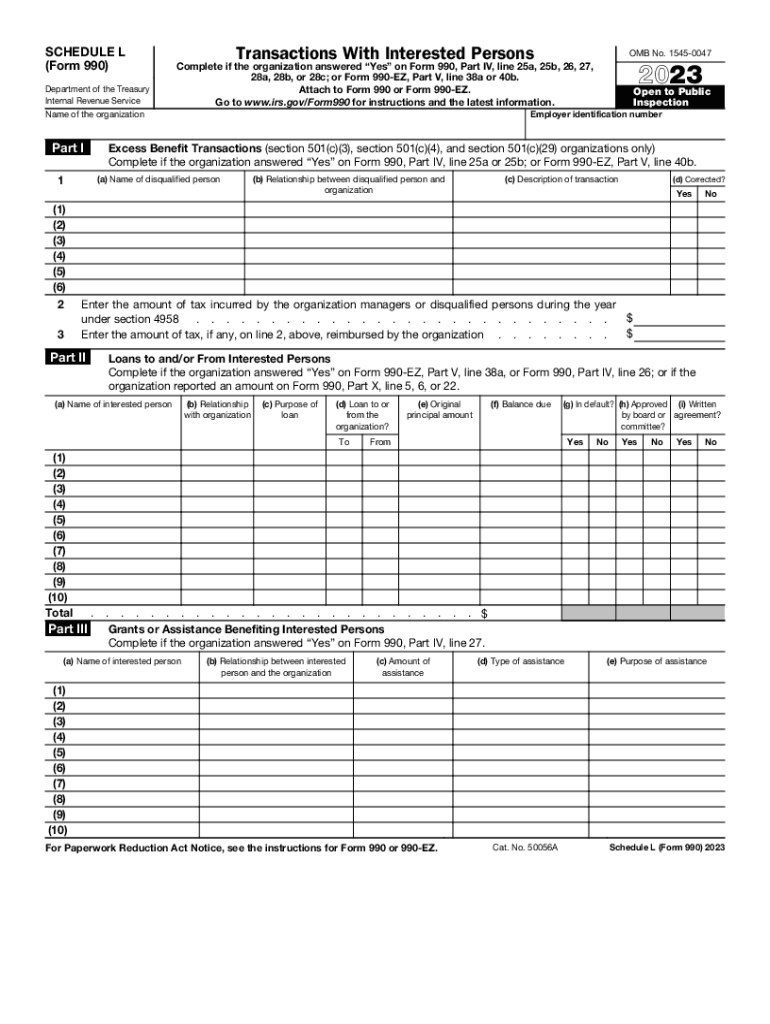

Tax Brief Form 990, Schedule L Transactions with 2023-2026

Understanding Schedule L for Form 1120S

Schedule L is a crucial part of Form 1120S, which is used by S corporations to report their income, deductions, and credits. This schedule specifically provides a balance sheet that reflects the financial position of the corporation at the beginning and end of the tax year. It includes details about assets, liabilities, and shareholders' equity, which are essential for assessing the company's financial health.

How to Complete Schedule L for Form 1120S

Filling out Schedule L involves several steps. First, gather your financial statements, including balance sheets and income statements. You will need to report the total assets, total liabilities, and shareholders' equity as of the beginning and end of the tax year. Ensure that the figures are accurate and reflect your corporation's financial status. Each section must be completed carefully to avoid discrepancies that could lead to penalties or audits.

Key Components of Schedule L

Schedule L consists of several key components, including:

- Assets: This section lists all the assets owned by the corporation, including cash, accounts receivable, inventory, and fixed assets.

- Liabilities: Here, you will report all debts and obligations, such as loans, accounts payable, and any other liabilities.

- Shareholders' Equity: This part reflects the ownership interest in the corporation, including common stock, additional paid-in capital, and retained earnings.

Filing Deadlines for Schedule L

It is important to be aware of the filing deadlines for Form 1120S, including Schedule L. Generally, S corporations must file their tax returns by the fifteenth day of the third month after the end of their tax year. For corporations operating on a calendar year, this means the deadline is March 15. If you need additional time, you can file for an extension, which grants you six more months to submit your return.

IRS Guidelines for Schedule L

The IRS provides specific guidelines for completing Schedule L. It is essential to follow these guidelines to ensure compliance and avoid penalties. The IRS requires that all amounts reported on Schedule L must be rounded to the nearest dollar. Additionally, any discrepancies between the balance sheet and other financial statements must be reconciled and explained clearly in the return.

Common Mistakes to Avoid on Schedule L

When completing Schedule L, several common mistakes can occur. These include:

- Failing to report all assets and liabilities accurately.

- Inconsistent figures between Schedule L and other parts of Form 1120S.

- Not reconciling discrepancies in the financial statements.

By being aware of these pitfalls, you can ensure a smoother filing process and maintain compliance with IRS regulations.

Quick guide on how to complete tax brief form 990 schedule l transactions with

Complete Tax Brief Form 990, Schedule L Transactions With effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Tax Brief Form 990, Schedule L Transactions With on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to amend and eSign Tax Brief Form 990, Schedule L Transactions With without any hassle

- Obtain Tax Brief Form 990, Schedule L Transactions With and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Edit and eSign Tax Brief Form 990, Schedule L Transactions With ensuring excellent communication at any phase of the form preparation procedure with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax brief form 990 schedule l transactions with

Create this form in 5 minutes!

How to create an eSignature for the tax brief form 990 schedule l transactions with

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for users in 2017 interested in eSigning?

In 2017, interested users can benefit from features like customizable templates, in-person signing, and document tracking. These tools streamline the eSigning process and enhance productivity, making it easier to manage documents. Additionally, airSlate SignNow ensures a secure environment for your documents.

-

How much does airSlate SignNow cost for businesses in 2017 interested in eSignature solutions?

For those in 2017 interested in eSignature solutions, airSlate SignNow offers a variety of pricing plans tailored to different business needs. Plans start competitively, ensuring that businesses of all sizes can afford effective document management without breaking the bank. Be sure to check for any current promotions or discounts.

-

Can airSlate SignNow integrate with other software in 2017 for users interested in automating workflows?

Yes, airSlate SignNow provides robust integrations with other software applications in 2017, making it an excellent choice for users interested in automating workflows. Integrations with platforms like Google Drive, Salesforce, and Zapier allow for seamless data transfer and enhanced efficiency. This makes it easier to manage documents and keep your business processes running smoothly.

-

What are the benefits of using airSlate SignNow for businesses in 2017 interested in going paperless?

For businesses in 2017 interested in going paperless, airSlate SignNow offers signNow benefits, including reduced paper costs and enhanced security for documents. The platform's cloud-based solutions minimize the need for physical document storage, which can save both time and space. Furthermore, going paperless contributes to a more sustainable business practice.

-

Is airSlate SignNow user-friendly for new users in 2017 interested in eSigning tools?

Absolutely! airSlate SignNow is designed with user-friendliness in mind for those in 2017 interested in eSigning tools. The intuitive interface allows even newcomers to navigate the platform effectively without a steep learning curve. Users can quickly start eSigning documents and collaborate with others efficiently.

-

What security features does airSlate SignNow provide for those in 2017 interested in document protection?

For users in 2017 interested in document protection, airSlate SignNow includes robust security features such as encryption and multi-factor authentication. These measures ensure that sensitive information remains secure while passing through the eSigning process. This commitment to security provides peace of mind for businesses handling confidential documents.

-

How can airSlate SignNow help remote teams in 2017 interested in collaborative work?

For remote teams in 2017 interested in collaborative work, airSlate SignNow facilitates easy document sharing and signing from any location. The platform allows multiple users to collaborate in real-time, ensuring that workflows remain uninterrupted regardless of physical distance. This feature is particularly valuable for businesses with diverse workforces.

Get more for Tax Brief Form 990, Schedule L Transactions With

Find out other Tax Brief Form 990, Schedule L Transactions With

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement