8879 Form 2016

What is the 8879 Form

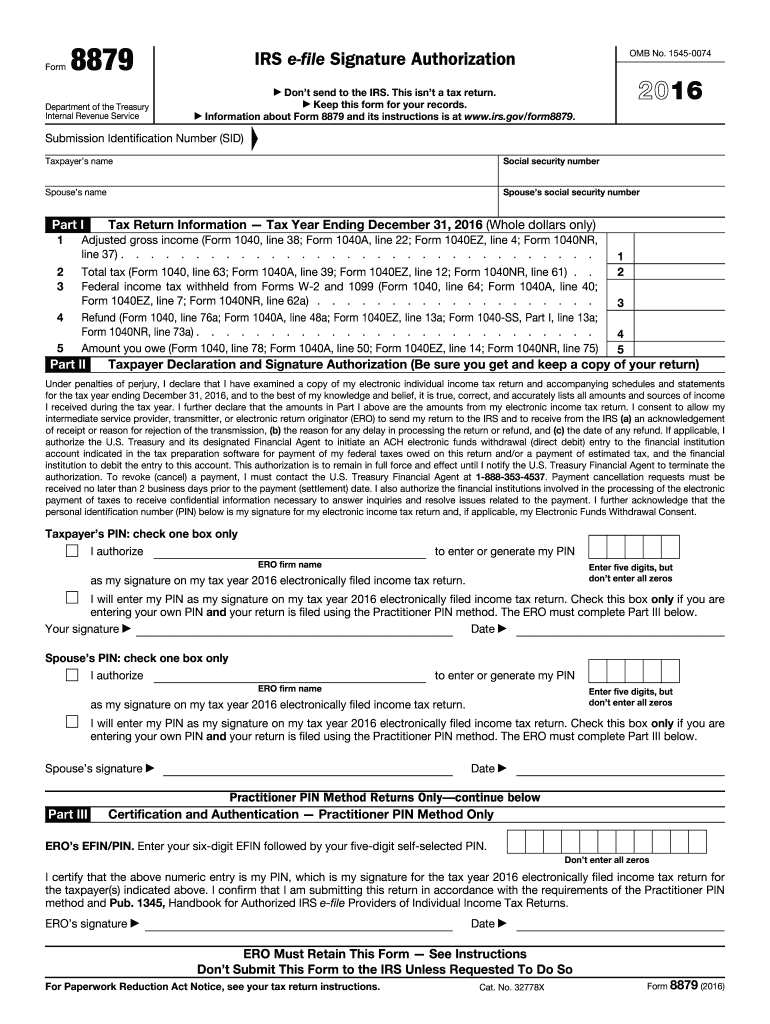

The 8879 Form, also known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers in the United States to authorize an electronic filing of their tax return. This form serves as a declaration that the information provided on the tax return is accurate and complete, allowing taxpayers to e-file their returns securely. The 8879 Form must be signed by both the taxpayer and the paid preparer, if applicable, to ensure compliance with IRS regulations.

How to use the 8879 Form

Using the 8879 Form involves several steps to ensure proper authorization for electronic filing. First, taxpayers must complete their tax return using approved tax preparation software. Once the return is ready for submission, the software will prompt users to generate the 8879 Form. Taxpayers should then review the information on the form for accuracy before signing it. The signed form can be submitted electronically alongside the tax return, streamlining the filing process.

Steps to complete the 8879 Form

Completing the 8879 Form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including Social Security numbers, filing status, and income details.

- Use tax preparation software to complete your tax return.

- Generate the 8879 Form through the software once your return is finalized.

- Review the form for accuracy, ensuring all details match your tax return.

- Sign the form electronically if using e-signature capabilities, or print and sign manually.

- Submit the signed 8879 Form along with your e-filed tax return.

Legal use of the 8879 Form

The legal use of the 8879 Form is governed by IRS regulations. It must be signed by the taxpayer and, if applicable, the paid preparer to validate the electronic filing of the tax return. The form must be retained for three years from the date of filing, as it may be requested by the IRS for verification purposes. Ensuring compliance with these legal requirements is essential for avoiding penalties and ensuring the integrity of the e-filing process.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8879 Form. Taxpayers should ensure they are using the most current version of the form, as updates may occur annually. The IRS stipulates that the form must be signed before the electronic filing of the tax return. Additionally, taxpayers should be aware of the security measures in place for e-signatures to protect their sensitive information during the filing process.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 Form align with the tax return deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. If taxpayers are unable to meet this deadline, they may request an extension, which allows for additional time to file. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 2016 8879 form

Complete 8879 Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage 8879 Form on any platform using airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

The easiest way to edit and eSign 8879 Form without stress

- Locate 8879 Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose how you would like to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from a device of your choice. Edit and eSign 8879 Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 8879 form

Create this form in 5 minutes!

How to create an eSignature for the 2016 8879 form

How to generate an electronic signature for your 2016 8879 Form in the online mode

How to create an electronic signature for your 2016 8879 Form in Google Chrome

How to create an electronic signature for signing the 2016 8879 Form in Gmail

How to make an electronic signature for the 2016 8879 Form right from your smart phone

How to make an eSignature for the 2016 8879 Form on iOS

How to generate an eSignature for the 2016 8879 Form on Android devices

People also ask

-

What is the 8879 Form and how is it used?

The 8879 Form is an e-file signature authorization document utilized by taxpayers to electronically sign their tax returns. With airSlate SignNow, you can easily send and eSign the 8879 Form, ensuring a smooth and secure filing process for your taxes.

-

How does airSlate SignNow facilitate the signing of the 8879 Form?

airSlate SignNow simplifies the signing process for the 8879 Form by providing a user-friendly platform that allows you to send, eSign, and store documents securely. Our solution streamlines your workflow, making it easy to manage tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for the 8879 Form?

Yes, airSlate SignNow offers a cost-effective solution for eSigning documents, including the 8879 Form. We provide flexible pricing plans to suit various business needs, ensuring you get the best value for your document signing requirements.

-

Can I integrate airSlate SignNow with other tax software for the 8879 Form?

Absolutely! airSlate SignNow integrates seamlessly with various tax software, allowing you to manage the 8879 Form and other tax documents effectively. This integration enhances your workflow, helping you save time and reduce errors in your tax filing process.

-

What security features does airSlate SignNow offer for the 8879 Form?

airSlate SignNow prioritizes your security by implementing advanced encryption and secure storage for documents like the 8879 Form. Our platform complies with industry standards to ensure that your sensitive information remains protected throughout the signing process.

-

How quickly can I send and sign the 8879 Form with airSlate SignNow?

With airSlate SignNow, you can send and sign the 8879 Form in just a few minutes. Our efficient platform allows you to prepare and distribute documents quickly, ensuring that you stay on track with your tax deadlines.

-

What devices can I use to access airSlate SignNow for the 8879 Form?

You can access airSlate SignNow from any device, including desktops, tablets, and smartphones. This flexibility allows you to manage and sign the 8879 Form on the go, making it convenient for busy professionals.

Get more for 8879 Form

Find out other 8879 Form

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile