Home Treasury Govfinancial Sanctionsfaqs990U S Department of the Treasury 2022

IRS Guidelines

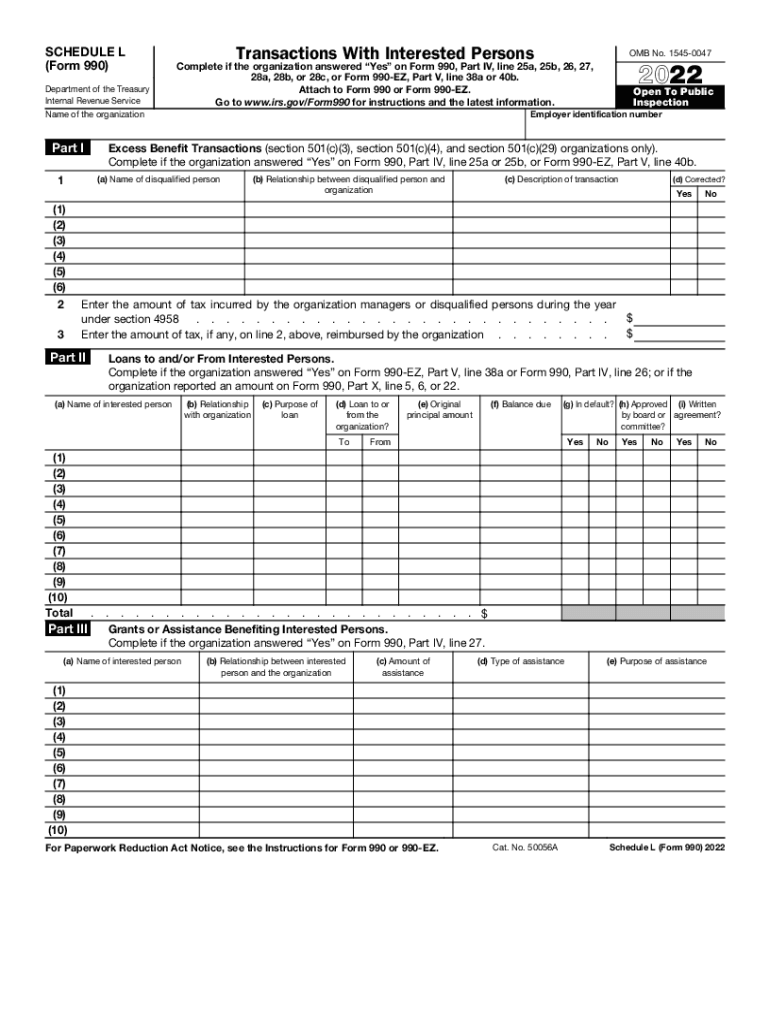

The IRS provides specific guidelines for completing the IRS 990EZ persons form. This form is typically used by small tax-exempt organizations to report their financial information. Understanding these guidelines is crucial to ensure compliance and avoid potential penalties. The form requires organizations to disclose revenue, expenses, and net assets, which helps the IRS assess the organization's financial health and adherence to tax regulations.

Steps to Complete the IRS 990EZ Persons Form

Completing the IRS 990EZ persons form involves several key steps:

- Gather Financial Information: Collect all necessary financial records, including income statements and balance sheets.

- Fill Out the Form: Accurately enter the required information, ensuring all figures are correct and reflect your organization's financial status.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Sign and Date: Ensure that the form is signed by an authorized individual within the organization.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the IRS 990EZ persons form to avoid penalties. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization's tax year. For example, if the tax year ends on December thirty-first, the form would be due on May fifteenth. It is advisable to file early to allow for any potential issues that may arise during the submission process.

Form Submission Methods

The IRS 990EZ persons form can be submitted through various methods, catering to the preferences of different organizations:

- Online Submission: Organizations can file electronically through the IRS e-file system, which is a convenient and efficient option.

- Mail Submission: The form can be printed and mailed to the appropriate IRS address, which varies based on the organization's location.

- In-Person Submission: Some organizations may choose to deliver the form directly to an IRS office, although this method is less common.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the IRS 990EZ persons form can lead to significant penalties. Organizations that do not file on time may incur a fine, which can escalate based on the duration of the delay. Additionally, repeated failures to file can result in the loss of tax-exempt status, which can severely impact the organization's operations and funding.

Eligibility Criteria

Not all organizations are eligible to file the IRS 990EZ persons form. To qualify, an organization must generally have gross receipts of less than two hundred fifty thousand dollars and total assets of less than five hundred thousand dollars. Understanding these criteria is essential for organizations to determine their filing obligations and ensure they are using the correct form for their financial reporting.

Quick guide on how to complete hometreasurygovfinancial sanctionsfaqs990us department of the treasury

Complete Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury seamlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents promptly without any holdups. Handle Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury without hassle

- Find Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury and click on Acquire Form to commence.

- Make use of the tools we offer to submit your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Finish button to save your alterations.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct hometreasurygovfinancial sanctionsfaqs990us department of the treasury

Create this form in 5 minutes!

People also ask

-

What is the IRS 990EZ form, and how does it relate to airSlate SignNow?

The IRS 990EZ form is a shorter version of the Form 990 used by tax-exempt organizations to report financial information. With airSlate SignNow, you can easily eSign and manage IRS 990EZ forms digitally, streamlining the process for organizations needing to submit their IRS 990EZ persons sample efficiently.

-

How can I eSign my IRS 990EZ persons sample using airSlate SignNow?

To eSign your IRS 990EZ persons sample with airSlate SignNow, simply upload your document, add the necessary fields for signatures, and send it for eSignature. Our platform allows you to track the signing process in real time, ensuring your document is signed and filed quickly.

-

What are the pricing options for airSlate SignNow when handling IRS 990EZ forms?

airSlate SignNow offers a range of pricing plans designed to meet different business needs. Whether you are a small non-profit or a larger organization handling multiple IRS 990EZ persons samples, there is a cost-efficient plan available that includes features tailored for efficient document management.

-

What features does airSlate SignNow offer for managing IRS 990EZ persons sample submissions?

airSlate SignNow provides robust features for managing your IRS 990EZ persons sample submissions, including customizable templates, automated workflows, and secure cloud storage. These features ensure that your documents are not only easy to work with but are also compliant with IRS regulations.

-

Can airSlate SignNow integrate with other tools to manage IRS 990EZ forms?

Yes, airSlate SignNow can integrate with various third-party applications and software solutions, making it easier to manage your IRS 990EZ persons sample alongside other tools you may use. Popular integrations include Google Drive, Dropbox, and CRM software, enhancing your document management workflow.

-

Is airSlate SignNow compliant with federal and state regulations for IRS 990EZ forms?

Yes, airSlate SignNow is designed to comply with federal and state regulations for eSigning documents, including the IRS 990EZ persons sample. Our platform uses secure encryption methods and follows industry standards to ensure that your submissions are protected and legally valid.

-

What benefits does airSlate SignNow offer for non-profit organizations filing IRS 990EZ?

Non-profit organizations can benefit from airSlate SignNow by reducing paperwork and streamlining the filing process for IRS 990EZ persons samples. The platform allows for quick eSignature collection, ensures document security, and saves valuable time and resources during tax season.

Get more for Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497321302 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497321303 form

- Letter tenant in 497321304 form

- New york landlord 497321305 form

- New york tenant 497321306 form

- Letter from landlord to tenant as notice to tenant of tenants disturbance of neighbors peaceful enjoyment to remedy or lease 497321307 form

- Letter tenant notice 497321308 form

- New york law form

Find out other Home treasury govfinancial sanctionsfaqs990U S Department Of The Treasury

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer