you time and reducing the hassle of managing your T2125 Form. Consider the potential savings on tax deductions when using our platform.

-

Can I integrate airSlate SignNow with other software for my T2125 Form?

Absolutely! airSlate SignNow seamlessly integrates with numerous accounting and business software solutions, allowing you to manage your T2125 Form alongside your other financial documents. This integration improves efficiency by automating data transfer, ensuring your information is always up-to-date.

-

What features does airSlate SignNow offer for handling the T2125 Form?

airSlate SignNow provides a range of features to assist with your T2125 Form, including eSigning, document templates, and secure cloud storage. These tools make it easier to complete and manage your T2125 Form, ensuring that you can track changes and access your documents anytime, anywhere.

-

How secure is my information when using airSlate SignNow for the T2125 Form?

Security is a top priority at airSlate SignNow. When working with your T2125 Form, your data is protected by industry-standard encryption and secure servers. We ensure that all documents and personal information are kept confidential and safe from unauthorized access.

-

Can I access my T2125 Form on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and manage your T2125 Form on-the-go. Whether you need to eSign or edit your document, our mobile app provides the flexibility to handle your paperwork wherever you are.

Get more for T2125 Form

Find out other T2125 Form

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online