4797 Instructions Irs Form

What is the 4797 Instructions IRS

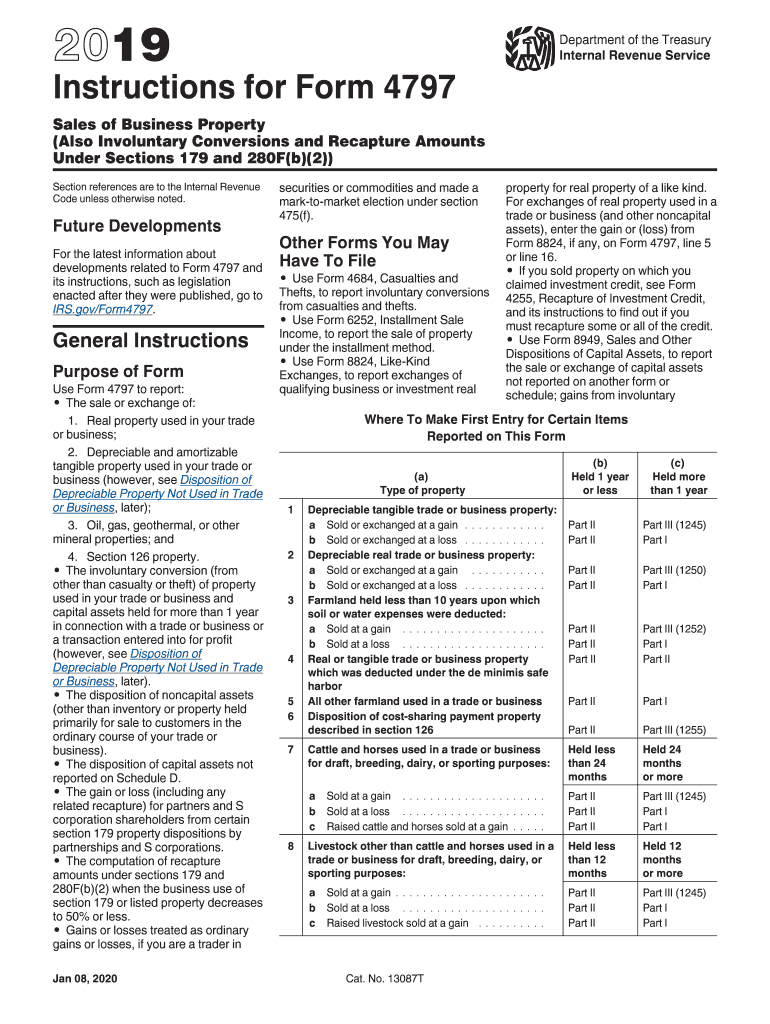

The 4797 form, officially known as "Sales of Business Property," is used by taxpayers to report the sale or exchange of business property. This includes assets such as real estate, machinery, and equipment. The IRS 4797 instructions provide guidance on how to accurately complete the form, detailing the necessary information and calculations required for reporting gains or losses from these transactions. Understanding the purpose of this form is essential for compliance with tax regulations and for ensuring that all relevant financial activities are properly documented.

Steps to Complete the 4797 Instructions IRS

Completing the IRS 4797 form involves several key steps:

- Gather necessary information: Collect details about the property sold, including purchase price, sale price, and any depreciation taken.

- Determine the type of property: Identify whether the property is section 1250, section 1245, or other types, as this affects how gains and losses are reported.

- Calculate gains or losses: Use the information gathered to calculate the gain or loss from the sale, considering any applicable adjustments.

- Complete the form: Fill out the 4797 form with the calculated figures and any additional required information.

- Review and file: Ensure accuracy in the completed form before submitting it to the IRS by the designated deadline.

Legal Use of the 4797 Instructions IRS

The legal use of the IRS 4797 form is crucial for taxpayers engaging in the sale of business property. When used correctly, the form ensures compliance with federal tax laws, allowing taxpayers to report their transactions accurately. It is important to follow the IRS guidelines closely, as improper use of the form can lead to penalties or audits. The instructions help clarify the legal requirements surrounding the reporting of gains and losses, ensuring that all transactions are documented in accordance with IRS standards.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 4797 form are typically aligned with the annual tax return deadlines. Generally, taxpayers must file their 4797 form by April fifteenth of the year following the tax year in which the sale occurred. If the taxpayer is unable to meet this deadline, they may request an extension, but it is important to ensure that all forms are submitted accurately and on time to avoid late fees and penalties.

Examples of Using the 4797 Instructions IRS

Examples of scenarios where the IRS 4797 instructions are applicable include:

- Sale of rental property: When a taxpayer sells a rental property, they must report the sale on the 4797 form, detailing any depreciation and gains.

- Sale of business equipment: If a business sells machinery or equipment, the transaction must be reported, including any applicable losses or gains.

- Exchange of property: In cases where property is exchanged rather than sold, the 4797 form is still required to report the transaction and any resulting tax implications.

Required Documents

To complete the IRS 4797 form accurately, taxpayers should prepare the following documents:

- Purchase and sale agreements: Documentation of the original purchase price and sale price of the property.

- Depreciation records: Detailed records of any depreciation claimed on the property over the years.

- Tax returns: Previous tax returns may be necessary to support the information reported on the 4797 form.

Quick guide on how to complete form 4797 sale of business propertysupport

Complete 4797 Instructions Irs effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a superb eco-friendly substitute for traditional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle 4797 Instructions Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to modify and eSign 4797 Instructions Irs with ease

- Obtain 4797 Instructions Irs and click Get Form to initiate.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document needs in just a few clicks from any device you choose. Edit and eSign 4797 Instructions Irs and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4797 sale of business propertysupport

How to create an electronic signature for your Form 4797 Sale Of Business Propertysupport in the online mode

How to create an electronic signature for the Form 4797 Sale Of Business Propertysupport in Chrome

How to generate an electronic signature for signing the Form 4797 Sale Of Business Propertysupport in Gmail

How to generate an electronic signature for the Form 4797 Sale Of Business Propertysupport right from your smart phone

How to create an eSignature for the Form 4797 Sale Of Business Propertysupport on iOS devices

How to create an eSignature for the Form 4797 Sale Of Business Propertysupport on Android OS

People also ask

-

What is publication 544 2019 and how does it relate to eSigning?

Publication 544 2019 is an IRS guideline related to the taxation of capital gains and losses. While it may not directly discuss eSigning, understanding tax implications can be crucial when signing financial documents through platforms like airSlate SignNow, ensuring compliance and accuracy.

-

How does airSlate SignNow help in managing tax-related documents?

With airSlate SignNow, you can securely sign, send, and store tax documents, ensuring they are always compliant with guidelines like publication 544 2019. Our platform offers templates and integration options to streamline the process, making tax management simpler.

-

Is airSlate SignNow cost-effective for small businesses handling financial documents?

Yes, airSlate SignNow offers flexible pricing plans that are budget-friendly for small businesses. This cost-effective solution allows you to manage essential documents, such as those related to publication 544 2019, without breaking the bank.

-

What features does airSlate SignNow provide for document security?

airSlate SignNow implements advanced security measures, including encryption and secure access controls, to protect your sensitive documents. This is especially important for documents that relate to financial regulations, including publication 544 2019.

-

Can I integrate airSlate SignNow with my existing financial software?

Yes, airSlate SignNow offers seamless integrations with various financial software applications, enhancing your workflow. This allows you to manage documents related to publication 544 2019 more efficiently, directly from your preferred platform.

-

How can airSlate SignNow improve my document turnaround time for tax filings?

By utilizing airSlate SignNow's automated workflows and eSigning capabilities, you can signNowly reduce the time taken to finalize tax documents. This means you can expedite processes related to publication 544 2019, ensuring timely submissions and compliance.

-

What types of documents can I send for eSignature with airSlate SignNow?

You can send a variety of documents for eSignature using airSlate SignNow, including contracts, forms, and tax documents related to publication 544 2019. Our platform supports multiple file formats, making it versatile for different business needs.

Get more for 4797 Instructions Irs

Find out other 4797 Instructions Irs

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament