8879 Form 2013

What is the 8879 Form

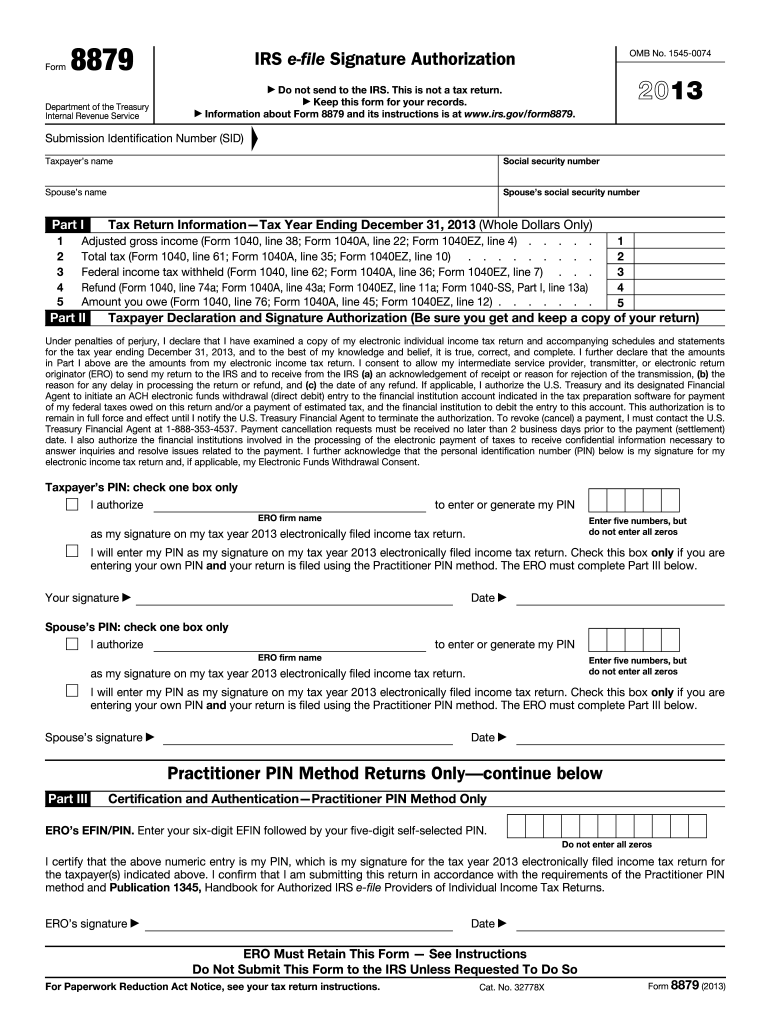

The 8879 Form, officially known as the IRS e-file Signature Authorization, is a crucial document used by taxpayers in the United States to authorize an electronic return. This form serves as a signature for e-filing, allowing taxpayers to sign their tax returns electronically without the need for physical signatures. It is particularly beneficial for individuals who file their taxes through tax preparation software or professional services. The 8879 Form ensures that the taxpayer's consent is documented, facilitating a smoother e-filing process.

How to use the 8879 Form

Using the 8879 Form involves several straightforward steps. First, taxpayers must complete their tax return using an e-filing software or through a tax professional. Once the return is prepared, the taxpayer will receive the 8879 Form to review. They should verify that all information is accurate and matches the details on their tax return. After confirming the accuracy, the taxpayer can sign the form electronically. This signature authorizes the e-filing of their tax return, allowing the tax preparer to submit it directly to the IRS on their behalf.

Steps to complete the 8879 Form

Completing the 8879 Form requires careful attention to detail. Follow these steps for accurate completion:

- Begin by entering your name, Social Security number, and the tax year.

- Provide the name and identification number of the tax preparer if applicable.

- Review the tax return information to ensure it aligns with the details on the 8879 Form.

- Sign and date the form electronically to authorize the e-filing process.

- Retain a copy of the signed form for your records.

Legal use of the 8879 Form

The legal use of the 8879 Form is governed by IRS regulations that recognize electronic signatures as valid under the Electronic Signatures in Global and National Commerce (ESIGN) Act. To ensure compliance, it is essential that the form is filled out correctly and signed by the taxpayer. The 8879 Form must be retained by the tax preparer for a specific period, as it serves as proof of consent for e-filing. This legal framework helps protect both the taxpayer and the tax preparer during the e-filing process.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 8879 Form. Taxpayers should ensure that they are using the most current version of the form, as updates may occur. The IRS requires that the form be signed before the tax return is submitted electronically. Additionally, taxpayers should be aware of the retention requirements, which stipulate that the signed form must be kept for at least three years from the date of filing. Familiarity with these guidelines can help prevent issues during the e-filing process.

Form Submission Methods

The 8879 Form can be submitted in conjunction with the e-filing of your tax return. While the form itself does not need to be mailed to the IRS, it must be retained by the tax preparer or the taxpayer for record-keeping purposes. In cases where a taxpayer chooses to file a paper return, the 8879 Form is not applicable. It is important to follow the submission methods outlined by the IRS to ensure compliance and avoid potential penalties.

Quick guide on how to complete 2013 8879 form

Effortlessly Prepare 8879 Form on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can easily locate the right form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Manage 8879 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and eSign 8879 Form with Ease

- Locate 8879 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose your preferred method for submitting your form—email, SMS, or invitation link—or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign 8879 Form to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 8879 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 8879 form

The best way to generate an electronic signature for your PDF file in the online mode

The best way to generate an electronic signature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The way to make an electronic signature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 8879 Form and how is it used?

The 8879 Form is an IRS form used to authorize e-filing of a tax return. It allows taxpayers to electronically sign their tax returns and facilitate the e-filing process securely and efficiently. Using the airSlate SignNow platform, you can easily send, sign, and manage your 8879 Form digitally.

-

What are the benefits of using airSlate SignNow for the 8879 Form?

Using airSlate SignNow for the 8879 Form offers numerous benefits, including reduced paper usage, faster processing times, and enhanced security features. Our platform enables users to complete and sign the 8879 Form from anywhere, ensuring a seamless e-filing experience. Additionally, our user-friendly interface simplifies the process, making it accessible for everyone.

-

Is airSlate SignNow cost-effective for handling the 8879 Form?

Yes, airSlate SignNow is a cost-effective solution for managing the 8879 Form and other documents. We offer various pricing plans tailored to different business needs, ensuring you get the most value for your investment. By streamlining the e-signature process, you can save both time and money in document management.

-

Can I integrate airSlate SignNow with other software for managing the 8879 Form?

Absolutely! airSlate SignNow seamlessly integrates with various applications, enhancing your ability to manage the 8879 Form alongside other documents. This integration enables you to automate workflows, track document statuses, and improve overall efficiency in your operations. Check our integration options to find the best fit for your needs.

-

Is airSlate SignNow compliant with IRS regulations for the 8879 Form?

Yes, airSlate SignNow complies with IRS regulations concerning the signing and submission of the 8879 Form. Our platform employs industry-standard security measures to ensure that e-signed documents meet all legal requirements for authenticity and integrity. You can confidently use our service for submitting your 8879 Form electronically.

-

How does airSlate SignNow ensure the security of the 8879 Form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption protocols and the latest security technologies to safeguard your 8879 Form and other sensitive documents. Our system also offers secure storage and access controls, ensuring that only authorized users can view or edit your documents.

-

Can multiple users collaborate on the 8879 Form with airSlate SignNow?

Yes, airSlate SignNow allows for easy collaboration between users on the 8879 Form. Multiple participants can be invited to review and sign the document simultaneously, streamlining the process and enhancing team communication. This collaborative feature is perfect for tax professionals working with clients to finalize their filings.

Get more for 8879 Form

- Higher unit 15 topic test answers form

- Flu season is upon us heres everything you need to know form

- Volunteer application ampamp release waiver of liability mountain form

- Gerson therapy a treatment to avoid at all cost edzard ernst form

- Request for name ampamp address change total community credit form

- Change of address form intotal health

- American valet claim information

- Sopijan vaihto form

Find out other 8879 Form

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form