Form 990 or 990 EZ Schedule L Transactions with Interested Persons Irs 2016

What is the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

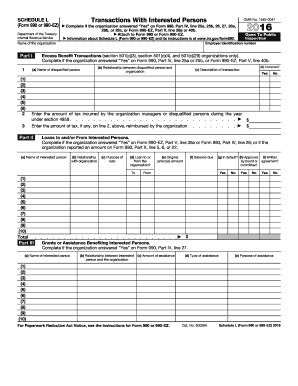

The Form 990 or 990 EZ Schedule L is a crucial document for tax-exempt organizations in the United States. It focuses on transactions between the organization and interested persons, which include substantial contributors, board members, and their family members. This schedule is designed to disclose certain financial transactions that may raise concerns about conflicts of interest or self-dealing. By providing transparency, the IRS aims to ensure that tax-exempt entities operate in accordance with their charitable missions and maintain public trust.

How to use the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

Using the Form 990 or 990 EZ Schedule L involves carefully documenting transactions with interested persons. Organizations must report any transactions that exceed a specified threshold, including loans, leases, and sales of goods or services. Accurate record-keeping is essential, as these disclosures help the IRS assess compliance with tax regulations. Organizations should review their financial activities and consult with tax professionals to ensure that all relevant transactions are reported correctly on this schedule.

Steps to complete the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

Completing the Form 990 or 990 EZ Schedule L involves several key steps:

- Gather financial records related to transactions with interested persons.

- Identify all interested persons and the nature of their relationship with the organization.

- Document each transaction, including dates, amounts, and descriptions.

- Determine if any transactions exceed the reporting threshold set by the IRS.

- Complete the schedule by filling in the required information accurately.

- Review the completed form for accuracy and completeness before submission.

Key elements of the Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

Several key elements must be included when completing the Form 990 or 990 EZ Schedule L. These include:

- Name and relationship of the interested person.

- Description of the transaction, including the type and purpose.

- Amount of the transaction and any outstanding balances.

- Terms of the transaction, such as payment schedules or interest rates.

- Any additional information that may be required by the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 or 990 EZ Schedule L. Organizations must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Understanding the definitions of interested persons and reportable transactions.

- Following the instructions provided in the IRS Form 990 or 990 EZ instructions booklet.

- Maintaining thorough documentation to support the reported transactions.

- Filing the schedule timely as part of the overall Form 990 submission.

Penalties for Non-Compliance

Failure to comply with the reporting requirements of the Form 990 or 990 EZ Schedule L can result in significant penalties. The IRS may impose fines for incomplete or inaccurate disclosures, which can vary based on the severity of the violation. Additionally, organizations may face reputational damage and loss of tax-exempt status if they fail to demonstrate transparency in their financial dealings. It is essential for organizations to prioritize compliance to avoid these repercussions.

Quick guide on how to complete 2016 form 990 or 990 ez schedule l transactions with interested persons irs

Accomplish Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents rapidly without interruptions. Manage Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs seamlessly

- Obtain Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in a few clicks from your chosen device. Alter and eSign Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 form 990 or 990 ez schedule l transactions with interested persons irs

Create this form in 5 minutes!

How to create an eSignature for the 2016 form 990 or 990 ez schedule l transactions with interested persons irs

How to generate an electronic signature for your 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs in the online mode

How to create an eSignature for your 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs in Chrome

How to create an electronic signature for putting it on the 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs in Gmail

How to make an eSignature for the 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs straight from your smartphone

How to make an electronic signature for the 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs on iOS devices

How to generate an electronic signature for the 2016 Form 990 Or 990 Ez Schedule L Transactions With Interested Persons Irs on Android OS

People also ask

-

What is Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs is a report required by the IRS to disclose certain transactions between tax-exempt organizations and their interested persons. This schedule ensures transparency and compliance in financial dealings. airSlate SignNow helps streamline the e-signing of documents related to these transactions.

-

How does airSlate SignNow facilitate Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs?

airSlate SignNow provides an easy-to-use platform that allows organizations to send, sign, and manage documents electronically. This efficiency reduces the administrative burden associated with compliance tasks like preparing Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. Our solution also helps in organizing important records securely for future reference.

-

What are the key features of airSlate SignNow for handling Form 990 Or 990 EZ Schedule L?

Key features include customizable document templates, bulk sending options, audit trails, and cloud storage. These tools simplify the process of managing Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. Additionally, electronic signatures ensure that documents are legally binding and securely stored.

-

Is airSlate SignNow cost-effective for small organizations preparing Form 990 Or 990 EZ?

Yes, airSlate SignNow is designed to be a cost-effective solution for all organizations, including small non-profits. Our flexible pricing plans cater to various needs, ensuring that you can access the features you need without overspending on unnecessary options. This affordability allows small organizations to comply with requirements like the Report for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs.

-

Can airSlate SignNow integrate with other software for Form 990 management?

Absolutely! airSlate SignNow offers integration capabilities with various accounting and financial management systems. These integrations facilitate smoother overall management of Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs by synchronizing data across platforms, ensuring that all financial paperwork is aligned.

-

What benefits does airSlate SignNow provide for non-profits related to IRS compliance?

With airSlate SignNow, non-profits can ensure timely and accurate compliance with IRS requirements, including Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs. Benefits include enhanced efficiency, reduced paperwork, and a user-friendly interface. Additionally, our secure platform helps in maintaining confidentiality while ensuring compliance.

-

How does the e-signing process work for Form 990 Or 990 EZ Schedule L?

The e-signing process with airSlate SignNow is straightforward. You upload the necessary document for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs, add the signers, and they will receive a notification to sign electronically. This not only speeds up the process but also maintains a secure and legally compliant signature.

Get more for Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

- Conrail railroad scholarships form

- Not valid unless printed on physicianamp39s letterhead form

- Ncui 604 formpdffillercom

- Schedule of florida sales or use tax credits claimed on form

- Biogift oregon forms

- Applicationaffidavit for birth doula recertification dona form

- Va form 26 8791 vba va

- Lyme tap form 2012

Find out other Form 990 Or 990 EZ Schedule L Transactions With Interested Persons Irs

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA