New Jersey Form NJ 630 Application for Extension of Time 2021

What is the New Jersey Form NJ 630 Application For Extension Of Time

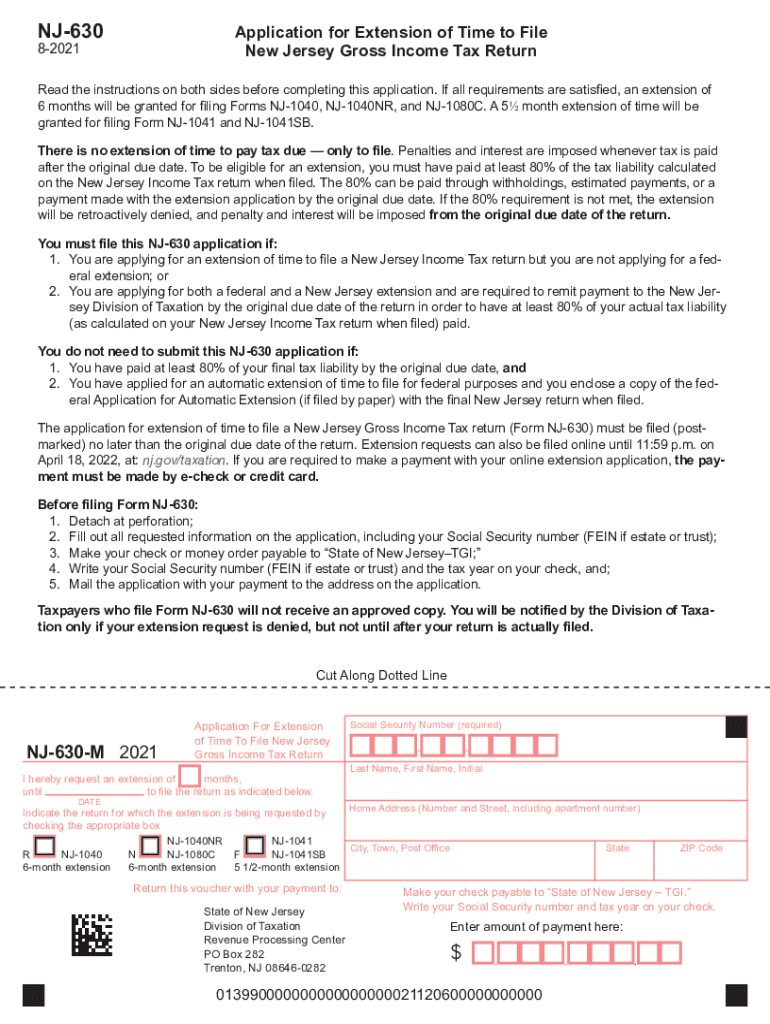

The New Jersey Form NJ 630 is an application that allows taxpayers to request an extension of time to file their state income tax returns. This form is particularly useful for individuals and businesses who may need additional time to gather necessary information or complete their tax filings. By submitting this application, taxpayers can receive an automatic extension, which typically grants them an additional six months to file their New Jersey income tax forms.

How to use the New Jersey Form NJ 630 Application For Extension Of Time

To effectively use the New Jersey Form NJ 630, taxpayers should first ensure they meet the eligibility criteria for an extension. Once eligibility is confirmed, the form can be filled out with the required personal and financial information. It is essential to submit the completed form by the specified deadline to avoid penalties. The form can be filed electronically or mailed to the appropriate state tax office, depending on the taxpayer's preference.

Steps to complete the New Jersey Form NJ 630 Application For Extension Of Time

Completing the New Jersey Form NJ 630 involves several key steps:

- Gather necessary information, including your Social Security number, income details, and any relevant tax documents.

- Fill out the form accurately, ensuring all sections are completed, including the taxpayer's name, address, and the reason for the extension.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the state tax website or mail it to the designated address.

Legal use of the New Jersey Form NJ 630 Application For Extension Of Time

The legal use of the New Jersey Form NJ 630 is governed by state tax laws. When properly completed and submitted, this form serves as a valid request for an extension of time to file state income tax returns. It is important to note that while the form extends the filing deadline, it does not extend the deadline for payment of any taxes owed. Taxpayers should ensure that any estimated taxes due are paid by the original deadline to avoid interest and penalties.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for taxpayers using the New Jersey Form NJ 630. The application must be submitted by the original due date of the tax return to qualify for the extension. For most individual taxpayers, this date falls on April fifteenth. If the due date falls on a weekend or holiday, the deadline is typically extended to the next business day. Keeping track of these dates helps ensure compliance and avoids unnecessary penalties.

Required Documents

When completing the New Jersey Form NJ 630, taxpayers may need to provide certain documents to support their application. These documents can include:

- Previous year’s tax return for reference.

- Income statements such as W-2s or 1099s.

- Any documentation related to deductions or credits being claimed.

Having these documents ready can streamline the completion process and ensure accuracy in the application.

Quick guide on how to complete new jersey form nj 630 application for extension of time

Effortlessly Prepare New Jersey Form NJ 630 Application For Extension Of Time on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents quickly and efficiently. Manage New Jersey Form NJ 630 Application For Extension Of Time seamlessly on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Alter and eSign New Jersey Form NJ 630 Application For Extension Of Time with Ease

- Locate New Jersey Form NJ 630 Application For Extension Of Time and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information, then click the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign New Jersey Form NJ 630 Application For Extension Of Time to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey form nj 630 application for extension of time

Create this form in 5 minutes!

How to create an eSignature for the new jersey form nj 630 application for extension of time

How to create an e-signature for a PDF in the online mode

How to create an e-signature for a PDF in Chrome

The best way to create an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature from your smart phone

How to generate an e-signature for a PDF on iOS devices

The way to create an electronic signature for a PDF file on Android OS

People also ask

-

What is airSlate SignNow and how does it work in NJ Jersey?

airSlate SignNow is a powerful eSignature platform that enables businesses in NJ Jersey to send and sign documents easily. The platform simplifies the signing process by allowing users to create, send, and manage documents electronically, promoting efficiency and reducing paper use.

-

How much does airSlate SignNow cost for businesses in NJ Jersey?

The pricing for airSlate SignNow varies depending on the plan you choose. Businesses in NJ Jersey can select from several affordable subscription options tailored to meet their specific needs, ensuring that even small enterprises can access powerful document management features.

-

What features does airSlate SignNow offer for NJ Jersey users?

airSlate SignNow offers a variety of features such as document templates, customizable workflows, and real-time tracking that are particularly beneficial for users in NJ Jersey. These features help streamline the signing process and integrate with existing business operations seamlessly.

-

Are there any benefits of using airSlate SignNow in NJ Jersey?

Using airSlate SignNow in NJ Jersey comes with several benefits, including increased efficiency and reduced turnaround times for document signing. Moreover, businesses can save costs related to printing and postage, ultimately improving productivity.

-

Can airSlate SignNow integrate with other applications for NJ Jersey businesses?

Yes, airSlate SignNow offers integrations with various popular applications like Google Drive, Salesforce, and Microsoft Office, making it an ideal choice for businesses in NJ Jersey. These integrations enhance workflow efficiency and allow seamless collaboration across different platforms.

-

Is airSlate SignNow secure for businesses in NJ Jersey?

airSlate SignNow prioritizes security, using advanced encryption and compliance protocols to protect sensitive information. Businesses in NJ Jersey can confidently send and sign important documents, knowing that their data is secure and compliant with legal standards.

-

What types of documents can be signed using airSlate SignNow in NJ Jersey?

airSlate SignNow supports a wide variety of document types, including contracts, agreements, and forms, making it suitable for businesses in NJ Jersey across different industries. This versatility ensures that all critical documents can be managed effectively no matter the use case.

Get more for New Jersey Form NJ 630 Application For Extension Of Time

- Mo assignment form

- Letter from landlord to tenant as notice of abandoned personal property missouri form

- Guaranty or guarantee of payment of rent missouri form

- Letter from landlord to tenant as notice of default on commercial lease missouri form

- Residential or rental lease extension agreement missouri form

- Commercial rental lease application questionnaire missouri form

- Apartment lease rental application questionnaire missouri form

- Missouri residential lease form

Find out other New Jersey Form NJ 630 Application For Extension Of Time

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement