HOH Audit Letter HOH Audit Letter Ftb Ca 2015

What is the HOH Audit Letter?

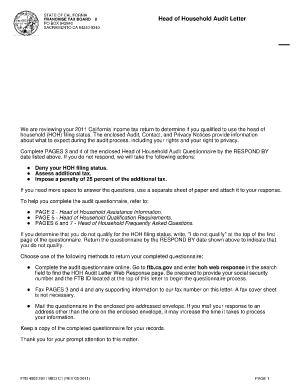

The HOH Audit Letter is a formal communication issued by the California Franchise Tax Board (FTB) to taxpayers claiming Head of Household (HOH) status on their tax returns. This letter typically indicates that the FTB is conducting an audit to verify the eligibility of the HOH claim. The audit process ensures compliance with state tax laws and helps prevent fraudulent claims. Understanding the specifics of this letter is crucial for taxpayers to respond appropriately and maintain their tax status.

How to Obtain the HOH Audit Letter

To receive the HOH Audit Letter, taxpayers usually do not need to take any action, as it is generated by the California FTB after the agency identifies a need for verification. However, if a taxpayer believes they are eligible for HOH status and have not received a letter, they can contact the FTB directly. It is also advisable to ensure that all relevant tax documents are accurate and submitted on time to avoid potential audits.

Steps to Complete the HOH Audit Letter

Completing the HOH Audit Letter involves several key steps:

- Review the Letter: Carefully read the letter to understand the specific information requested by the FTB.

- Gather Documentation: Collect all necessary documents that support your HOH claim, such as proof of residency, dependent information, and income records.

- Respond Promptly: Provide the requested information within the timeframe specified in the letter to avoid penalties.

- Submit Documentation: Send the gathered documents back to the FTB through the method indicated in the letter, whether by mail or electronically.

Key Elements of the HOH Audit Letter

The HOH Audit Letter typically includes several important components:

- Taxpayer Information: This section includes the taxpayer's name, address, and Social Security number.

- Audit Reason: A brief explanation of why the audit is being conducted, often related to discrepancies in the HOH claim.

- Requested Documentation: A detailed list of documents that the FTB requires to verify the HOH status.

- Response Deadline: The date by which the taxpayer must respond to the audit request.

Legal Use of the HOH Audit Letter

The HOH Audit Letter serves a legal purpose in the context of tax compliance. It is a formal request for information that taxpayers are obligated to respond to under California tax law. Failure to comply with the request can result in penalties, including adjustments to tax returns and potential legal action. Taxpayers should treat this letter with seriousness and ensure that their responses are accurate and timely.

Filing Deadlines and Important Dates

Timely response to the HOH Audit Letter is crucial. The letter will specify a deadline for submitting the required documentation. Taxpayers should mark this date on their calendars and ensure that they allow sufficient time to gather the necessary documents. Missing the deadline can lead to further complications, including potential penalties or adjustments to tax filings.

Create this form in 5 minutes or less

Find and fill out the correct hoh audit letter hoh audit letter ftb ca

Create this form in 5 minutes!

How to create an eSignature for the hoh audit letter hoh audit letter ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an HOH Audit Letter HOH Audit Letter Ftb Ca?

An HOH Audit Letter HOH Audit Letter Ftb Ca is a notification from the California Franchise Tax Board indicating that your Head of Household filing status is under review. This letter typically requests additional documentation to verify your eligibility for the HOH status. Understanding this letter is crucial for ensuring compliance and avoiding potential penalties.

-

How can airSlate SignNow help with the HOH Audit Letter HOH Audit Letter Ftb Ca?

airSlate SignNow provides a streamlined solution for managing documents related to your HOH Audit Letter HOH Audit Letter Ftb Ca. You can easily eSign and send necessary documents securely, ensuring that you meet the requirements set by the California Franchise Tax Board. This simplifies the process and helps you respond promptly to any requests.

-

What features does airSlate SignNow offer for handling audit letters?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your HOH Audit Letter HOH Audit Letter Ftb Ca. These features allow you to create, send, and store documents efficiently, ensuring that you have everything you need at your fingertips during an audit process.

-

Is there a cost associated with using airSlate SignNow for HOH Audit Letters?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with HOH Audit Letter HOH Audit Letter Ftb Ca. The plans are designed to be cost-effective, providing you with the tools necessary to manage your documents without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other tools for managing my audit documents?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your HOH Audit Letter HOH Audit Letter Ftb Ca alongside your existing tools. This integration enhances your workflow, making it easier to access and share documents across platforms, ensuring a smooth audit process.

-

What are the benefits of using airSlate SignNow for my audit letter needs?

Using airSlate SignNow for your HOH Audit Letter HOH Audit Letter Ftb Ca offers numerous benefits, including increased efficiency, enhanced security, and improved compliance. The platform simplifies document management, allowing you to focus on your business while ensuring that all necessary paperwork is handled correctly and securely.

-

How secure is airSlate SignNow when handling sensitive documents like audit letters?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including HOH Audit Letter HOH Audit Letter Ftb Ca. You can trust that your sensitive information is safe from unauthorized access, giving you peace of mind while managing your audit-related documents.

Get more for HOH Audit Letter HOH Audit Letter Ftb Ca

- Withholding tax faqs division of revenue delaware form

- Wwwpdffillercom495197735 wcwt 5 refund of2019 form de wcwt 5 wilmington fill online printable

- City property taxwilmington decity wage ampamp net profits taxeswilmington decity property taxwilmington de form

- Fillable online delaware form 200 c tax year delaware

- Application for initial clinical laboratory registration lab155pdf form

- 1065 schedule b 1 2018 form

- Irs form 8843 2009

- Downtime critical care systems assessment virginia form

Find out other HOH Audit Letter HOH Audit Letter Ftb Ca

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now