Soc426a 2016

What is the Soc426a

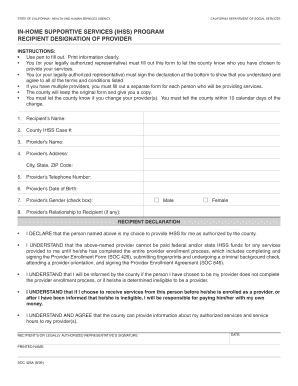

The Soc426a is a specific form used primarily for tax purposes in the United States. It is designed to collect essential information from individuals or businesses regarding their social security contributions. This form is crucial for ensuring accurate reporting to the Internal Revenue Service (IRS) and maintaining compliance with federal tax regulations. Understanding the purpose and requirements of the Soc426a is vital for taxpayers to avoid potential issues with their tax filings.

How to use the Soc426a

Using the Soc426a involves several straightforward steps. First, gather all necessary personal and financial information, including your social security number and any relevant income details. Next, carefully fill out the form, ensuring that all sections are completed accurately. Once the form is filled, review it for any errors before submission. It is essential to keep a copy for your records. The Soc426a can be submitted electronically or via mail, depending on your preference and the requirements set by the IRS.

Steps to complete the Soc426a

Completing the Soc426a requires attention to detail. Follow these steps for accurate submission:

- Obtain the latest version of the Soc426a from the IRS website or authorized sources.

- Fill in your personal information, including your name, address, and social security number.

- Provide details about your income and any deductions applicable.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Soc426a

The Soc426a is legally mandated for individuals and businesses required to report their social security contributions. Proper use of this form is essential for compliance with U.S. tax laws. Failing to submit the Soc426a can lead to penalties, including fines and interest on unpaid taxes. It is important to understand the legal implications of using this form to ensure adherence to all relevant regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Soc426a can vary based on individual circumstances. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these deadlines to avoid late filing penalties.

Required Documents

To complete the Soc426a, certain documents are necessary. These include:

- Your social security card or number.

- Income statements, such as W-2s or 1099s.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return, if applicable.

Having these documents on hand will streamline the completion process and enhance accuracy.

Create this form in 5 minutes or less

Find and fill out the correct soc426a 5299951

Create this form in 5 minutes!

How to create an eSignature for the soc426a 5299951

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Soc426a and how does it relate to airSlate SignNow?

Soc426a is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, ensuring that documents are signed quickly and securely. By utilizing Soc426a, businesses can improve efficiency and reduce turnaround times for important documents.

-

What are the pricing options for airSlate SignNow with Soc426a?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options that incorporate the Soc426a feature. Pricing is designed to be cost-effective, ensuring that businesses of all sizes can access powerful eSigning tools. You can choose from monthly or annual subscriptions based on your usage requirements.

-

What features does Soc426a offer for document signing?

Soc426a includes a variety of features such as customizable templates, automated workflows, and real-time tracking of document status. These features help users manage their signing processes more effectively. With Soc426a, you can also integrate with other tools to enhance your document management experience.

-

How can Soc426a benefit my business?

By implementing Soc426a, your business can signNowly reduce the time spent on document signing and management. This feature promotes a more efficient workflow, allowing your team to focus on core tasks rather than administrative duties. Additionally, Soc426a enhances security and compliance, ensuring that your documents are handled safely.

-

Can I integrate Soc426a with other software tools?

Yes, Soc426a is designed to seamlessly integrate with various software applications, enhancing your overall productivity. Whether you use CRM systems, project management tools, or cloud storage solutions, Soc426a can connect with them to streamline your document workflows. This integration capability makes it easier to manage documents across different platforms.

-

Is there a mobile app for airSlate SignNow with Soc426a?

Absolutely! airSlate SignNow offers a mobile app that includes the Soc426a feature, allowing you to manage and sign documents on the go. The app is user-friendly and ensures that you can access your documents anytime, anywhere. This flexibility is ideal for businesses that require mobility in their operations.

-

What types of documents can I sign using Soc426a?

Soc426a supports a wide range of document types, including contracts, agreements, and forms. This versatility allows businesses to use airSlate SignNow for various signing needs. Whether you need to sign legal documents or internal memos, Soc426a can handle it efficiently.

Get more for Soc426a

- Honorable terry j hatter jr united states district court form

- Bill of costs official district court formfree legal forms

- Justia request to proceed in forma pauperis with

- Prisonerplaintiff form

- Instructions for filing a civil rights complaint by a prisoner general instructions form

- Federal habeas corpus packetpdf central district of california form

- Family guide nys department of corrections and form

- Service of process us marshals form

Find out other Soc426a

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe