About Form 8379, Injured Spouse AllocationInternal 2020

What is Form 8379, Injured Spouse Allocation?

Form 8379, known as the Injured Spouse Allocation, is a tax form used by married couples who file jointly when one spouse has a past-due obligation that could affect the tax refund. This form allows the "injured" spouse to claim their share of the refund, ensuring that they receive their entitled amount despite the other spouse's debts. It is essential for protecting the rights of the spouse who is not responsible for the debt, such as student loans, child support, or federal tax obligations.

Steps to Complete Form 8379

Completing Form 8379 involves several steps to ensure accuracy and compliance with IRS guidelines. Here’s a brief overview of the process:

- Gather necessary documents, including your tax return and any relevant financial statements.

- Provide personal information for both spouses, including Social Security numbers and filing status.

- Calculate the total tax refund and determine the portion attributable to the injured spouse.

- Complete the form by following the instructions carefully, ensuring all information is accurate.

- Submit the completed form along with your tax return or separately if already filed.

How to Obtain Form 8379

You can obtain Form 8379 through various methods. The most straightforward way is to download it directly from the IRS website. Alternatively, you may request a physical copy by contacting the IRS or visiting a local IRS office. Ensure that you have the most current version of the form to avoid any issues during submission.

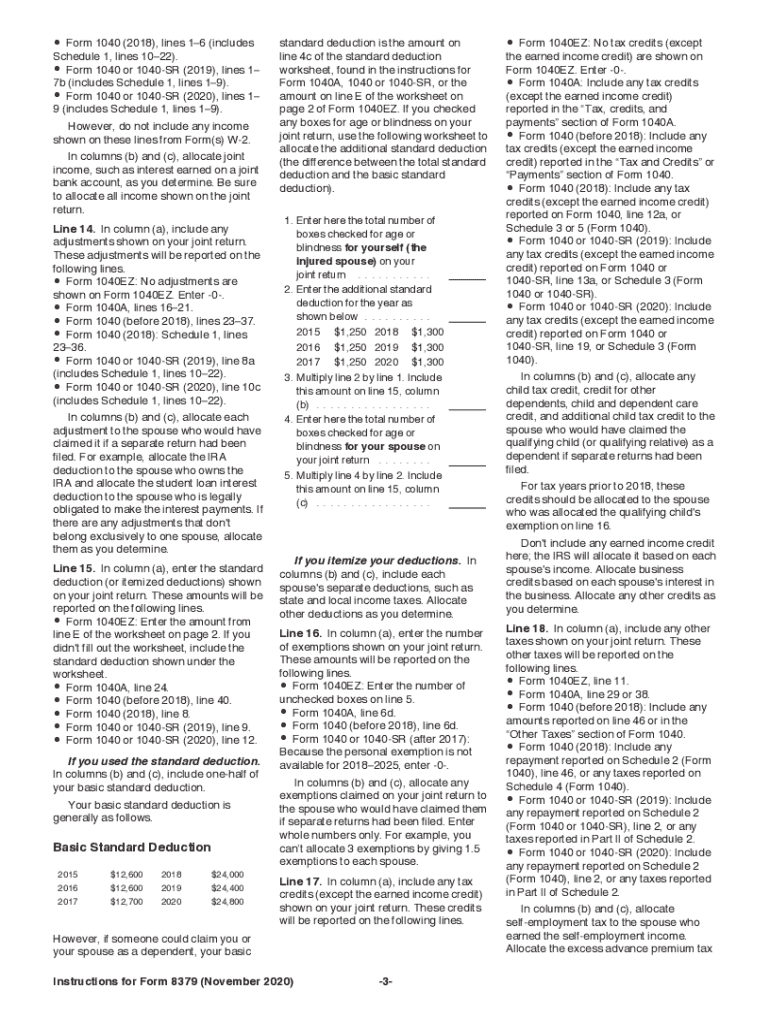

IRS Guidelines for Form 8379

The IRS provides specific guidelines for completing and submitting Form 8379. These include instructions on eligibility, required documentation, and deadlines for submission. It is crucial to follow these guidelines closely to ensure that the form is processed efficiently and to avoid delays in receiving your refund. Familiarizing yourself with these guidelines can help streamline the process and enhance your chances of a successful claim.

Eligibility Criteria for Form 8379

To qualify for filing Form 8379, certain eligibility criteria must be met. Primarily, you must be a married taxpayer filing jointly, and one spouse must have a past-due obligation that affects the tax refund. Additionally, the injured spouse must have earned income or made tax payments during the year in question. Understanding these criteria is vital to ensure that you can successfully claim your portion of the refund.

Form Submission Methods

Form 8379 can be submitted through various methods, depending on whether you are filing it with your tax return or separately. If filing jointly, include it with your tax return. If you have already filed your return, you can submit Form 8379 separately by mailing it to the appropriate IRS address. Ensure that you check the IRS guidelines for the correct submission method to avoid any complications.

Quick guide on how to complete about form 8379 injured spouse allocationinternal

Effortlessly Prepare About Form 8379, Injured Spouse AllocationInternal on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 8379, Injured Spouse AllocationInternal on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

The Easiest Way to Modify and Electronically Sign About Form 8379, Injured Spouse AllocationInternal with Ease

- Locate About Form 8379, Injured Spouse AllocationInternal and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and hit the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or disorganized documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign About Form 8379, Injured Spouse AllocationInternal and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8379 injured spouse allocationinternal

Create this form in 5 minutes!

How to create an eSignature for the about form 8379 injured spouse allocationinternal

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the process to get IRS 8379 print using airSlate SignNow?

To get IRS 8379 print, simply upload your document to the airSlate SignNow platform. You can then add electronic signatures and send it for review. Our user-friendly interface ensures that you can get IRS 8379 print quickly and efficiently.

-

Is there a cost associated with getting IRS 8379 print with airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans to suit your business needs. Each plan includes features such as unlimited document signing and secure storage, allowing you to get IRS 8379 print without any hidden fees.

-

Can I securely store my IRS 8379 print documents on airSlate SignNow?

Absolutely! When you get IRS 8379 print using airSlate SignNow, all your documents are securely stored in the cloud. This ensures easy access and peace of mind knowing your information is protected.

-

How does airSlate SignNow integrate with other tools for IRS 8379 printing?

airSlate SignNow seamlessly integrates with various applications like Google Drive and Dropbox. This means you can directly access and manage files you need to get IRS 8379 print, enhancing your workflow efficiency.

-

Are there features to help track the status of my IRS 8379 print?

Yes, airSlate SignNow provides advanced tracking features that let you monitor the status of your documents. This allows you to see when your IRS 8379 print is opened, signed, or completed, ensuring you're always in the loop.

-

What are the benefits of using airSlate SignNow to get IRS 8379 print?

Using airSlate SignNow to get IRS 8379 print offers numerous benefits, including speed, security, and ease of use. You can complete your documents from anywhere, making it a convenient choice for busy schedules.

-

Is it easy to eSign the IRS 8379 form with airSlate SignNow?

Yes, it is incredibly easy to eSign the IRS 8379 form with airSlate SignNow. The platform simplifies the signing process, allowing users to securely add signatures with just a few clicks to get IRS 8379 print done quickly.

Get more for About Form 8379, Injured Spouse AllocationInternal

- Wisconsin eastern bankruptcy form

- Wisconsin western district bankruptcy guide and forms package for chapters 7 or 13 wisconsin

- Bill of sale with warranty by individual seller wisconsin form

- Bill of sale with warranty for corporate seller wisconsin form

- Bill of sale without warranty by individual seller wisconsin form

- Bill of sale without warranty by corporate seller wisconsin form

- Creditors matrix 497430750 form

- Verification of creditors matrix wisconsin form

Find out other About Form 8379, Injured Spouse AllocationInternal

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form