Form 8879 2014

What is the Form 8879

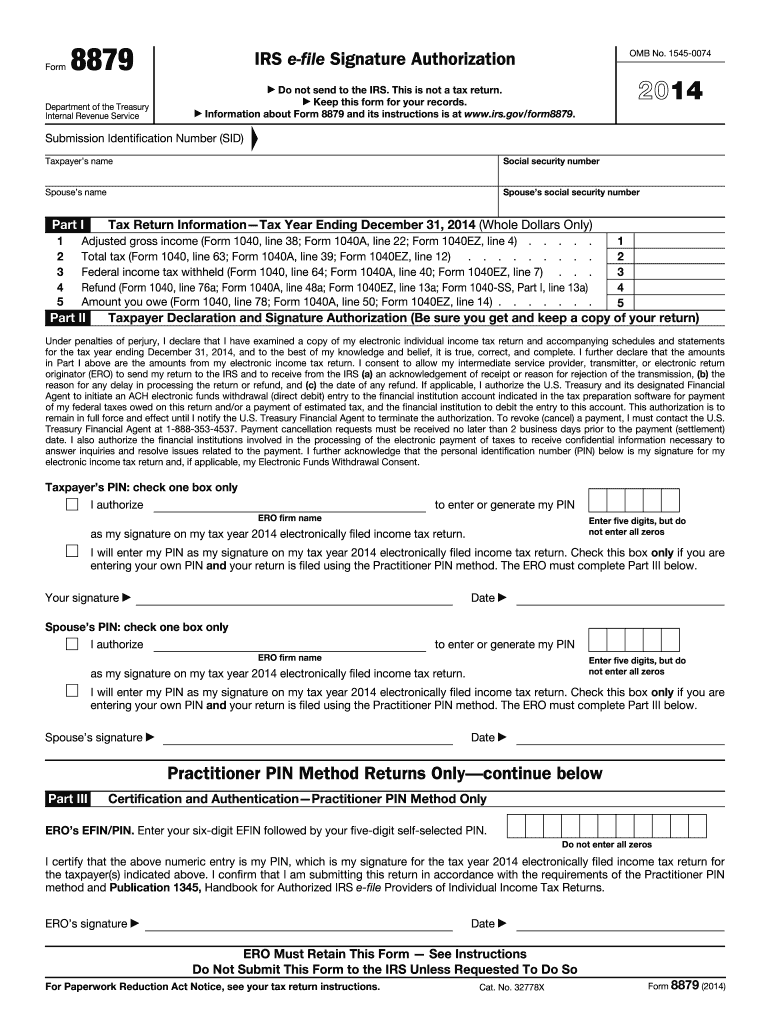

The Form 8879, also known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers in the United States to authorize an electronic filing of their tax returns. This form allows taxpayers to sign their returns electronically, streamlining the filing process. By completing this form, taxpayers provide their consent for the electronic submission of their tax information, which is especially useful for those who work with tax professionals. The Form 8879 ensures that the IRS receives the necessary authorization to process the e-filed return securely.

How to use the Form 8879

Using the Form 8879 involves a straightforward process. First, taxpayers must fill out the required information, including their name, Social Security number, and details about their tax return. Once completed, the taxpayer or their tax preparer must sign the form electronically. This signature serves as an official authorization for the IRS to accept the e-filed return. It is important to ensure that all information is accurate and complete before submission, as any discrepancies can lead to complications with the IRS.

Steps to complete the Form 8879

Completing the Form 8879 requires several key steps:

- Gather necessary documents, including your tax return and personal identification.

- Fill in your name, Social Security number, and tax year on the form.

- Provide the tax preparer's information if applicable.

- Review all entries for accuracy.

- Sign the form electronically to authorize the e-filing.

- Submit the completed form to your tax preparer or file it as required.

Legal use of the Form 8879

The legal use of the Form 8879 is governed by regulations set forth by the IRS. To be considered valid, the form must be signed by the taxpayer and must accurately reflect the details of the tax return being filed. The electronic signature provided on the form is legally binding and must comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). This ensures that the electronic filing process is secure and recognized by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8879 align with the overall tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should ensure that their Form 8879 is completed and submitted in a timely manner to avoid penalties. Additionally, if an extension is filed, the deadline for submitting the Form 8879 may also be extended, but it is crucial to check the specific guidelines for each tax year.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the Form 8879. These guidelines outline the necessary information required on the form, the process for electronic signatures, and the importance of maintaining accurate records. Taxpayers are encouraged to refer to the official IRS instructions for the Form 8879 to ensure compliance with all regulations. Following these guidelines helps to facilitate a smooth filing process and reduces the risk of errors that could lead to delays or issues with the IRS.

Quick guide on how to complete 2014 form 8879

Effortlessly prepare Form 8879 on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 8879 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 8879 with ease

- Obtain Form 8879 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred delivery method for your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors requiring new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8879 and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 form 8879

Create this form in 5 minutes!

How to create an eSignature for the 2014 form 8879

The way to make an electronic signature for a PDF file online

The way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your mobile device

The way to generate an eSignature for a PDF file on iOS

The way to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is Form 8879 and how does it work with airSlate SignNow?

Form 8879 is the IRS e-file Signature Authorization that allows taxpayers to authorize electronic filing of their tax returns. With airSlate SignNow, you can easily create, send, and eSign Form 8879 securely, ensuring compliance with IRS requirements while streamlining the filing process.

-

How can I integrate Form 8879 with other tools using airSlate SignNow?

airSlate SignNow offers seamless integrations with various applications, allowing you to automate your workflows. You can connect Form 8879 with popular accounting software and CRMs, making it easier to manage your tax documents efficiently and effectively.

-

What pricing plans are available for using airSlate SignNow for Form 8879?

airSlate SignNow provides flexible pricing plans tailored to different business needs, including options for basic and advanced features. Regardless of the plan you choose, eSigning and managing your Form 8879 is cost-effective, ensuring you only pay for the features you truly need.

-

Are there any benefits to using airSlate SignNow for eSigning Form 8879?

Using airSlate SignNow for eSigning Form 8879 offers numerous benefits including enhanced security, speed, and convenience. The platform enables you to sign documents from anywhere, reducing the time and effort traditionally needed for tax preparation and submissions.

-

Is airSlate SignNow secure for handling sensitive documents like Form 8879?

Absolutely! airSlate SignNow employs advanced encryption and security protocols to ensure that all sensitive documents, including Form 8879, are kept safe. You can trust that your data will be protected throughout the eSigning process.

-

Can I collaborate with others on Form 8879 using airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration, enabling multiple parties to review and eSign Form 8879. This feature simplifies the process for tax professionals and clients, facilitating a quicker, more efficient workflow.

-

What features does airSlate SignNow offer for managing Form 8879?

airSlate SignNow provides features such as customizable templates, in-app notifications, and audit trails for tracking changes on Form 8879. These tools streamline the preparation and filing process, ensuring that all documents are completed accurately and on time.

Get more for Form 8879

- Kenya form application visa download

- For use of this form see usfk reg 690 1 the proponent agency is the fkcp

- Lincoln square pancake house job application form

- Email leaveadminutsa form

- Shoneys application print form

- Nef business plan template pdf form

- Personnel action form template

- Job shadowing agreement evaluation form the top

Find out other Form 8879

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation