Schedule L 2019

What is the Schedule L

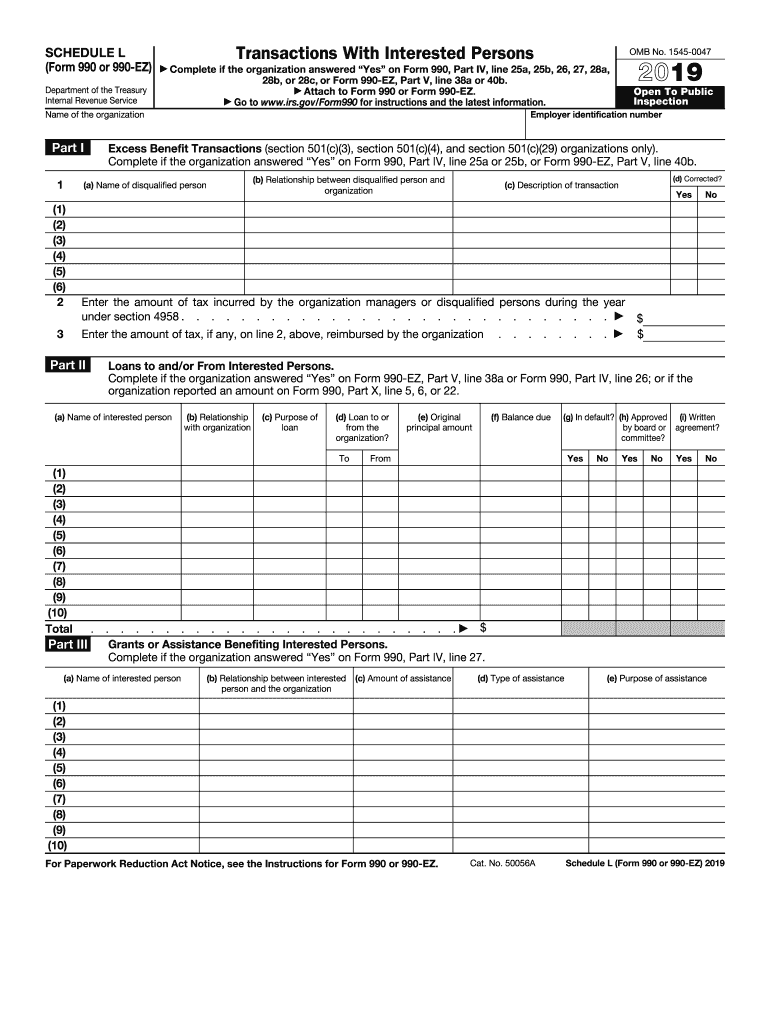

The Schedule L is a supplemental form used by certain tax-exempt organizations to provide detailed information about their assets and liabilities. This form is part of the IRS Form 990 series, specifically designed for organizations that need to disclose their financial position more comprehensively. By completing Schedule L, organizations can report their financial activities, ensuring transparency and compliance with IRS regulations.

How to use the Schedule L

Using the Schedule L involves gathering pertinent financial information related to the organization’s assets and liabilities. Organizations must accurately report their financial data, including investments, loans, and other obligations. This information helps the IRS assess the financial health of the organization and ensures that it adheres to tax-exempt status requirements. It is essential to follow the instructions provided by the IRS carefully to avoid errors that could lead to compliance issues.

Steps to complete the Schedule L

Completing the Schedule L requires a systematic approach to ensure accuracy. Here are the steps to follow:

- Gather financial statements, including balance sheets and income statements.

- Identify all assets, including cash, investments, and property.

- List all liabilities, such as loans and outstanding debts.

- Fill out the Schedule L form, ensuring all required fields are completed.

- Review the form for accuracy and completeness before submission.

