8879s Form Fillable

What is the 8879s Form Fillable

The 8879s form, officially known as the IRS e-file Signature Authorization for Form 1040, is a crucial document used by taxpayers in the United States. This form allows taxpayers to authorize an electronic return originator (ERO) to file their tax returns electronically. The 8879s form ensures that the taxpayer's identity is verified and provides a legal basis for the electronic submission of their tax information. It is particularly important for those who prefer the convenience of e-filing while maintaining compliance with IRS regulations.

Steps to Complete the 8879s Form Fillable

Completing the 8879s form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your Social Security number, the tax year, and details about your tax return. Next, fill out the form with your personal information, ensuring that all entries are accurate. After completing the form, review it carefully to confirm that all information is correct. Finally, sign and date the form electronically or print it for manual submission, depending on your filing method. Following these steps will help ensure that your form is completed correctly and submitted on time.

Legal Use of the 8879s Form Fillable

The legal use of the 8879s form is governed by IRS regulations, which stipulate that the form must be signed by the taxpayer to authorize e-filing. This signature can be provided electronically, which is recognized as valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act. It is essential for taxpayers to understand that the 8879s form serves as a binding agreement between them and the ERO, affirming that the information provided is accurate and complete. Failure to comply with these legal requirements may result in penalties or delays in processing the tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8879s form. Taxpayers must ensure that the form is completed accurately and submitted in accordance with IRS deadlines for e-filing. It is also important to keep a copy of the signed form for personal records, as it may be required for future reference or in the event of an audit. The IRS recommends reviewing the instructions provided with the form to understand all requirements and ensure compliance with current tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 8879s form align with the overall tax filing deadlines set by the IRS. Typically, individual taxpayers must file their federal tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to be aware of these dates to avoid penalties for late filing. Additionally, if an extension is filed, the 8879s form must still be submitted by the extended deadline to ensure compliance with e-filing regulations.

Form Submission Methods (Online / Mail / In-Person)

The 8879s form can be submitted through various methods, depending on the preferences of the taxpayer and the ERO. For electronic submissions, the form is typically signed and submitted online directly through the ERO's software. Alternatively, taxpayers may choose to print the form and submit it by mail or in person, although electronic submission is encouraged for efficiency and security. It is important to follow the specific instructions provided by the ERO regarding submission methods to ensure proper processing of the tax return.

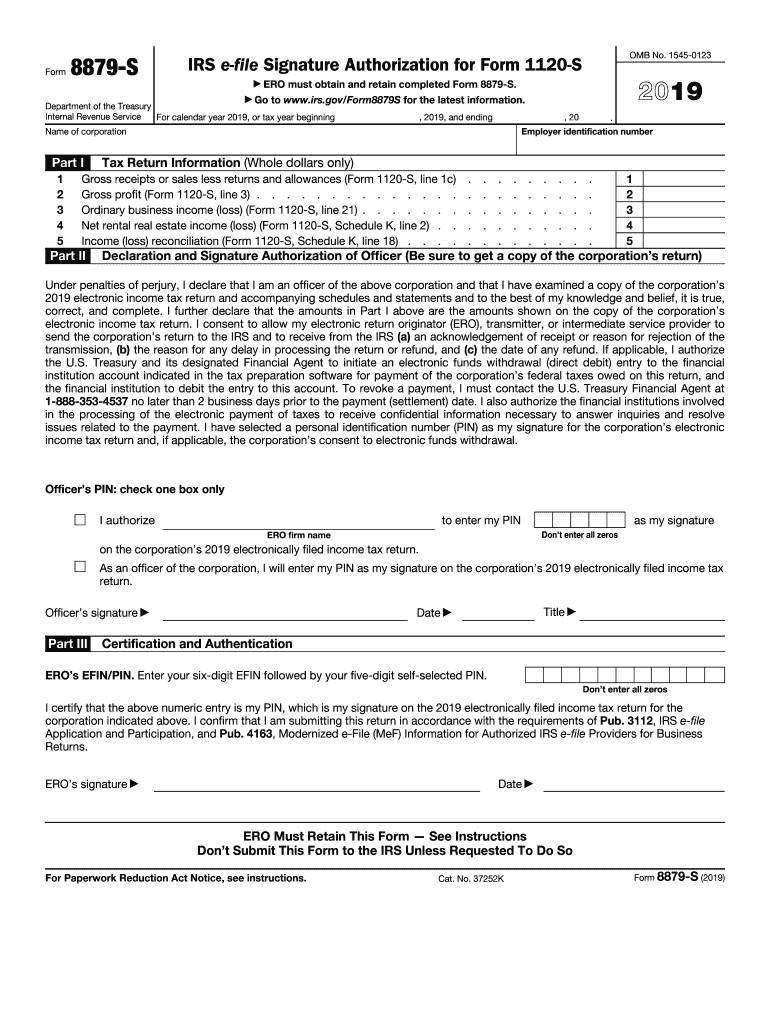

Quick guide on how to complete 2019 form 8879 s irs e file signature authorization for form 1120 s

Complete 8879s Form Fillable effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely archive it online. airSlate SignNow provides all the tools you need to generate, modify, and eSign your documents quickly without holdups. Manage 8879s Form Fillable on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign 8879s Form Fillable with ease

- Obtain 8879s Form Fillable and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign 8879s Form Fillable and ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8879 s irs e file signature authorization for form 1120 s

How to create an eSignature for your 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S online

How to make an electronic signature for your 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S in Chrome

How to generate an eSignature for putting it on the 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S in Gmail

How to create an electronic signature for the 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S straight from your mobile device

How to generate an electronic signature for the 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S on iOS

How to create an eSignature for the 2019 Form 8879 S Irs E File Signature Authorization For Form 1120 S on Android devices

People also ask

-

What is 8879 so and how does it relate to airSlate SignNow?

8879 so refers to a secure and reliable electronic signing process facilitated by airSlate SignNow. This feature allows users to send and eSign documents efficiently while maintaining compliance with legal standards.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans designed to fit various business needs. With plans starting at affordable rates, you can easily leverage features like 8879 so without breaking your budget.

-

What features does airSlate SignNow provide for document signing?

AirSlate SignNow includes a variety of features such as customizable templates, automated workflows, and the secure 8879 so eSigning solution. These features help streamline the signing process and enhance productivity.

-

How does airSlate SignNow ensure the security of eSigned documents?

Security is a top priority for airSlate SignNow, which utilizes industry-standard encryption and compliance measures. The 8879 so feature is specifically designed to protect sensitive data during the eSigning process.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers robust integrations with various applications. This allows users to incorporate the seamless 8879 so feature within their existing workflows, enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly reduce the time and resources spent on document management. The 8879 so solution ensures a user-friendly experience, making it easier for your team to eSign important documents swiftly.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, including small businesses. You can enjoy the full benefits of the 8879 so feature without needing extensive resources.

Get more for 8879s Form Fillable

Find out other 8879s Form Fillable

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed