8879 Form 2015

What is the 8879 Form

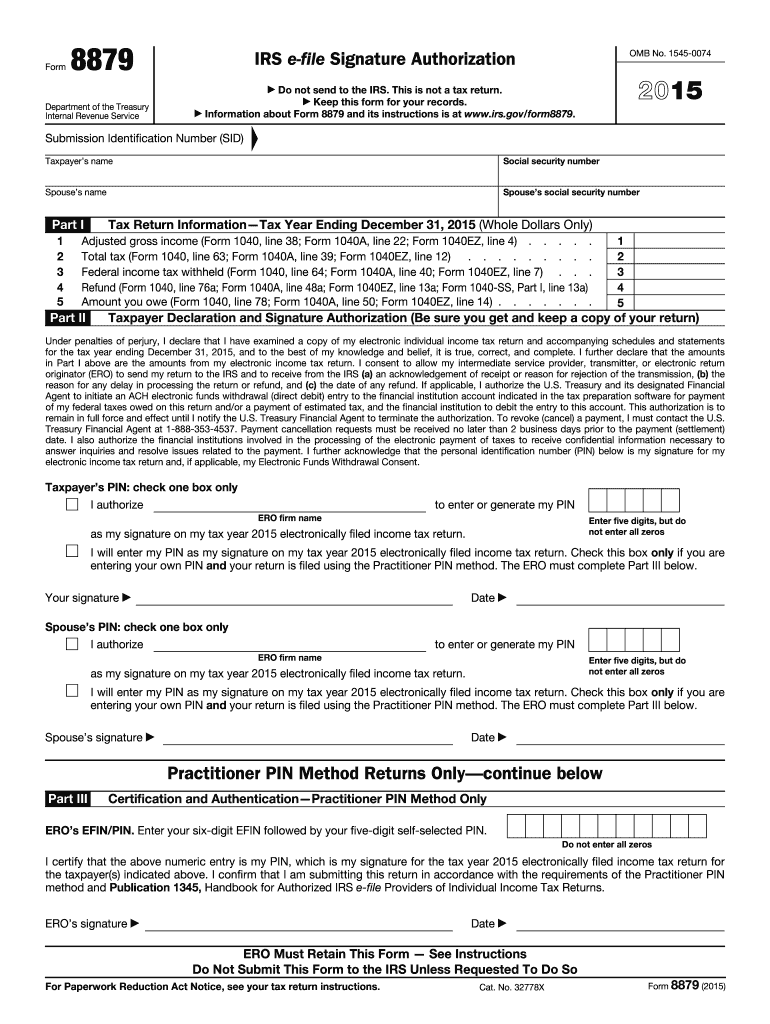

The 8879 Form, officially known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers in the United States to authorize the electronic filing of their tax returns. This form serves as a signature substitute, allowing taxpayers to electronically sign their returns without needing to submit a physical signature. It is particularly important for tax preparers who file returns on behalf of clients, ensuring that the e-filing process complies with IRS regulations.

How to use the 8879 Form

Using the 8879 Form involves several straightforward steps. First, taxpayers must complete their tax returns, either through tax preparation software or with the assistance of a tax professional. Once the return is prepared, the taxpayer reviews the information for accuracy. After confirming the details, the taxpayer or their representative fills out the 8879 Form, providing necessary information such as the taxpayer's name, Social Security number, and the amount of the refund or balance due. Finally, the taxpayer must sign the form electronically, which then allows the tax preparer to file the return electronically with the IRS.

Steps to complete the 8879 Form

Completing the 8879 Form requires careful attention to detail. Here are the key steps:

- Gather all necessary tax documents, including W-2s, 1099s, and any other relevant income statements.

- Prepare your tax return using your chosen method, whether it be tax software or a tax professional.

- Review your tax return to ensure all information is accurate and complete.

- Fill out the 8879 Form, ensuring that you provide all required information, including your name, Social Security number, and the tax year.