Legal use of the Schedule L

The Schedule L must be used in accordance with IRS regulations to maintain compliance with federal tax laws. Organizations are legally required to provide accurate information regarding their financial status. Failure to do so can result in penalties or loss of tax-exempt status. It is crucial for organizations to understand the legal implications of the information reported on this form, as it reflects their financial integrity and accountability.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule L. These guidelines detail what information must be reported and how it should be presented. Organizations should refer to the IRS instructions for Form 990 and Schedule L to ensure compliance. Adhering to these guidelines helps organizations avoid common pitfalls and ensures that they meet all necessary requirements for maintaining their tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Schedule L to avoid penalties. Generally, the Schedule L is due on the same date as the Form 990, which is typically the fifteenth day of the fifth month after the end of the organization's fiscal year. Extensions may be available, but it is essential to file the form on time to maintain compliance with IRS regulations.

Required Documents

To complete the Schedule L accurately, organizations will need several documents, including:

- Financial statements, such as balance sheets and income statements.

- Records of all assets and liabilities.

- Documentation supporting any reported transactions or financial activities.

Having these documents readily available will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete 2019 schedule l form 990 or 990 ez internal revenue

Effortlessly Prepare Schedule L on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to swiftly create, modify, and electronically sign your documents without delays. Handle Schedule L on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Schedule L with Ease

- Obtain Schedule L and click Get Form to begin.

- Make use of our tools to complete your document.

- Emphasize important portions of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which only takes moments and holds the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule L to ensure effective communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 schedule l form 990 or 990 ez internal revenue

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule l form 990 or 990 ez internal revenue

How to create an electronic signature for the 2019 Schedule L Form 990 Or 990 Ez Internal Revenue in the online mode

How to create an eSignature for your 2019 Schedule L Form 990 Or 990 Ez Internal Revenue in Chrome

How to generate an electronic signature for putting it on the 2019 Schedule L Form 990 Or 990 Ez Internal Revenue in Gmail

How to make an electronic signature for the 2019 Schedule L Form 990 Or 990 Ez Internal Revenue right from your smart phone

How to create an eSignature for the 2019 Schedule L Form 990 Or 990 Ez Internal Revenue on iOS devices

How to make an eSignature for the 2019 Schedule L Form 990 Or 990 Ez Internal Revenue on Android OS

People also ask

-

What is Schedule L in airSlate SignNow?

Schedule L refers to the specific feature within airSlate SignNow that allows users to effectively manage and organize their signing processes. This feature enhances document workflows, ensuring that your paperwork is completed efficiently and securely.

-

How does Schedule L benefit my business?

Utilizing Schedule L can streamline your document management operations, saving time and reducing errors in signing processes. With enhanced tracking and organization, your business will experience improved efficiency while maintaining compliance.

-

What are the pricing options for Schedule L on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. By selecting a plan that includes Schedule L, you can gain access to premium eSigning features at competitive rates designed to provide maximum value.

-

Can I integrate Schedule L with other applications?

Yes, Schedule L integrates seamlessly with a variety of popular business applications, including CRM tools and cloud storage services. This connectivity enhances your overall workflow by allowing for easier document sharing and collaboration.

-

Is it easy to use Schedule L for document signing?

Absolutely! Schedule L is designed with user-friendliness in mind, allowing both tech-savvy users and beginners to navigate the features effortlessly. You can quickly set up documents for signing, making it an ideal solution for businesses looking to simplify their processes.

-

What security measures are in place for Schedule L document handling?

Security is a top priority with Schedule L. airSlate SignNow employs advanced encryption for document storage and transmission, ensuring that all sensitive information remains protected throughout the signing process.

-

What types of documents can I manage using Schedule L?

Schedule L supports a wide range of document types, including contracts, agreements, and forms. This versatility allows businesses to handle all necessary documentation within a single platform, streamlining operations.

Get more for Schedule L

- Uniform residential appraisal report fillable

- Uscg form 1280 2004

- Purdue school of medicine form

- Wedding planner checklist form

- Writing a behavior contract cure lifeworks form

- Uniform order form junior girl school years 3 6

- Diploma issue ampamp replacement duplicate diploma request form

- Request for an official transcript by mail form

Find out other Schedule L

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation