Ct 1065ct 1120si 2022

Understanding the Ct 1065ct 1120si

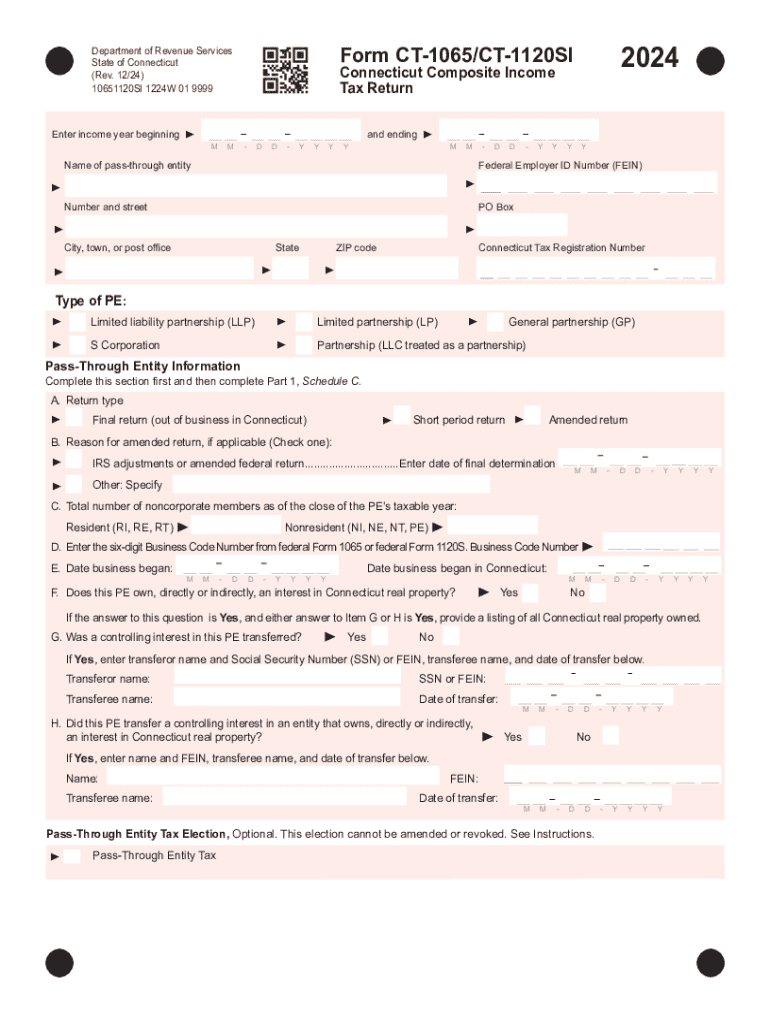

The Ct 1065ct 1120si is a tax form used primarily by partnerships and S corporations in Connecticut. This form is essential for reporting income, deductions, and credits to the state. It allows businesses to provide a comprehensive overview of their financial activities for the tax year, ensuring compliance with state tax regulations. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and avoiding penalties.

Steps to Complete the Ct 1065ct 1120si

Completing the Ct 1065ct 1120si involves several key steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the form with accurate financial data, ensuring all sections are completed.

- Calculate total income, deductions, and credits to determine the tax liability.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to avoid penalties.

Required Documents for the Ct 1065ct 1120si

To successfully complete the Ct 1065ct 1120si, certain documents are necessary:

- Financial statements, including profit and loss statements.

- Records of all business expenses and deductions.

- Previous tax returns, if applicable, for reference.

- Details of any credits claimed for the tax year.

Filing Deadlines for the Ct 1065ct 1120si

Timely filing of the Ct 1065ct 1120si is essential to avoid penalties. The typical deadline for submission is the fifteenth day of the third month following the end of the tax year. For calendar year filers, this means the deadline is usually March 15. Extensions may be available, but it is important to file the necessary forms to request an extension before the original deadline.

Legal Use of the Ct 1065ct 1120si

The Ct 1065ct 1120si serves a legal purpose in tax compliance for partnerships and S corporations. Filing this form accurately ensures that businesses meet their tax obligations under Connecticut law. Failure to file or inaccuracies can lead to legal repercussions, including fines and audits. Understanding the legal implications of this form is vital for maintaining good standing with state tax authorities.

Examples of Using the Ct 1065ct 1120si

Businesses may encounter various scenarios where the Ct 1065ct 1120si is applicable:

- A partnership with multiple members reporting shared income and expenses.

- An S corporation distributing profits to shareholders while reporting on the form.

- Businesses claiming specific deductions related to operational costs.

Who Issues the Ct 1065ct 1120si

The Ct 1065ct 1120si is issued by the Connecticut Department of Revenue Services. This agency is responsible for administering state tax laws and ensuring compliance among businesses operating within Connecticut. Understanding the role of this agency can help businesses navigate the filing process more effectively.

Create this form in 5 minutes or less

Find and fill out the correct ct 1065ct 1120si

Create this form in 5 minutes!

How to create an eSignature for the ct 1065ct 1120si

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ct 1065ct 1120si?

Ct 1065ct 1120si refers to specific tax forms used for reporting income and expenses for partnerships and S corporations in Connecticut. Understanding these forms is crucial for compliance and accurate tax reporting. airSlate SignNow can help streamline the process of preparing and signing these documents.

-

How does airSlate SignNow simplify the Ct 1065ct 1120si filing process?

airSlate SignNow simplifies the Ct 1065ct 1120si filing process by providing an intuitive platform for creating, sending, and eSigning documents. This ensures that all necessary signatures are obtained quickly and securely, reducing the time spent on paperwork. With our solution, you can focus more on your business and less on administrative tasks.

-

What are the pricing options for using airSlate SignNow for Ct 1065ct 1120si?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Our plans are designed to be cost-effective, ensuring that you can manage your Ct 1065ct 1120si documents without breaking the bank. You can choose a plan that fits your needs and budget, making it easier to stay compliant.

-

Can I integrate airSlate SignNow with other software for managing Ct 1065ct 1120si?

Yes, airSlate SignNow integrates seamlessly with various accounting and document management software. This allows you to manage your Ct 1065ct 1120si documents alongside your existing tools, enhancing efficiency and reducing the risk of errors. Our integrations help streamline your workflow and improve productivity.

-

What features does airSlate SignNow offer for managing Ct 1065ct 1120si documents?

airSlate SignNow offers a range of features tailored for managing Ct 1065ct 1120si documents, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are handled efficiently and securely. You can also collaborate with team members easily, making the process smoother.

-

How secure is airSlate SignNow for handling Ct 1065ct 1120si documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your Ct 1065ct 1120si documents. You can trust that your sensitive information is safe while using our platform, allowing you to focus on your business without worrying about data bsignNowes.

-

What are the benefits of using airSlate SignNow for Ct 1065ct 1120si?

Using airSlate SignNow for Ct 1065ct 1120si offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows you to manage your documents digitally, saving time and resources. Additionally, the ease of eSigning helps ensure that your filings are completed on time.

Get more for Ct 1065ct 1120si

- Va form 21 0788

- Emergency funding requisition form

- Hud 51000 form

- Boston home center program application and disclosure form

- Pbgc form 10

- Advance notice of reportable events pbgc form

- Agreement to pay individual or 1099 reportable entity departments weber form

- La trobe communication questionnaireby jacinta douglas christine bracy amp pamela snow template form

Find out other Ct 1065ct 1120si

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word