- Sign the form electronically to authorize the e-filing of your tax return.

- Submit the 8879 Form to your tax preparer, who will then file your return electronically with the IRS.

Legal use of the 8879 Form

The legal validity of the 8879 Form hinges on compliance with IRS regulations regarding electronic signatures. The form must be signed by the taxpayer to authorize the e-filing of their tax return. This electronic signature is considered legally binding, provided that the taxpayer has consented to use electronic filing methods. It is essential for both taxpayers and tax preparers to understand the legal implications of using this form, as improper use may lead to penalties or delays in processing tax returns.

Filing Deadlines / Important Dates

Filing deadlines for the 8879 Form align with the overall tax filing deadlines in the United States. Typically, individual tax returns are due by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure that their 8879 Form is completed and submitted to their tax preparer before this deadline to avoid any late filing penalties. Additionally, if taxpayers apply for an extension, they must still file the 8879 Form by the extended deadline to authorize e-filing.

Who Issues the Form

The 8879 Form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and tax law enforcement in the United States. Taxpayers can obtain the form directly from the IRS website or through tax preparation software that includes the form as part of the e-filing process. It is important to ensure that you are using the most current version of the form, as updates may occur to reflect changes in tax laws or filing procedures.

Quick guide on how to complete 2015 8879 form

Effortlessly Prepare 8879 Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the right form and securely store it digitally. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents promptly without waiting. Manage 8879 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign 8879 Form effortlessly

- Locate 8879 Form and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign 8879 Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 8879 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 8879 form

How to create an electronic signature for your PDF online

How to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your smartphone

How to create an electronic signature for a PDF on iOS

The best way to create an eSignature for a PDF document on Android

People also ask

-

What is the 8879 Form?

The 8879 Form is an IRS e-file signature authorization form that allows taxpayers to electronically sign and file their tax returns. Using the 8879 Form streamlines the e-filing process, ensuring compliance with IRS regulations while enhancing security and convenience.

-

How does airSlate SignNow facilitate the signing of the 8879 Form?

airSlate SignNow provides an intuitive platform that allows users to easily upload, send, and eSign the 8879 Form. With its user-friendly interface, you can complete the signing process in just a few clicks, saving you time and reducing the hassle of paperwork.

-

What are the costs associated with using airSlate SignNow for the 8879 Form?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. While there is a base subscription fee, using the platform to handle the 8879 Form can save you money through reduced printing and mailing costs, making it a cost-effective solution for e-signing.

-

Can I integrate airSlate SignNow with other software for processing the 8879 Form?

Yes, airSlate SignNow integrates seamlessly with popular applications like QuickBooks, Salesforce, and Google Drive. This allows you to streamline your workflow and manage the 8879 Form alongside your existing tools for greater efficiency.

-

What security measures does airSlate SignNow implement for the 8879 Form?

airSlate SignNow takes security seriously, employing advanced encryption standards and secure cloud storage to protect your documents, including the 8879 Form. This ensures that your sensitive information remains confidential and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for the 8879 Form?

Using airSlate SignNow for the 8879 Form allows for quick and efficient electronic signing, reducing turnaround time. Additionally, you’ll benefit from a centralized document management system, ensuring that all your signed forms are easily accessible when needed.

-

Is there a mobile app for signing the 8879 Form with airSlate SignNow?

Absolutely! airSlate SignNow offers a mobile app that allows you to sign the 8879 Form on the go. This feature ensures you can easily manage your documents anytime, anywhere, enhancing flexibility and convenience.

Get more for 8879 Form

- Cna renewal michigan form

- Troy family practice form

- E referral application blue care network e referral form

- Fhps health history form

- Locations cardiology associates of michigan michigans form

- Npi dissemination form for bcbsm

- Allergy skin ampampamp ear clinic for pets 441 photos form

- Bcn e referral form

Find out other 8879 Form

- Sign Connecticut Healthcare / Medical Business Plan Template Free

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe