Ms State Tax Forms 2014

What is the Ms State Tax Forms

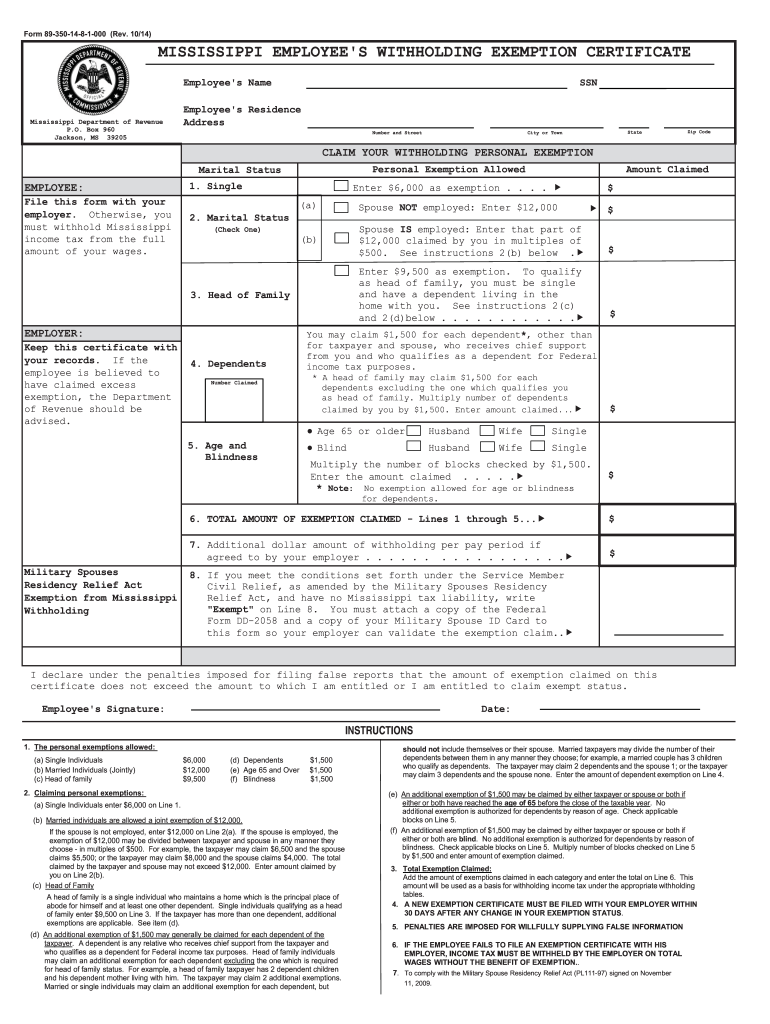

The Ms State Tax Forms are official documents required by the state of Mississippi for various tax-related purposes. These forms facilitate the reporting of income, deductions, and credits to ensure compliance with state tax laws. Taxpayers may need to complete different forms depending on their specific circumstances, such as individual income tax, business taxes, or property taxes. Understanding the purpose of each form is essential for accurate filing and compliance.

How to use the Ms State Tax Forms

Using the Ms State Tax Forms involves several steps to ensure accurate completion and submission. First, identify the specific form required for your tax situation. Next, gather all necessary documentation, such as W-2s, 1099s, and other income statements. Complete the form by accurately entering your financial information, ensuring all calculations are correct. Once completed, review the form for any errors before submitting it according to the guidelines provided by the Mississippi Department of Revenue.

Steps to complete the Ms State Tax Forms

Completing the Ms State Tax Forms requires careful attention to detail. Follow these steps for a smooth process:

- Determine the correct form based on your tax situation.

- Collect all relevant financial documents, including income statements and deduction records.

- Fill out the form accurately, ensuring all required fields are completed.

- Double-check your entries for accuracy, particularly numerical values and calculations.

- Sign and date the form as required.

- Submit the form via the designated method: online, by mail, or in person.

Legal use of the Ms State Tax Forms

The legal use of the Ms State Tax Forms is governed by Mississippi tax laws and regulations. These forms must be filled out accurately and submitted by the established deadlines to avoid penalties. Electronic signatures are generally accepted, provided they comply with the state's eSignature laws. It is crucial to keep copies of submitted forms and any supporting documentation for your records, as these may be needed for future reference or in case of an audit.

Filing Deadlines / Important Dates

Filing deadlines for the Ms State Tax Forms vary based on the type of form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 each year, though extensions may be available. Businesses may have different deadlines depending on their fiscal year. It is essential to stay informed about these dates to ensure timely filing and avoid late fees or penalties.

Required Documents

When completing the Ms State Tax Forms, certain documents are typically required. These may include:

- W-2 forms from employers

- 1099 forms for other income sources

- Documentation for deductions, such as mortgage interest statements

- Receipts for business expenses, if applicable

- Previous year’s tax return for reference

Gathering these documents beforehand can streamline the completion process and ensure accuracy.

Form Submission Methods (Online / Mail / In-Person)

The Ms State Tax Forms can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission via the Mississippi Department of Revenue's website, which may offer faster processing times.

- Mailing the completed forms to the appropriate address as specified in the form instructions.

- In-person submission at designated state tax offices, which may be beneficial for those seeking immediate assistance.

Choosing the right submission method can impact the speed and efficiency of your tax filing experience.

Quick guide on how to complete ms state tax forms 2014

Prepare Ms State Tax Forms effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to access the right template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without interruptions. Handle Ms State Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related activity today.

The easiest method to modify and eSign Ms State Tax Forms without hassle

- Obtain Ms State Tax Forms and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or obscure confidential information with specific tools that airSlate SignNow provides for this task.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Edit and eSign Ms State Tax Forms and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ms state tax forms 2014

Create this form in 5 minutes!

How to create an eSignature for the ms state tax forms 2014

How to generate an eSignature for your Ms State Tax Forms 2014 online

How to generate an eSignature for your Ms State Tax Forms 2014 in Google Chrome

How to create an eSignature for signing the Ms State Tax Forms 2014 in Gmail

How to create an eSignature for the Ms State Tax Forms 2014 straight from your smart phone

How to create an eSignature for the Ms State Tax Forms 2014 on iOS

How to create an eSignature for the Ms State Tax Forms 2014 on Android devices

People also ask

-

What are Ms State Tax Forms and why are they important?

Ms State Tax Forms are essential documents required for filing state taxes in Mississippi. They ensure compliance with state tax laws and help you accurately report your income and deductions. Using airSlate SignNow to complete these forms can simplify the signing process and enhance your tax filing experience.

-

How can airSlate SignNow help with Ms State Tax Forms?

airSlate SignNow streamlines the process of filling out and signing Ms State Tax Forms. Our platform allows you to easily upload, edit, and eSign these forms securely online. This not only saves time but ensures that your documents are professionally handled and stored.

-

Is airSlate SignNow suitable for individuals filing Ms State Tax Forms?

Yes, airSlate SignNow is ideal for both individuals and businesses filing Ms State Tax Forms. Whether you're a freelancer or a small business owner, our user-friendly interface allows you to manage your tax documents efficiently and with ease.

-

What features does airSlate SignNow offer for managing Ms State Tax Forms?

airSlate SignNow provides features such as customizable templates for Ms State Tax Forms, secure eSignature options, and cloud storage for easy access. Additionally, our platform allows for real-time tracking of document status, ensuring you never miss a deadline.

-

Are there any integrations available with airSlate SignNow for Ms State Tax Forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your Ms State Tax Forms. These integrations help streamline your workflow, allowing you to import data directly into your tax documents.

-

What is the pricing structure for using airSlate SignNow for Ms State Tax Forms?

airSlate SignNow offers a variety of pricing plans to accommodate different needs, starting with a free trial. Our plans are cost-effective, ensuring that you can efficiently manage your Ms State Tax Forms without breaking the bank.

-

Can I access my Ms State Tax Forms from anywhere using airSlate SignNow?

Yes, with airSlate SignNow, you can access your Ms State Tax Forms from any device with internet access. Our cloud-based platform ensures that your documents are available whenever you need them, providing flexibility and convenience.

Get more for Ms State Tax Forms

- Eohhs access administrator designation form 2013

- Dallas central appraisal district dallascad form

- Income only trust form

- Fzyr 2011 form

- Resource family applicant registrationupdate form

- Okdhs tulsa form

- In the general court of justice district court division nccourts form

- Special student registration form pdf the evergreen state college evergreen

Find out other Ms State Tax Forms

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word