Irs 8379 Instructions Form 2015

What is the Irs 8379 Instructions Form

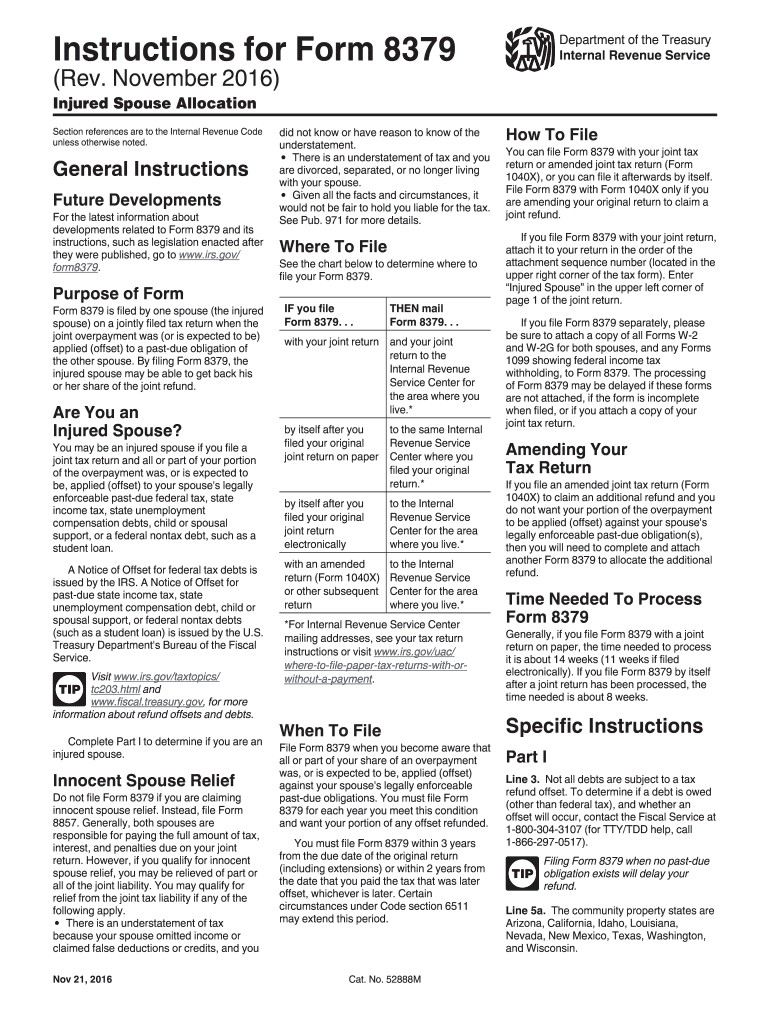

The Irs 8379 Instructions Form is a tax document used by married couples who file jointly but wish to request their share of a tax refund due to their spouse's outstanding debts. This form allows one spouse to claim their portion of a refund while protecting their share from being applied to the other spouse's debts, such as unpaid taxes, child support, or student loans. Understanding the purpose and implications of this form is crucial for taxpayers seeking to navigate their financial obligations effectively.

How to use the Irs 8379 Instructions Form

To use the Irs 8379 Instructions Form, taxpayers should first ensure they meet the eligibility criteria, which typically includes filing jointly and having a refund that may be subject to offset. The form must be completed accurately, detailing the necessary information about both spouses. It is important to follow the instructions closely to avoid errors that could delay the processing of the request. Once completed, the form should be submitted alongside the tax return or sent separately to the appropriate IRS address.

Steps to complete the Irs 8379 Instructions Form

Completing the Irs 8379 Instructions Form involves several key steps:

- Gather necessary information, including Social Security numbers, tax filing status, and details of any debts.

- Fill out the form accurately, ensuring all sections are completed, particularly those related to income and debts.

- Review the form for any mistakes or omissions that could lead to processing delays.

- Submit the form either with your tax return or separately, following the IRS guidelines for submission.

Legal use of the Irs 8379 Instructions Form

The legal use of the Irs 8379 Instructions Form is governed by IRS regulations, which stipulate that it is designed specifically for taxpayers who are married and filing jointly. This form must be used in accordance with federal tax laws to ensure that the request for a refund is legitimate and valid. Utilizing this form correctly helps protect the rights of the requesting spouse while ensuring compliance with legal obligations regarding tax refunds and debt offsets.

Filing Deadlines / Important Dates

Filing deadlines for the Irs 8379 Instructions Form align with the general tax filing deadlines set by the IRS. Typically, the deadline for submitting tax returns is April fifteenth of each year. If you are submitting the form separately from your tax return, it is advisable to do so as soon as possible after filing to expedite the processing of your refund. Additionally, taxpayers should be aware of any extensions that may apply, which can affect these deadlines.

Required Documents

When completing the Irs 8379 Instructions Form, several documents may be required to support the request. These typically include:

- Tax returns for both spouses, including any W-2s or 1099s.

- Documentation of any debts that may affect the refund, such as notices from the IRS or other agencies.

- Identification information, including Social Security numbers.

Having these documents readily available can streamline the process and help ensure that the form is completed accurately.

Quick guide on how to complete irs 8379 instructions 2015 form

Accomplish Irs 8379 Instructions Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as a flawless eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools required to devise, alter, and electronically sign your documents quickly without complications. Handle Irs 8379 Instructions Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented task today.

The ideal method to alter and electronically sign Irs 8379 Instructions Form without hassle

- Find Irs 8379 Instructions Form and select Get Form to begin.

- Employ the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that necessitate printing out new document copies. airSlate SignNow fulfills your document management needs in a few clicks from any device you prefer. Alter and electronically sign Irs 8379 Instructions Form and ensure superb communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 8379 instructions 2015 form

Create this form in 5 minutes!

How to create an eSignature for the irs 8379 instructions 2015 form

How to create an eSignature for the Irs 8379 Instructions 2015 Form in the online mode

How to make an eSignature for the Irs 8379 Instructions 2015 Form in Chrome

How to generate an eSignature for signing the Irs 8379 Instructions 2015 Form in Gmail

How to generate an electronic signature for the Irs 8379 Instructions 2015 Form right from your smart phone

How to make an eSignature for the Irs 8379 Instructions 2015 Form on iOS

How to make an eSignature for the Irs 8379 Instructions 2015 Form on Android

People also ask

-

What are the Irs 8379 Instructions Form requirements?

To complete the Irs 8379 Instructions Form, you must provide accurate personal information, including your Social Security number and the details of your tax return. It's essential to follow the guidelines carefully to ensure your application for injured spouse relief is processed efficiently.

-

How can airSlate SignNow help with the Irs 8379 Instructions Form?

With airSlate SignNow, you can easily eSign and send your Irs 8379 Instructions Form securely online. Our platform simplifies the document process, allowing you to complete and submit your forms quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Irs 8379 Instructions Form?

airSlate SignNow offers a variety of pricing plans that cater to different needs. You can choose a plan that fits your budget while benefiting from our user-friendly features to manage your Irs 8379 Instructions Form and other documents.

-

Can I integrate airSlate SignNow with other software for managing the Irs 8379 Instructions Form?

Yes, airSlate SignNow provides seamless integrations with popular software and applications, allowing you to manage your Irs 8379 Instructions Form alongside other tools you already use. This integration enhances your workflow and improves productivity.

-

What features does airSlate SignNow offer for handling the Irs 8379 Instructions Form?

AirSlate SignNow provides features such as customizable templates, secure eSignature options, and tracking capabilities to streamline your Irs 8379 Instructions Form process. You can ensure compliance and maintain organization with our intuitive interface.

-

How secure is my information when using airSlate SignNow for the Irs 8379 Instructions Form?

Your security is our top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your personal and financial information while you manage your Irs 8379 Instructions Form online.

-

Can I access my Irs 8379 Instructions Form from any device using airSlate SignNow?

Absolutely! AirSlate SignNow is designed to be accessible from any device, allowing you to view and manage your Irs 8379 Instructions Form on-the-go. Whether you’re using a computer, tablet, or smartphone, you can stay connected and productive.

Get more for Irs 8379 Instructions Form

Find out other Irs 8379 Instructions Form

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online