Tax Deduction Waiver on the Refund of Your Unused Rrsp, Prpp, or Spp Contributions 2020

Understanding the Tax Deduction Waiver on Unused RRSP, PRPP, or SPP Contributions

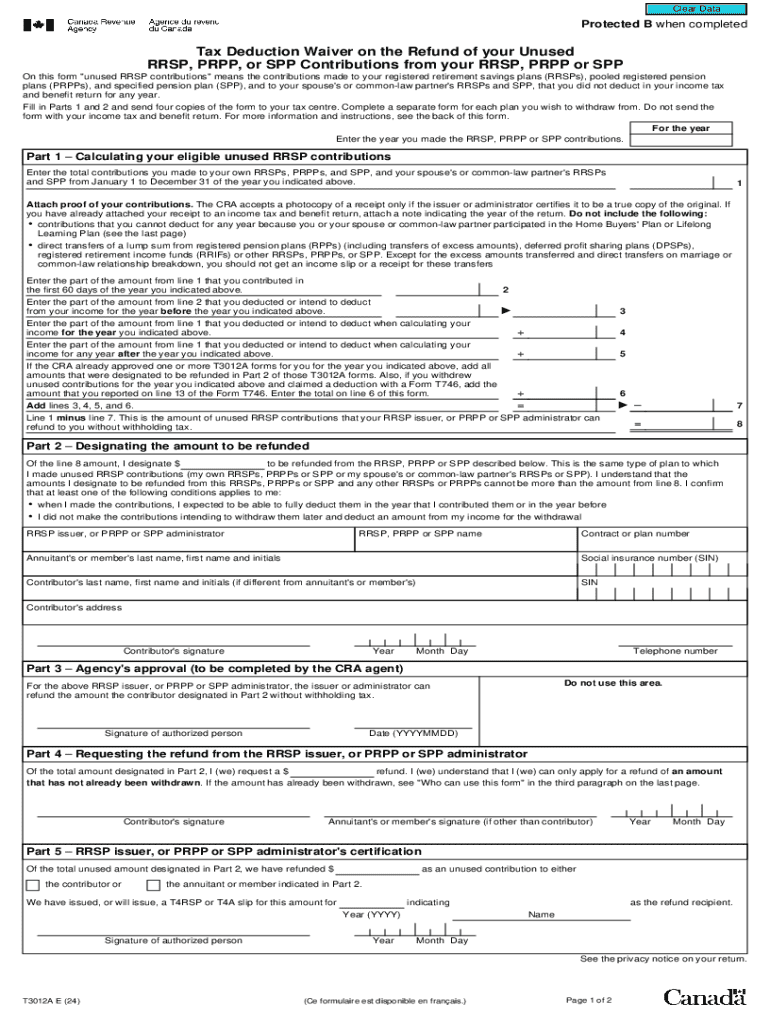

The Tax Deduction Waiver on the refund of your unused Registered Retirement Savings Plan (RRSP), Pooled Registered Pension Plan (PRPP), or Specified Pension Plan (SPP) contributions allows taxpayers to reclaim taxes on contributions that were not utilized for tax deductions in previous years. This waiver is particularly beneficial for individuals who may have over-contributed to their retirement accounts or decided not to claim deductions for various reasons. By applying for this waiver, taxpayers can potentially reduce their taxable income and improve their overall financial situation.

Steps to Utilize the Tax Deduction Waiver

To effectively use the Tax Deduction Waiver, individuals should follow these steps:

- Review your past contributions to RRSP, PRPP, or SPP accounts to identify any unused amounts.

- Gather documentation that supports your contributions, including account statements and tax returns.

- Complete the necessary forms to apply for the waiver, ensuring all information is accurate.

- Submit your application to the appropriate tax authority, either online or via mail.

- Monitor the status of your application and respond promptly to any requests for additional information.

Eligibility Criteria for the Tax Deduction Waiver

To qualify for the Tax Deduction Waiver, taxpayers must meet certain eligibility criteria. These typically include:

- Having made contributions to an RRSP, PRPP, or SPP that were not claimed as tax deductions.

- Filing taxes in the United States and adhering to local tax regulations.

- Providing adequate documentation to support the claim for the waiver.

Required Documents for the Tax Deduction Waiver Application

When applying for the Tax Deduction Waiver, it is essential to prepare and submit the following documents:

- Proof of contributions, such as account statements or receipts.

- Previous tax returns that indicate your contribution history.

- Completed application forms specific to the waiver.

Filing Deadlines for the Tax Deduction Waiver

Timely submission of the Tax Deduction Waiver application is crucial. Key deadlines include:

- The deadline for filing your tax return, which is typically April 15 for most taxpayers.

- Any specific deadlines set by the tax authority for submitting waiver applications.

IRS Guidelines on Tax Deduction Waivers

The Internal Revenue Service (IRS) provides guidelines on how to handle tax deductions and waivers. Familiarizing yourself with these guidelines can help ensure compliance and maximize benefits. Key points include:

- Understanding the implications of unused contributions on your taxable income.

- Keeping accurate records of all contributions and deductions claimed.

- Consulting IRS publications or a tax professional for personalized advice.

Create this form in 5 minutes or less

Find and fill out the correct tax deduction waiver on the refund of your unused rrsp prpp or spp contributions

Create this form in 5 minutes!

How to create an eSignature for the tax deduction waiver on the refund of your unused rrsp prpp or spp contributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions?

The Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions allows individuals to receive a tax waiver on the refunds they get from unused contributions to their Registered Retirement Savings Plans (RRSP), Pooled Registered Pension Plans (PRPP), or Specified Pension Plans (SPP). This means you can potentially save on taxes while accessing your funds.

-

How can airSlate SignNow help with the Tax Deduction Waiver process?

airSlate SignNow simplifies the documentation process required for claiming the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions. Our platform allows you to easily eSign and send necessary documents, ensuring a smooth and efficient experience.

-

Are there any fees associated with using airSlate SignNow for tax-related documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. While there may be fees associated with using our platform, the benefits of streamlining your document processes, especially for the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions, can outweigh the costs.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents. These features can signNowly aid in the process of claiming the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions.

-

Can I integrate airSlate SignNow with other financial software?

Absolutely! airSlate SignNow offers integrations with various financial and accounting software, making it easier to manage your documents related to the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions. This ensures that all your financial data is synchronized and accessible.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. These advantages are particularly valuable when dealing with the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions.

-

Is airSlate SignNow suitable for both individuals and businesses?

Yes, airSlate SignNow is designed to cater to both individuals and businesses. Whether you are filing for the Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions as an individual or managing it for a business, our platform can accommodate your needs.

Get more for Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions

Find out other Tax Deduction Waiver On The Refund Of Your Unused Rrsp, Prpp, Or Spp Contributions

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast