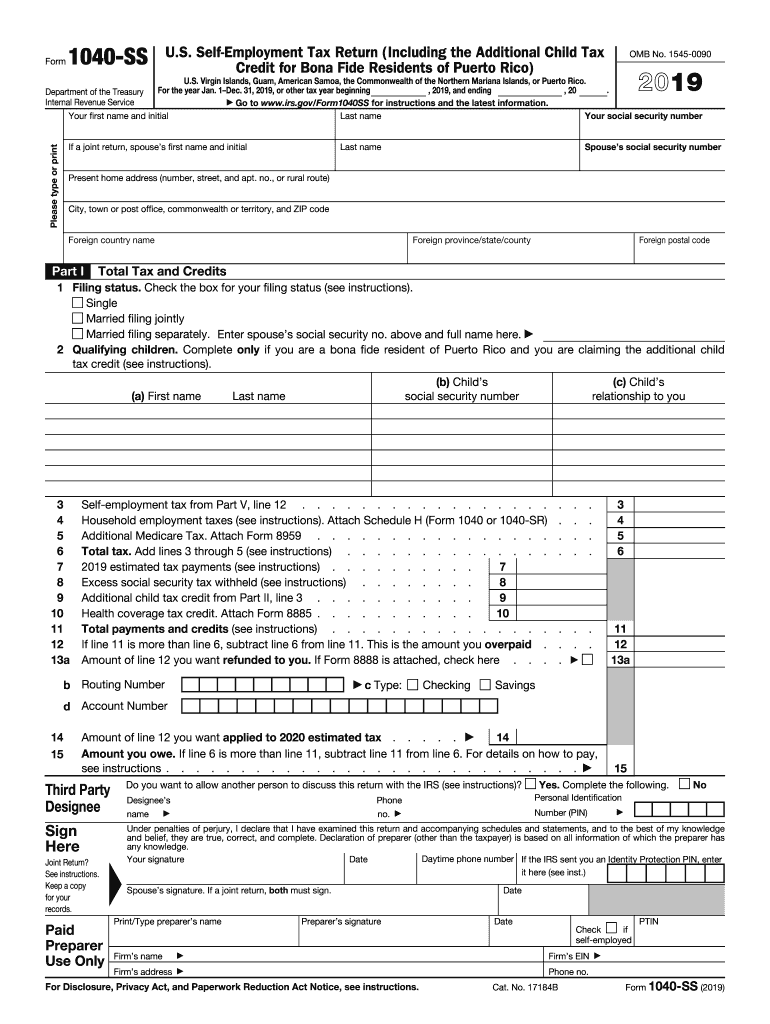

1040 Ss Form

What is the 2019 Form 1040?

The 2019 Form 1040 is the standard individual income tax return form used by taxpayers in the United States. This form is essential for reporting income, calculating taxes owed, and determining eligibility for various tax credits and deductions. It is part of the Internal Revenue Service (IRS) tax filing process and is a crucial document for individuals to fulfill their tax obligations. The 1040 form allows taxpayers to provide detailed information about their income sources, including wages, dividends, and interest, as well as any adjustments to income, tax credits, and payments made throughout the year.

Steps to Complete the 2019 Form 1040

Completing the 2019 Form 1040 involves several key steps to ensure accurate reporting and compliance with IRS regulations. Here are the main steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information: Enter your name, address, Social Security number, and filing status at the top of the form.

- Report income: Input your total income from various sources in the designated sections.

- Claim deductions: Identify and claim any eligible deductions, such as student loan interest or mortgage interest.

- Calculate tax liability: Use the provided tax tables to determine your tax liability based on your taxable income.

- Report payments: Include any tax payments made throughout the year, including withholding and estimated payments.

- Sign and date the form: Ensure that you sign and date the form before submission.

Legal Use of the 2019 Form 1040

The 2019 Form 1040 is legally binding when filled out correctly and submitted to the IRS. To ensure legal compliance, taxpayers must provide accurate information and adhere to IRS guidelines. The form must be signed by the taxpayer, and any false information can lead to penalties or legal repercussions. Additionally, electronic signatures are accepted if the form is submitted online, provided that the eSignature meets the requirements set forth by the ESIGN Act and UETA.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file the Form 1040 was April 15, 2020. Taxpayers who needed additional time could file for an extension, allowing them until October 15, 2020, to submit their returns. It is crucial to be aware of these deadlines to avoid penalties and interest on any taxes owed. The IRS encourages early filing to expedite refunds and reduce the risk of errors.

Required Documents for the 2019 Form 1040

To accurately complete the 2019 Form 1040, taxpayers need to gather several key documents, including:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductible expenses, such as mortgage interest statements or medical expenses.

- Proof of tax payments made throughout the year, including estimated tax payments.

Form Submission Methods

The 2019 Form 1040 can be submitted in several ways, allowing flexibility for taxpayers. Options include:

- Online filing: Many taxpayers choose to file electronically using tax software, which simplifies the process and reduces errors.

- Mail: Taxpayers can print the completed form and mail it to the appropriate IRS address based on their location and type of return.

- In-person: Some individuals may opt to file in person at designated IRS offices, especially if they require assistance.

Quick guide on how to complete 2019 form 1040 ss us self employment tax return including the additional child tax credit for bona fide residents of puerto rico

Effortlessly complete 1040 Ss on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 1040 Ss on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and electronically sign 1040 Ss effortlessly

- Obtain 1040 Ss and click on Get Form to begin.

- Make use of the tools we offer to finalize your document.

- Highlight important sections of your documents or redact sensitive information using the tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Stop worrying about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of your document management needs in just a few clicks from your choice of device. Edit and electronically sign 1040 Ss and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1040 ss us self employment tax return including the additional child tax credit for bona fide residents of puerto rico

How to create an electronic signature for the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico in the online mode

How to generate an electronic signature for the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico in Chrome

How to make an electronic signature for putting it on the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico in Gmail

How to make an eSignature for the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico right from your smart phone

How to create an eSignature for the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico on iOS devices

How to create an eSignature for the 2019 Form 1040 Ss Us Self Employment Tax Return Including The Additional Child Tax Credit For Bona Fide Residents Of Puerto Rico on Android

People also ask

-

What is the 1040 2019 form?

The 1040 2019 form is the standard IRS document used for individual income tax filing in the United States for the year 2019. It allows taxpayers to report their income, claim deductions and credits, and determine their tax liability or refund. Using airSlate SignNow, you can easily eSign and submit your 1040 2019 form securely online.

-

How can airSlate SignNow help me with my 1040 2019 form?

airSlate SignNow streamlines the process of filling out and submitting your 1040 2019 form by allowing you to eSign documents electronically. This not only saves time but also ensures your forms are filed correctly and on time. With our user-friendly interface, you can complete and manage your tax paperwork with ease.

-

Is airSlate SignNow secure for signing my 1040 2019 form?

Yes, airSlate SignNow employs advanced encryption and security measures to protect your personal information when signing your 1040 2019 form. You can trust that your data is secure and that our platform complies with industry standards for electronic signatures. We prioritize your privacy and the confidentiality of your documentation.

-

Are there any costs associated with using airSlate SignNow for my 1040 2019 form?

airSlate SignNow offers various pricing plans that are cost-effective, making it accessible for individuals and businesses alike. Depending on your needs, you can choose a plan that suits you best for managing your 1040 2019 form eSignatures. We provide a transparent pricing structure with no hidden fees.

-

Can I integrate airSlate SignNow with other software to manage my 1040 2019 form?

Absolutely! airSlate SignNow integrates seamlessly with various productivity and financial software, enabling you to manage your 1040 2019 form effectively. Whether you use accounting software or document management systems, our integrations help streamline your workflows and improve efficiency.

-

What features does airSlate SignNow offer for handling the 1040 2019 form?

airSlate SignNow provides features such as document templates, automated reminders, and real-time tracking for your 1040 2019 form. These tools help enhance efficiency and ensure that you never miss a deadline. Our platform simplifies document management, making it easier for you to complete your tax filings.

-

Do I need to download the 1040 2019 form to use airSlate SignNow?

No, you don’t need to download the 1040 2019 form separately. You can easily access the form through airSlate SignNow’s platform, fill it out online, and eSign it without any hassle. This functionality allows for a smoother and quicker filing process without additional downloads.

Get more for 1040 Ss

Find out other 1040 Ss

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors