T2125 Fill Out and Auto Calculatecomplete Form Online 2019

What is the T2125?

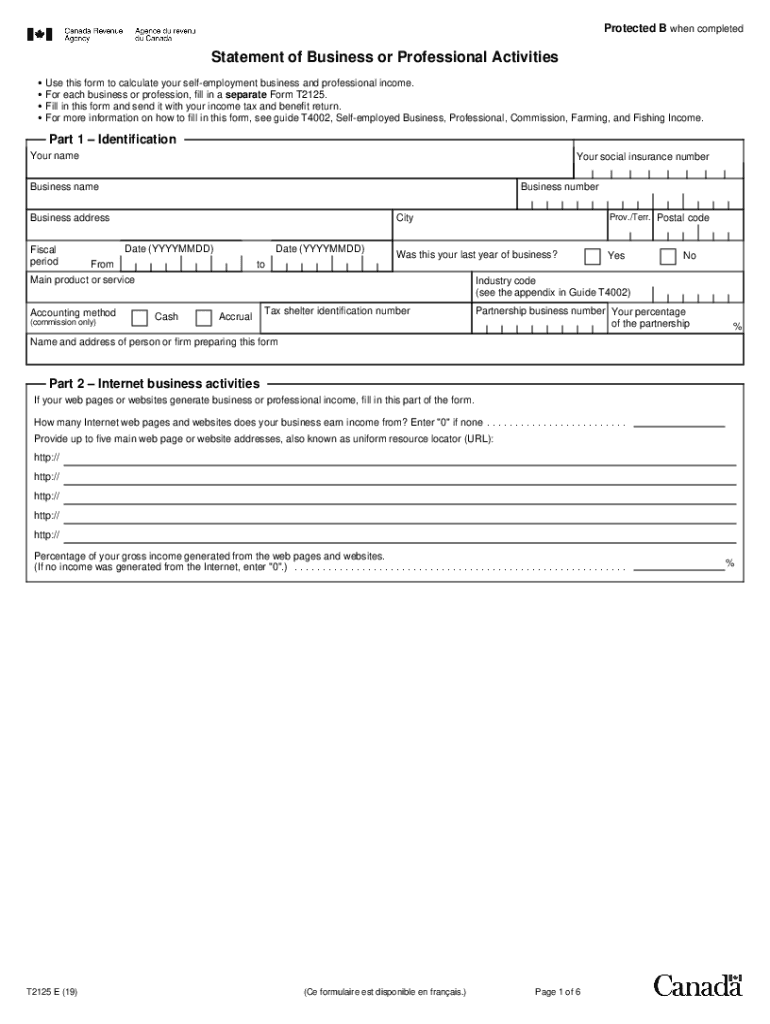

The T2125 form, also known as the Statement of Business Activities, is a tax form used by self-employed individuals in Canada to report their business income and expenses. This form is essential for calculating net income, which is then included in the individual's personal tax return. It is particularly relevant for sole proprietors and partners in a partnership. The T2125 allows taxpayers to detail their business activities, providing a comprehensive overview of their financial situation to the Canada Revenue Agency (CRA).

Key elements of the T2125

The T2125 form includes several key sections that require detailed information:

- Business Information: This section captures the name, address, and type of business.

- Income: Taxpayers must report all sources of income generated from their business activities.

- Expenses: This section allows for the deduction of various business-related expenses, such as supplies, utilities, and vehicle costs.

- Net Income Calculation: The form provides a framework for calculating net income by subtracting total expenses from total income.

Steps to complete the T2125

Filling out the T2125 form involves several steps to ensure accurate reporting:

- Gather all relevant financial documents, including income statements and receipts for expenses.

- Complete the business information section with accurate details about your business.

- Report all income earned during the tax year in the income section.

- List all eligible business expenses, ensuring to categorize them appropriately.

- Calculate net income by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the T2125

The T2125 form is legally binding when filled out correctly and submitted to the CRA. It is crucial for self-employed individuals to maintain accurate records and ensure compliance with tax regulations. The information provided on this form can be subject to audits, making it essential to retain supporting documents for all reported income and expenses. Using reliable digital tools for completion can enhance accuracy and security.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the T2125 is vital for compliance:

- The T2125 must be submitted along with your personal tax return, typically due by April 30 each year.

- If you are self-employed, you may have until June 15 to file, but any taxes owed are still due by April 30.

Form Submission Methods

The T2125 form can be submitted through various methods:

- Online: Many taxpayers choose to file their taxes electronically using tax software that supports the T2125 form.

- Mail: You can print the completed form and send it to the CRA by mail.

- In-Person: Some individuals may opt to deliver their forms directly to a local CRA office.

Quick guide on how to complete t2125 fill out and auto calculatecomplete form online

Easily prepare T2125 Fill Out And Auto Calculatecomplete Form Online on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers the ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents quickly without delays. Manage T2125 Fill Out And Auto Calculatecomplete Form Online on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused activity today.

Edit and electronically sign T2125 Fill Out And Auto Calculatecomplete Form Online effortlessly

- Obtain T2125 Fill Out And Auto Calculatecomplete Form Online and click Get Form to initiate the process.

- Utilize the tools provided to fill out your form.

- Select important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign T2125 Fill Out And Auto Calculatecomplete Form Online while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t2125 fill out and auto calculatecomplete form online

Create this form in 5 minutes!

How to create an eSignature for the t2125 fill out and auto calculatecomplete form online

How to make an eSignature for your PDF file online

How to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The best way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The best way to create an electronic signature for a PDF file on Android devices

People also ask

-

What is t2125 in relation to airSlate SignNow?

The t2125 refers to the form used for reporting business income in Canada. airSlate SignNow can help businesses manage the documentation needed for their t2125 submission by streamlining document workflows and facilitating electronic signatures.

-

How does airSlate SignNow help with t2125 document creation?

With airSlate SignNow, users can create, edit, and send t2125-related documents digitally. Our platform allows for easy customization and integration of necessary data and signatures to ensure your t2125 forms are accurate and ready for submission.

-

Is airSlate SignNow cost-effective for managing t2125 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing t2125 forms. We provide various pricing plans that cater to businesses of all sizes, ensuring you have the tools you need without breaking the budget while managing your tax documentation.

-

What are the key features of airSlate SignNow for handling t2125 forms?

Key features of airSlate SignNow for t2125 forms include customizable templates, cloud storage, and electronic signature capabilities. These tools allow businesses to automate their documentation processes and enhance efficiency while preparing their t2125 submissions.

-

Can I integrate airSlate SignNow with other tools for t2125 management?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms. This allows users to incorporate airSlate SignNow into their existing workflows, making the management of t2125 forms even more efficient and accessible.

-

What benefits does airSlate SignNow provide for handling t2125 submissions?

Using airSlate SignNow for t2125 submissions streamlines the entire process, reducing paperwork and time spent on manual data entry. This enhances accuracy and ensures timely submissions, ultimately benefiting your business operations and reducing stress during tax season.

-

Is airSlate SignNow secure for handling sensitive information in t2125 forms?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that all sensitive information in your t2125 forms is protected. Our platform employs advanced encryption and security measures to safeguard your documents during the eSignature process.

Get more for T2125 Fill Out And Auto Calculatecomplete Form Online

- New resident guide virginia form

- Virginia cancellation form

- Satisfaction release or cancellation of deed of trust by individual virginia form

- Property deed trust 497428511 form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy virginia form

- Warranty deed for parents to child with reservation of life estate virginia form

- Warranty deed for separate or joint property to joint tenancy virginia form

- Property spouses form

Find out other T2125 Fill Out And Auto Calculatecomplete Form Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online