FORM 3 ACCOUNTANT'S REPORT to the Real Estate 2022-2026

What is the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

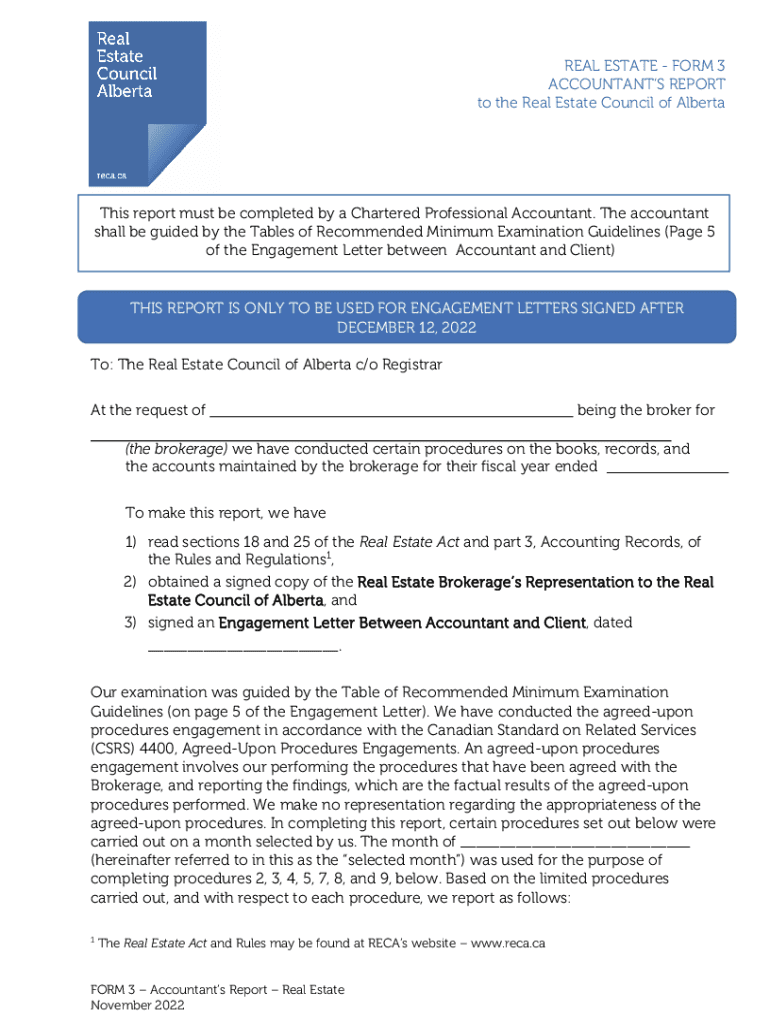

The FORM 3 ACCOUNTANT'S REPORT To The Real Estate is a formal document prepared by an accountant that provides a comprehensive overview of the financial status of a real estate entity. This report typically includes financial statements, accounting practices, and compliance with applicable regulations. It serves as a critical tool for stakeholders, including investors, lenders, and regulatory bodies, to assess the financial health and operational integrity of real estate ventures.

Key elements of the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

Several key elements are essential in the FORM 3 ACCOUNTANT'S REPORT. These include:

- Financial Statements: Detailed balance sheets, income statements, and cash flow statements that reflect the entity's financial performance.

- Accounting Policies: An overview of the accounting methods used, ensuring transparency and consistency in financial reporting.

- Compliance Information: Evidence of adherence to relevant laws and regulations governing real estate operations.

- Management Discussion: Insights from management regarding financial results and future outlook, providing context to the numbers.

Steps to complete the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

Completing the FORM 3 ACCOUNTANT'S REPORT involves several important steps:

- Gather Financial Data: Collect all necessary financial records, including transactions, invoices, and bank statements.

- Prepare Financial Statements: Create the balance sheet, income statement, and cash flow statement based on the gathered data.

- Document Accounting Policies: Clearly outline the accounting methods and policies used in the preparation of the financial statements.

- Review for Compliance: Ensure that all financial practices comply with relevant regulations and standards.

- Finalize the Report: Compile all sections into a cohesive report, ensuring clarity and accuracy before submission.

Legal use of the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

The FORM 3 ACCOUNTANT'S REPORT is often required for legal purposes, particularly in transactions involving real estate financing or sales. It may be used to satisfy lender requirements, support due diligence processes, or fulfill regulatory obligations. Ensuring that the report is prepared by a qualified accountant enhances its legal standing and credibility.

How to obtain the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

To obtain the FORM 3 ACCOUNTANT'S REPORT, individuals or entities typically need to engage a certified public accountant (CPA) or a qualified accounting firm. The process generally involves:

- Consultation: Discussing specific needs and expectations with the accountant.

- Data Provision: Providing all necessary financial documents and information required for the report.

- Review Process: Collaborating with the accountant during the preparation and review stages to ensure accuracy.

Examples of using the FORM 3 ACCOUNTANT'S REPORT To The Real Estate

The FORM 3 ACCOUNTANT'S REPORT can be utilized in various scenarios, including:

- Real Estate Financing: Lenders often require this report to assess the financial viability of a property before approving loans.

- Property Sales: Sellers may present the report to potential buyers to demonstrate the financial health of the property.

- Regulatory Compliance: Real estate entities may need to submit this report to comply with local or state regulations.

Create this form in 5 minutes or less

Find and fill out the correct form 3 accountants report to the real estate

Create this form in 5 minutes!

How to create an eSignature for the form 3 accountants report to the real estate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for FORM 3 ACCOUNTANT'S REPORT To The Real Estate

Find out other FORM 3 ACCOUNTANT'S REPORT To The Real Estate

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure