Form 8379 Injured Spouse Filed After Return E Filed 2023

What is the Form 8379 Injured Spouse Filed After Return E Filed

The Form 8379, known as the Injured Spouse Allocation, is a tax form used by individuals who file jointly with a spouse but are entitled to a refund that may be applied to their spouse's debts. This form allows the injured spouse to claim their share of the refund, ensuring that it is not intercepted for their partner's financial obligations, such as unpaid taxes, child support, or student loans. Filing this form is essential for protecting the injured spouse's right to their portion of the refund.

Steps to complete the Form 8379 Injured Spouse Filed After Return E Filed

Completing the Form 8379 involves several key steps:

- Gather necessary information, including your and your spouse's Social Security numbers, tax return details, and any relevant financial documents.

- Indicate the tax year for which you are filing the form.

- Complete the allocation section, which involves determining how much of the refund is attributable to the injured spouse.

- Sign and date the form, ensuring that both spouses have reviewed the information provided.

- Submit the form along with your tax return or send it separately if you have already filed your return.

How to obtain the Form 8379 Injured Spouse Filed After Return E Filed

The Form 8379 can be obtained directly from the Internal Revenue Service (IRS) website. It is available as a downloadable PDF, which can be printed and filled out manually. Additionally, tax preparation software often includes this form, allowing users to complete it digitally. Ensure you have the latest version of the form to comply with current IRS regulations.

IRS Guidelines

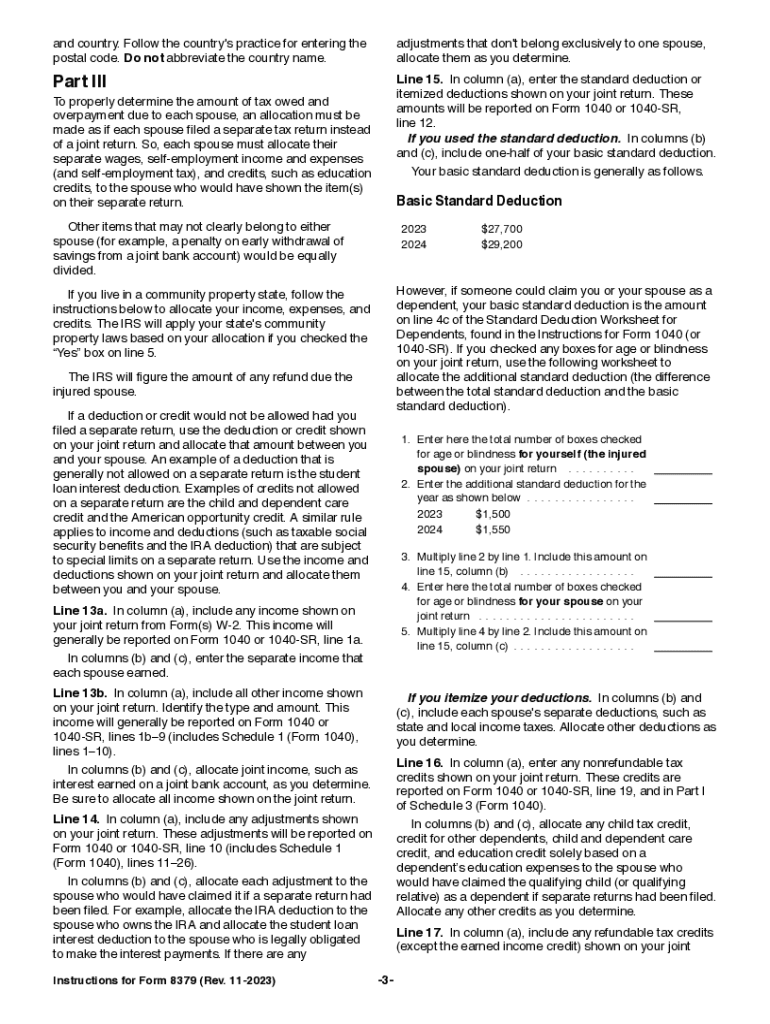

The IRS provides specific guidelines for completing the Form 8379. It is important to follow these instructions carefully to avoid delays in processing. The guidelines detail how to allocate income and deductions between spouses, the information required for each section of the form, and the submission process. Familiarizing yourself with these guidelines can help ensure a smooth filing experience.

Eligibility Criteria

To qualify to use Form 8379, certain eligibility criteria must be met. The injured spouse must have filed a joint tax return and must be entitled to a refund that is subject to being offset by the other spouse's debts. Additionally, the injured spouse should have reported income on the joint return and must not be legally responsible for the debts that are causing the refund to be withheld. Understanding these criteria is crucial for determining if this form is applicable.

Form Submission Methods (Online / Mail / In-Person)

Form 8379 can be submitted through various methods. If filing electronically, it can be included with your e-filed tax return using compatible tax software. For paper submissions, the completed form can be mailed to the appropriate IRS address based on your state of residence. In some cases, it may also be possible to deliver the form in person at a local IRS office. Be sure to check the IRS website for the most current submission addresses and methods.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8379 align with the standard tax return deadlines. Typically, the deadline for submitting your tax return is April 15 of the following year, unless an extension is filed. If you are submitting Form 8379 separately from your tax return, it is essential to ensure it is filed within the appropriate timeframe to avoid delays in receiving your refund. Keeping track of these dates is vital for successful filing.

Quick guide on how to complete form 8379 injured spouse filed after return e filed

Effortlessly Prepare Form 8379 Injured Spouse Filed After Return E Filed on Any Device

Digital document management has gained momentum among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, alter, and electronically sign your documents swiftly without any delays. Manage Form 8379 Injured Spouse Filed After Return E Filed on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to Alter and Electronically Sign Form 8379 Injured Spouse Filed After Return E Filed with Ease

- Locate Form 8379 Injured Spouse Filed After Return E Filed and click Get Form to begin.

- Use the tools we offer to complete your form.

- Select important parts of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes moments and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your preference. Modify and eSign Form 8379 Injured Spouse Filed After Return E Filed to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8379 injured spouse filed after return e filed

Create this form in 5 minutes!

How to create an eSignature for the form 8379 injured spouse filed after return e filed

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the injured spouse form instructions for using airSlate SignNow?

The injured spouse form instructions for using airSlate SignNow involve uploading your completed form, adding necessary signatures, and sending it securely. Our user-friendly interface guides you through each step to ensure your documents are processed accurately and efficiently. With airSlate SignNow, you can manage your forms anytime and anywhere.

-

How much does it cost to use airSlate SignNow for injured spouse forms?

airSlate SignNow offers competitive pricing plans that cater to different user needs, including individuals and businesses requiring injured spouse form instructions. You can choose from monthly or annual subscriptions that provide access to our robust eSigning features. Visit our pricing page for detailed information on plans and their corresponding features.

-

What features can help me with injured spouse form instructions?

airSlate SignNow provides several features to facilitate injured spouse form instructions, including customizable templates, secure storage, and real-time tracking of document status. Our platform also integrates with various applications, allowing you to streamline your workflow. With eSignature support, you can easily collect signatures from multiple parties.

-

Can airSlate SignNow help if I need to send multiple injured spouse forms?

Yes, airSlate SignNow is designed to handle multiple injured spouse forms efficiently. You can create templates for recurring forms, save time in document preparation, and send them simultaneously to multiple recipients. This feature enhances productivity and ensures all necessary forms are processed promptly.

-

Are the injured spouse form instructions compliant with legal standards?

Absolutely! The injured spouse form instructions provided by airSlate SignNow comply with legal standards and regulations for electronic signatures. Our platform meets the requirements necessary for enforceability, ensuring your documents hold up in legal contexts. You can confidently sign and send your forms knowing that they are compliant.

-

How do I get started with the injured spouse form instructions on airSlate SignNow?

Getting started with the injured spouse form instructions on airSlate SignNow is easy. Simply sign up for an account, access our template library, and locate the injured spouse form you need. Our intuitive platform will guide you through the instructions and features to make the process seamless.

-

What integrations does airSlate SignNow offer for managing injured spouse forms?

airSlate SignNow offers numerous integrations with popular applications like Google Drive, Salesforce, and Microsoft Office. These integrations simplify the process of managing your injured spouse forms by allowing you to access and edit your documents within the tools you already use. This flexibility improves workflow and efficiency.

Get more for Form 8379 Injured Spouse Filed After Return E Filed

- Athlete medical history form bsportmedbcb

- Paid time off request form requestor name de

- Key checkout form 47368844

- Nzs 3910 pdf download form

- Harris health financial assistance application form

- Safety fitness certificatealberta ca form

- Commodity purchase agreement template form

- Commodity broker agreement template form

Find out other Form 8379 Injured Spouse Filed After Return E Filed

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT