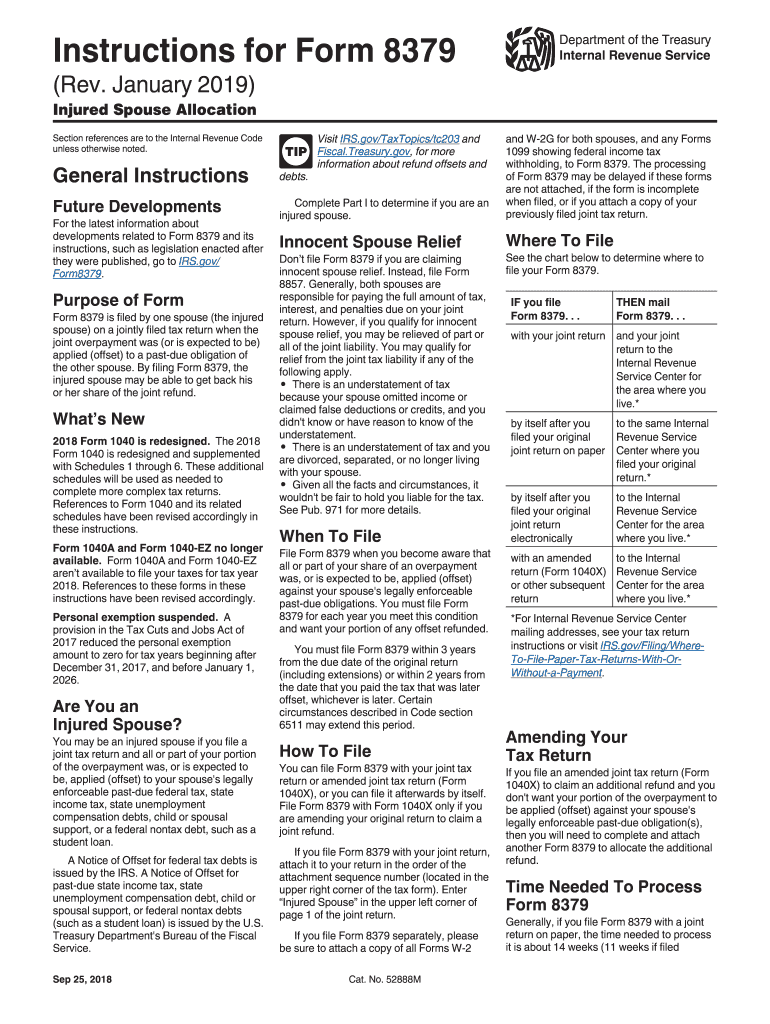

8379 Injured Spouse Form Instructions 2019

What is the 8379 Injured Spouse Form?

The 8379 Injured Spouse Form is a tax document used by individuals who are married and wish to request their share of a joint tax refund that may be withheld due to their spouse's tax obligations. This form is particularly relevant when one spouse has outstanding debts, such as student loans or unpaid child support, which could result in the entire refund being applied to those debts. By filing this form, the injured spouse can ensure that their portion of the refund is protected.

Steps to Complete the 8379 Injured Spouse Form

Completing the 8379 Injured Spouse Form involves several key steps:

- Gather necessary information: Collect your and your spouse's tax information, including Social Security numbers, filing status, and income details.

- Fill out the form: Provide accurate information in the designated sections, ensuring all required fields are completed.

- Calculate the refund: Determine the amount of the refund you are entitled to and how it will be divided.

- Sign and date: Both spouses must sign the form to validate the request.

- Submit the form: File the form either electronically or by mail, depending on your preference and the submission guidelines.

How to Obtain the 8379 Injured Spouse Form

The 8379 Injured Spouse Form can be obtained directly from the IRS website or through tax preparation software. It is essential to ensure that you are using the correct version of the form for the tax year you are filing. Additionally, local libraries and tax assistance centers may provide printed copies of the form for convenience.

Eligibility Criteria for the 8379 Injured Spouse Form

To qualify for filing the 8379 Injured Spouse Form, you must meet specific criteria:

- You must have filed a joint tax return with your spouse.

- Your spouse must have a debt that could result in the withholding of your tax refund.

- You must not be legally responsible for the debt that is causing the refund offset.

- Your income must be derived from sources that are not subject to the debt in question.

Filing Deadlines for the 8379 Injured Spouse Form

The deadline for filing the 8379 Injured Spouse Form typically aligns with the tax return filing deadline. For most taxpayers, this is April 15 of the following year. However, if you are filing for a prior tax year, you may have additional time. It is crucial to submit the form within the specified timeframe to ensure your claim is processed efficiently.

Form Submission Methods for the 8379 Injured Spouse Form

The 8379 Injured Spouse Form can be submitted through various methods:

- Electronically: If you are using tax software, you can file the form electronically along with your tax return.

- By mail: Print the completed form and send it to the appropriate IRS address based on your location.

- In-person: You may also visit a local IRS office to submit the form directly.

Quick guide on how to complete instructions for form 8379 rev january 2019 instructions for form 8379 injured spouse allocation

Complete 8379 Injured Spouse Form Instructions effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle 8379 Injured Spouse Form Instructions on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign 8379 Injured Spouse Form Instructions with ease

- Locate 8379 Injured Spouse Form Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to distribute your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign 8379 Injured Spouse Form Instructions and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 8379 rev january 2019 instructions for form 8379 injured spouse allocation

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 8379 rev january 2019 instructions for form 8379 injured spouse allocation

How to create an eSignature for the Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation online

How to make an electronic signature for your Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation in Chrome

How to generate an eSignature for putting it on the Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation in Gmail

How to create an electronic signature for the Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation right from your mobile device

How to create an electronic signature for the Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation on iOS

How to create an eSignature for the Instructions For Form 8379 Rev January 2019 Instructions For Form 8379 Injured Spouse Allocation on Android

People also ask

-

What is the 2015 8379 Injured Spouse Form and how do I use it?

The 2015 8379 Injured Spouse Form is a tax form used to request a portion of a joint tax refund when one spouse has debts that could offset the refund. To effectively use the form, follow the detailed 2015 8379 injured spouse form instructions, which ensure you provide the correct information to claim your rightful share of the refund.

-

What are the benefits of using airSlate SignNow for signing the 2015 8379 Injured Spouse Form?

Using airSlate SignNow to complete the 2015 8379 Injured Spouse Form streamlines the signing process, allowing for quick and secure electronic signatures. Our platform simplifies the submission process by providing clear templates and helpful reminders based on the 2015 8379 injured spouse form instructions.

-

How much does airSlate SignNow cost for processing forms like the 2015 8379 Injured Spouse Form?

airSlate SignNow offers competitive pricing plans that vary based on features and usage. You can choose a plan that fits your needs, whether you only need occasional access for forms like the 2015 8379 injured spouse form or require a more comprehensive solution for ongoing document management.

-

Are there specific features in airSlate SignNow that assist with the 2015 8379 Injured Spouse Form?

Yes, airSlate SignNow includes features such as document templates, collaborative editing, and automated workflow processes. These features provide clarity on how to fill out the form by adhering to the 2015 8379 injured spouse form instructions, making your experience much more efficient.

-

Can I integrate airSlate SignNow with other tools for handling my 2015 8379 Injured Spouse Form?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing document workflow management. This integration capability enables you to maintain better tracking and organization while following the 2015 8379 injured spouse form instructions.

-

Is airSlate SignNow secure for submitting sensitive forms like the 2015 8379 Injured Spouse Form?

Yes, airSlate SignNow prioritizes security and compliance to protect your data. We use encryption and secure storage practices, ensuring your information is safe while you complete sensitive documents like the 2015 8379 injured spouse form.

-

What support does airSlate SignNow provide for users filling out the 2015 8379 Injured Spouse Form?

Our dedicated support team is available to assist users with any questions or issues related to filling out the 2015 8379 Injured Spouse Form. We also provide extensive resources, including FAQs and guides based on the 2015 8379 injured spouse form instructions to help you navigate the process.

Get more for 8379 Injured Spouse Form Instructions

- Trust information form and trustee certification a

- Vte uwmc vascular diagnostic service university of washington vte washington form

- Liberty national life insurance policy lookup form

- 520894sp spanish phq 9 health form

- Demographic information sheet 260953656

- 20160628 medical assessment doc oru form

- Medical history form history form

- Patient information form osf medical group osfmedicalgroup

Find out other 8379 Injured Spouse Form Instructions

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now