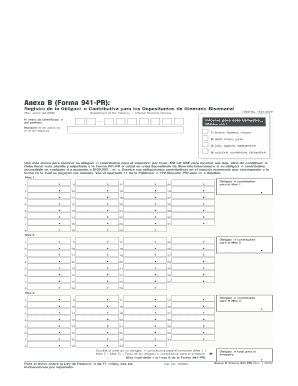

Schedule B Form 941 PR Rev January Report of Tax Liability for Semiweekly Schedule Depositors Spanish Version

What is the Schedule B Tax Form?

The Schedule B tax form, specifically the Schedule B Form 941, is used by employers to report their tax liability for semiweekly schedule depositors. This form is essential for businesses that withhold federal income taxes, Social Security, and Medicare taxes from their employees' wages. It provides the IRS with a detailed account of the taxes owed based on the payroll periods. Proper completion of this form ensures compliance with federal tax regulations and helps avoid penalties.

Key Elements of the Schedule B Tax Form

The Schedule B tax form includes several critical components that employers must accurately fill out. These elements consist of:

- Employer Identification Number (EIN): This unique identifier is assigned to businesses for tax purposes.

- Tax Period: The specific quarter for which the taxes are being reported.

- Tax Liability: The total amount of federal taxes owed for the reporting period, calculated based on employee wages.

- Deposit Schedule: Indicates whether the employer is a semiweekly or monthly depositor, which affects payment deadlines.

Steps to Complete the Schedule B Tax Form

Completing the Schedule B tax form involves several steps to ensure accuracy and compliance. Here is a straightforward process:

- Gather necessary information, including employee payroll records and the employer's EIN.

- Determine the tax liability for the reporting period based on total wages and applicable tax rates.

- Fill out the form, ensuring all sections are completed accurately, including the deposit schedule.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the designated deadline, either electronically or via mail.

IRS Guidelines for the Schedule B Tax Form

The IRS provides specific guidelines for completing and submitting the Schedule B tax form. These guidelines include:

- Ensure that the form is filed for each quarter where payroll taxes are withheld.

- Follow the deposit schedule based on the employer's classification as a semiweekly or monthly depositor.

- Retain copies of the submitted form and any supporting documentation for at least four years for audit purposes.

Filing Deadlines for the Schedule B Tax Form

Filing deadlines for the Schedule B tax form are crucial for compliance. Employers must submit the form by:

- The last day of the month following the end of the quarter for which the taxes are reported.

- For example, for the first quarter (January to March), the deadline is April 30.

Penalties for Non-Compliance with the Schedule B Tax Form

Failure to file the Schedule B tax form on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Late filing penalties based on the amount of tax owed.

- Interest on unpaid taxes, which accrues from the due date until paid.

- Potential audits by the IRS, leading to further scrutiny of business practices.

Quick guide on how to complete schedule b form 941 pr rev january 2005 report of tax liability for semiweekly schedule depositors spanish version

Effortlessly prepare Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents promptly without delays. Manage Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version with ease

- Locate Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form navigation, or mistakes that require reprinting. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version and guarantee remarkable communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule b form 941 pr rev january 2005 report of tax liability for semiweekly schedule depositors spanish version

How to generate an electronic signature for the Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version in the online mode

How to generate an eSignature for your Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version in Chrome

How to generate an electronic signature for signing the Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version in Gmail

How to create an electronic signature for the Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version right from your smartphone

How to make an eSignature for the Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version on iOS

How to generate an electronic signature for the Schedule B Form 941 Pr Rev January 2005 Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version on Android OS

People also ask

-

What is the schedule B tax form?

The schedule B tax form is used to report interest and ordinary dividends received during the tax year. It is a crucial document for taxpayers who earn income from these sources. Completing this form accurately is essential for compliance with IRS regulations.

-

How can airSlate SignNow help with the schedule B tax form?

airSlate SignNow streamlines the process of signing and sending the schedule B tax form electronically. With our easy-to-use platform, you can quickly prepare, eSign, and send your documents securely. This not only saves time but also ensures your forms are submitted promptly.

-

What features does airSlate SignNow offer for tax form management?

airSlate SignNow offers features such as customizable templates, real-time tracking, and integrations with popular accounting software. These tools make it easy to manage the schedule B tax form and other essential documents efficiently. Users can simplify their workflows and enhance productivity.

-

Is airSlate SignNow a cost-effective solution for managing tax forms?

Yes, airSlate SignNow provides a cost-effective solution for managing your schedule B tax form and other documents. With transparent pricing plans, businesses can find a package that fits their needs without overspending. This makes it an ideal choice for both small businesses and larger organizations.

-

Can I access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is accessible on mobile devices, allowing users to manage their schedule B tax form and documents on the go. Whether you are in the office or working remotely, our mobile-friendly platform ensures you can eSign and send documents anytime, anywhere.

-

Does airSlate SignNow integrate with other accounting software?

Yes, airSlate SignNow easily integrates with popular accounting software like QuickBooks and Xero. This integration facilitates seamless management of financial documents, including the schedule B tax form. Users can easily sync their data and streamline their accounting processes.

-

What are the benefits of using airSlate SignNow for tax form eSigning?

Using airSlate SignNow for eSigning your schedule B tax form provides numerous benefits. It offers enhanced security features, a user-friendly interface, and quick turnaround times. Ultimately, this ensures a more efficient and hassle-free experience when handling important tax documents.

Get more for Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version

Find out other Schedule B Form 941 PR Rev January Report Of Tax Liability For Semiweekly Schedule Depositors Spanish Version

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement