Form IRS 990 or 990 EZ Schedule L Fill Online 2020

What is the Form IRS 990 or 990 EZ Schedule L?

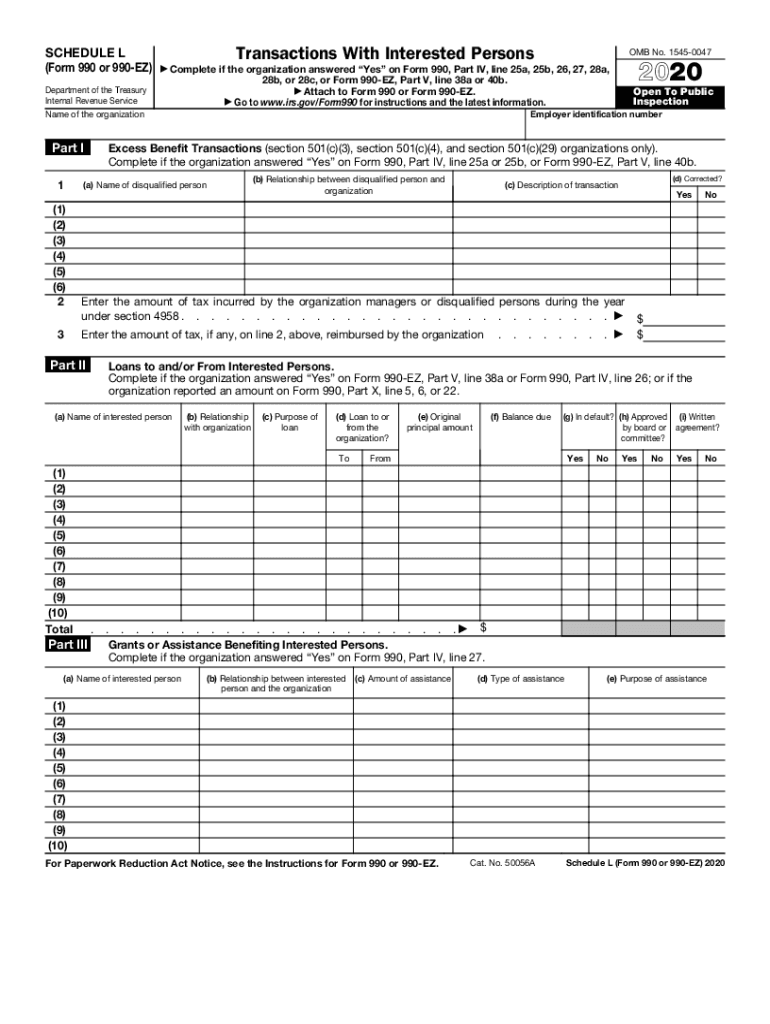

The IRS 990 and 990 EZ forms are essential documents for tax-exempt organizations in the United States. They provide detailed information about an organization's financial activities, governance, and compliance with federal regulations. Schedule L is a supplementary section of these forms that focuses on transactions between the organization and its interested persons, such as board members or key employees. Understanding Schedule L is crucial for ensuring transparency and adherence to IRS guidelines.

Steps to Complete the Form IRS 990 or 990 EZ Schedule L

Completing Schedule L involves several key steps:

- Gather necessary information: Collect data on transactions with interested persons, including amounts and descriptions.

- Identify interested persons: List individuals or entities that meet the IRS definition of interested persons, such as board members and key employees.

- Detail transactions: Provide comprehensive information about each transaction, including the nature, amount, and terms.

- Review for accuracy: Ensure all information is accurate and complete before submission.

Legal Use of the Form IRS 990 or 990 EZ Schedule L

Schedule L is legally required for certain tax-exempt organizations to disclose transactions with interested persons. This requirement helps maintain transparency and accountability, ensuring that organizations operate within the law. Failing to complete this schedule accurately can result in penalties or loss of tax-exempt status. Organizations must familiarize themselves with the legal implications of the information reported on Schedule L.

IRS Guidelines for Completing Schedule L

The IRS provides specific guidelines for completing Schedule L, emphasizing the importance of transparency in financial reporting. Organizations must report any transactions that exceed a certain threshold, typically $100,000, and include details about the nature of these transactions. Adhering to IRS guidelines ensures compliance and helps organizations avoid potential audits or penalties.

Filing Deadlines for IRS 990 or 990 EZ Schedule L

Organizations must file their IRS 990 or 990 EZ forms, including Schedule L, by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization’s fiscal year ends on December 31, the form is due by May 15 of the following year. Extensions may be available, but organizations should be aware of the implications of late filing.

Examples of Using the Form IRS 990 or 990 EZ Schedule L

Organizations use Schedule L to report various transactions, such as:

- Loans made to or from interested persons.

- Compensation arrangements with key employees.

- Sales or leases of property between the organization and interested persons.

These examples illustrate the types of transactions that must be disclosed to ensure compliance with IRS regulations.

Quick guide on how to complete 2019 form irs 990 or 990 ez schedule l fill online

Finish Form IRS 990 Or 990 EZ Schedule L Fill Online smoothly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage Form IRS 990 Or 990 EZ Schedule L Fill Online on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-related workflow today.

How to modify and electronically sign Form IRS 990 Or 990 EZ Schedule L Fill Online with ease

- Locate Form IRS 990 Or 990 EZ Schedule L Fill Online and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or redact sensitive data with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choosing. Modify and electronically sign Form IRS 990 Or 990 EZ Schedule L Fill Online and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form irs 990 or 990 ez schedule l fill online

Create this form in 5 minutes!

How to create an eSignature for the 2019 form irs 990 or 990 ez schedule l fill online

How to create an electronic signature for your PDF file in the online mode

How to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to create an electronic signature right from your smartphone

How to create an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF on Android

People also ask

-

What is the 990 interested form printable?

The 990 interested form printable is a document that helps organizations express their intent to apply for tax-exempt status under Section 501(c)(3). This form allows nonprofits to streamline the application process, ensuring that all necessary information is gathered efficiently for IRS submission.

-

How can I access the 990 interested form printable?

You can easily access the 990 interested form printable through airSlate SignNow's user-friendly platform. Simply navigate to our forms library, where you can download and print the form directly, or choose to fill it out electronically for added convenience.

-

Is there a cost associated with the 990 interested form printable?

airSlate SignNow provides the 990 interested form printable at no cost to users. By leveraging our platform, you can efficiently prepare your forms without any hidden fees, making it a budget-friendly option for nonprofits and organizations.

-

What features does airSlate SignNow offer for the 990 interested form printable?

With airSlate SignNow, you can easily sign, send, and store your 990 interested form printable securely. Our platform includes features such as document templates, eSignature capabilities, and cloud storage, making the process smooth and efficient from start to finish.

-

How does using the 990 interested form printable benefit my organization?

Utilizing the 990 interested form printable simplifies the application process for tax-exempt status, reducing paperwork and potential errors. This allows your organization to focus on its mission while ensuring compliance with IRS requirements, ultimately saving time and resources.

-

Can I integrate the 990 interested form printable with other applications?

Yes, airSlate SignNow allows integrations with various applications, enhancing the usability of your 990 interested form printable. Connect seamlessly with your existing tools and software such as CRM systems, project management apps, and cloud storage solutions for a more streamlined workflow.

-

What support options are available for users of the 990 interested form printable?

At airSlate SignNow, we offer comprehensive customer support for users of the 990 interested form printable. You can access our online resources, including FAQs, tutorials, and customer service representatives who are always ready to assist you with any questions or issues.

Get more for Form IRS 990 Or 990 EZ Schedule L Fill Online

- Business credit application west virginia form

- Individual credit application west virginia form

- Interrogatories to plaintiff for motor vehicle occurrence west virginia form

- Interrogatories to defendant for motor vehicle accident west virginia form

- Llc notices resolutions and other operations forms package west virginia

- Residential real estate sales disclosure statement west virginia form

- Notice of dishonored check civil keywords bad check bounced check west virginia form

- West virginia criminal form

Find out other Form IRS 990 Or 990 EZ Schedule L Fill Online

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed