8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil 2010

What is the 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form

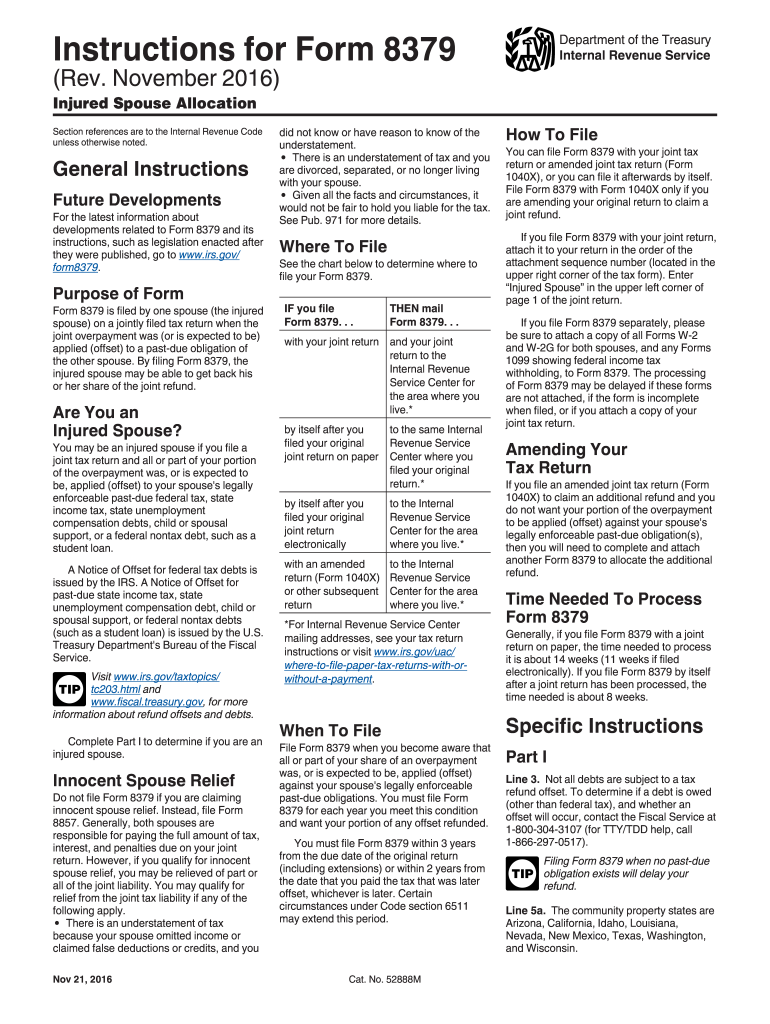

The 8379 Instructions form is a crucial document used primarily for tax purposes in the United States. This form provides guidance on how to fill out and submit Form 8379, which is used to request a refund of the injured spouse's share of a joint tax refund. It is essential for individuals who have filed jointly but believe that their portion of the refund is being withheld due to their spouse's tax liabilities. Understanding the instructions is vital to ensure accurate completion and timely submission.

Steps to complete the 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form

Completing the 8379 Instructions involves several key steps:

- Gather necessary documents, including your tax return and any relevant financial statements.

- Review the instructions carefully to understand eligibility criteria and required information.

- Fill out the form accurately, ensuring all personal and financial details are correct.

- Attach the completed form to your tax return if filing by mail or submit it electronically if using e-filing software.

- Keep a copy of the submitted form for your records.

Legal use of the 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form

The 8379 Instructions form is legally binding once completed and submitted according to IRS guidelines. To ensure its legality, it must be filled out truthfully and accurately. The form is protected under the same legal frameworks that govern tax documents, meaning that any false information can lead to penalties or legal repercussions. It is crucial to adhere to the guidelines provided to maintain compliance with federal tax laws.

IRS Guidelines

The IRS provides specific guidelines for completing the 8379 Instructions form. These guidelines include detailed instructions on eligibility, required documentation, and submission methods. It is important to follow these guidelines closely to avoid delays in processing your request for a refund. The IRS updates these guidelines periodically, so checking for the most current information is advisable.

Required Documents

To complete the 8379 Instructions form, you will need several documents, including:

- Your joint tax return (Form 1040 or 1040-SR).

- Any notices from the IRS regarding the tax refund being withheld.

- Proof of income and expenses, if applicable.

- Identification documents, such as Social Security numbers for both spouses.

Form Submission Methods (Online / Mail / In-Person)

The 8379 Instructions form can be submitted through various methods, depending on how you file your taxes:

- Online: If you are using tax preparation software, you can typically submit the form electronically along with your tax return.

- By Mail: If filing a paper return, attach the completed 8379 Instructions form to your tax return and send it to the appropriate IRS address.

- In-Person: You may also visit a local IRS office for assistance with submitting the form, although this option may require an appointment.

Quick guide on how to complete 8379 instructions filetypepdf filetypeps filetypedwf filetypekml filetypekmz filetypexls filetypeppt filetypedoc filetypertf

Effortlessly Prepare 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil on Any Device

Digital document management has become increasingly popular among companies and individuals alike. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to craft, edit, and electronically sign your documents swiftly without delays. Handle 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to Edit and Electronically Sign 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil with Ease

- Locate 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 8379 instructions filetypepdf filetypeps filetypedwf filetypekml filetypekmz filetypexls filetypeppt filetypedoc filetypertf

Create this form in 5 minutes!

How to create an eSignature for the 8379 instructions filetypepdf filetypeps filetypedwf filetypekml filetypekmz filetypexls filetypeppt filetypedoc filetypertf

The best way to make an electronic signature for a PDF file online

The best way to make an electronic signature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the advantages of using airSlate SignNow for handling 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form?

airSlate SignNow offers a user-friendly platform that streamlines the process of eSigning and sending documents, including various file types. With efficient features, businesses can easily manage their 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form with secure storage and compliance. This enhances productivity while ensuring the documents are legally binding.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow provides a free trial to explore its features, including handling 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form. This trial allows potential users to evaluate how the platform can efficiently meet their eSigning and document management needs without initial investment.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs, ensuring access to essential features for managing 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form. The pricing is competitive, providing great value in comparison to other eSigning solutions. Users can choose a plan that maximizes their productivity within budget.

-

Can airSlate SignNow integrate with other software?

Absolutely! airSlate SignNow supports integrations with popular business tools, making it easier to work with documents like the 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form. This feature allows seamless workflow and enhances usability by connecting with platforms like Salesforce, Google Workspace, and more.

-

How secure is the signing process with airSlate SignNow?

The signing process with airSlate SignNow is highly secured, ensuring that your documents, including 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form, are protected. airSlate employs strong encryption methods, detailed authentication options, and compliance with legal standards to maintain the integrity and confidentiality of your documents.

-

What types of documents can be sent and signed using airSlate SignNow?

Users can send and sign various document types through airSlate SignNow, including 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form. The platform supports multiple file formats, allowing for flexible document management and effective signing solutions tailored to various business scenarios.

-

How can I track the progress of my documents in airSlate SignNow?

airSlate SignNow provides real-time tracking features that allow users to monitor the status of their documents, including those with the 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Filetypeswf Form. This ensures users can receive notifications when documents are viewed or signed, improving communication and efficiency in the workflow.

Get more for 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil

- Indiana renunciation and disclaimer of property received by intestate succession indiana form

- In repair construction form

- Quitclaim deed from individual to husband and wife indiana form

- Warranty deed from individual to husband and wife indiana form

- Quitclaim deed individual grantor by attorney in fact to individual indiana form

- Indiana warranty form

- Transfer death deed in form

- Indiana transfer deed form

Find out other 8379 Instructions Filetypepdf Filetypeps Filetypedwf Filetypekml Filetypekmz Filetypexls Filetypeppt Filetypedoc Filetypertf Fil

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free