Change of Income Packet Instructions 2023-2026

Understanding the Change Of Income Packet Instructions

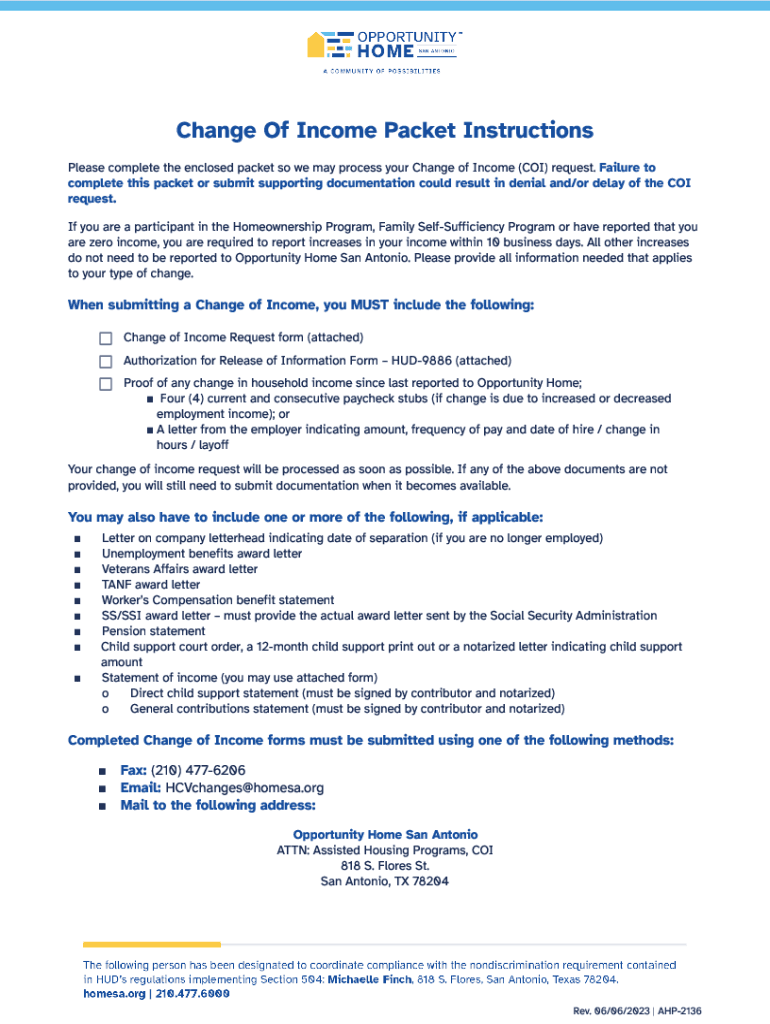

The Change Of Income Packet Instructions provide essential guidelines for individuals who need to report changes in their income. This form is crucial for maintaining accurate records with relevant agencies, particularly for those receiving benefits or assistance. Understanding the purpose of this packet is vital for ensuring compliance with regulations and avoiding potential penalties.

Steps to Complete the Change Of Income Packet Instructions

Completing the Change Of Income Packet involves several key steps:

- Gather necessary documentation that reflects your current income.

- Carefully read the instructions provided with the packet to understand specific requirements.

- Fill out the form accurately, ensuring all information is current and complete.

- Review your entries for any errors or omissions before submission.

- Submit the completed packet through the designated method, whether online, by mail, or in person.

Required Documents for the Change Of Income Packet

When filling out the Change Of Income Packet, it is important to include specific documents to support your reported income changes. Commonly required documents may include:

- Recent pay stubs or income statements.

- Tax returns from the previous year.

- Bank statements that reflect income deposits.

- Any relevant notices or letters from employers regarding changes in income.

Form Submission Methods

You can submit the Change Of Income Packet through various methods, depending on your preference and the requirements set by the issuing agency:

- Online: Many agencies allow for electronic submission via their websites.

- By Mail: You can print the completed form and send it to the designated address.

- In-Person: Some agencies accept submissions directly at their offices, which may provide immediate confirmation of receipt.

Legal Use of the Change Of Income Packet Instructions

The Change Of Income Packet Instructions are designed to ensure that individuals comply with legal requirements when reporting income changes. Accurate reporting is essential not only for maintaining eligibility for benefits but also for avoiding legal repercussions. Misreporting income can lead to penalties, including fines or loss of benefits.

Eligibility Criteria for the Change Of Income Packet

Eligibility to use the Change Of Income Packet typically depends on your current status regarding benefits or assistance programs. Common criteria include:

- Being a recipient of government assistance programs.

- Experiencing a significant change in income, such as a job loss or salary increase.

- Meeting specific income thresholds set by the issuing agency.

Create this form in 5 minutes or less

Find and fill out the correct change of income packet instructions

Create this form in 5 minutes!

How to create an eSignature for the change of income packet instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Change Of Income Packet Instructions?

The Change Of Income Packet Instructions provide a detailed guide on how to complete and submit your income change documentation. This ensures that all necessary information is accurately captured, facilitating a smooth process for your income adjustments.

-

How can I access the Change Of Income Packet Instructions?

You can easily access the Change Of Income Packet Instructions through the airSlate SignNow platform. Simply log in to your account, navigate to the resources section, and download the instructions to get started.

-

Are there any costs associated with the Change Of Income Packet Instructions?

The Change Of Income Packet Instructions are provided free of charge to all airSlate SignNow users. Our goal is to empower businesses with the necessary tools and information to manage their documentation effectively without incurring additional costs.

-

What features does airSlate SignNow offer for managing Change Of Income Packet Instructions?

airSlate SignNow offers features such as eSigning, document templates, and automated workflows to streamline the process of managing Change Of Income Packet Instructions. These tools help ensure that your documents are completed accurately and efficiently.

-

How do Change Of Income Packet Instructions benefit my business?

By following the Change Of Income Packet Instructions, your business can ensure compliance and accuracy in income reporting. This not only saves time but also reduces the risk of errors that could lead to financial discrepancies.

-

Can I integrate airSlate SignNow with other applications for Change Of Income Packet Instructions?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling Change Of Income Packet Instructions. This ensures that your documentation process is seamless and efficient across different platforms.

-

What support is available for questions about Change Of Income Packet Instructions?

Our customer support team is available to assist you with any questions regarding the Change Of Income Packet Instructions. You can signNow out via chat, email, or phone for prompt assistance and guidance.

Get more for Change Of Income Packet Instructions

- 4809pdf reset form missouri department of

- Mo 1040a 2019 individual income tax return singlemarried one income form

- Certification of sales under special conditions form

- Certification of reasons for which the taxpayer is not hacienda pr form

- Adem form 8700 12

- Do you know what a bunker delivery note includes form

- Incidentaccidentdeath report form

- How to become a mercy general hospital volunteer dignity form

Find out other Change Of Income Packet Instructions

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself