State Withholding Forms Mississippi 2024-2026

Understanding the Mississippi Withholding Form

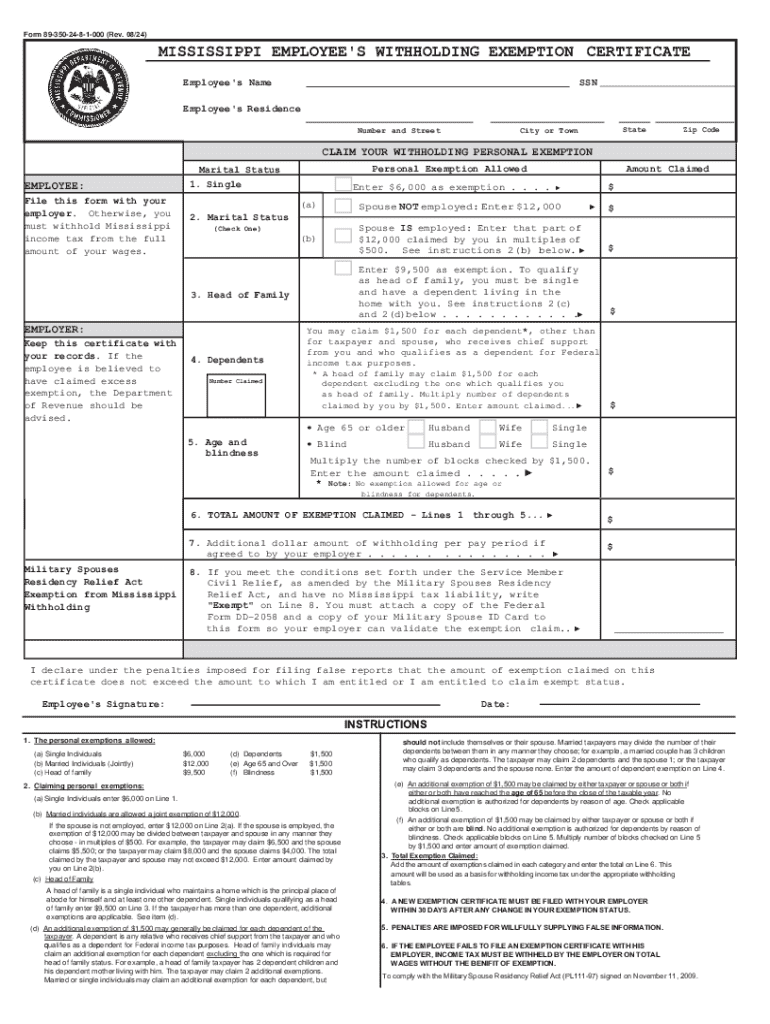

The Mississippi withholding form, often referred to as the MS employee withholding form, is essential for employers in Mississippi to accurately withhold state income taxes from employees' wages. This form helps ensure compliance with state tax regulations and allows employees to manage their tax liabilities effectively. It is crucial for both employers and employees to understand the purpose and requirements of this form to avoid any potential issues with the Mississippi Department of Revenue.

Steps to Complete the Mississippi Withholding Form

Completing the Mississippi withholding form involves several straightforward steps. First, gather the necessary information, including the employee's name, address, and Social Security number. Next, the employee must indicate their filing status, such as single or married, and provide any exemptions they may qualify for. It is also important to calculate the amount to be withheld based on the employee's earnings and the applicable tax rates. Once completed, both the employer and employee should retain a copy for their records.

How to Obtain the Mississippi Withholding Form

The Mississippi withholding form can be obtained from the Mississippi Department of Revenue's official website or directly from employers. It is available in a printable format, making it easy for employees to fill out and submit. Additionally, many payroll software programs include the necessary forms, streamlining the process for businesses and ensuring compliance with state regulations.

Legal Use of the Mississippi Withholding Form

The Mississippi withholding form serves a legal purpose in the context of tax withholding. Employers are required by law to withhold state income taxes from employees' wages, and the completion of this form is a critical step in fulfilling that obligation. Failure to properly complete or submit the form can result in penalties for both the employer and employee, making it essential to adhere to all legal requirements associated with the form.

Key Elements of the Mississippi Withholding Form

Key elements of the Mississippi withholding form include the employee's personal information, filing status, and the number of allowances claimed. Additionally, the form may require information regarding any additional amounts the employee wishes to withhold. Understanding these elements is crucial for accurate completion and compliance with state tax laws.

Filing Deadlines and Important Dates

Filing deadlines for the Mississippi withholding form are typically aligned with the state tax calendar. Employers must ensure that withholding amounts are submitted on time to avoid penalties. It is advisable for both employers and employees to stay informed about any changes in deadlines or requirements to ensure compliance throughout the tax year.

Create this form in 5 minutes or less

Find and fill out the correct state withholding forms mississippi

Create this form in 5 minutes!

How to create an eSignature for the state withholding forms mississippi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Mississippi withholding form?

The Mississippi withholding form is a document used by employers to report and withhold state income taxes from employees' wages. It ensures compliance with Mississippi tax laws and helps employees manage their tax obligations effectively.

-

How can airSlate SignNow help with the Mississippi withholding form?

airSlate SignNow simplifies the process of completing and submitting the Mississippi withholding form by providing an easy-to-use platform for eSigning and document management. This streamlines the workflow, making it faster and more efficient for businesses.

-

Is there a cost associated with using airSlate SignNow for the Mississippi withholding form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that facilitate the completion and management of documents like the Mississippi withholding form, ensuring you get value for your investment.

-

What features does airSlate SignNow offer for managing the Mississippi withholding form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing the Mississippi withholding form. These tools enhance efficiency and ensure that all necessary information is accurately captured.

-

Can I integrate airSlate SignNow with other software for handling the Mississippi withholding form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to seamlessly manage the Mississippi withholding form alongside your existing tools. This integration capability enhances productivity and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Mississippi withholding form?

Using airSlate SignNow for the Mississippi withholding form provides numerous benefits, including reduced paperwork, faster processing times, and improved accuracy. This solution empowers businesses to focus on their core operations while ensuring compliance with state tax regulations.

-

How secure is airSlate SignNow when handling the Mississippi withholding form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to the Mississippi withholding form. You can trust that your documents are safe and secure throughout the signing process.

Get more for State Withholding Forms Mississippi

- Irs form 4748

- Form w 7sp rev november 1999 fill in version

- Form 941cpr rev october 1998 planilla para la correcion de informatcion facilitada anteriormente en cuplimiento con la ley del

- Revocation of s corporation election form

- Cms 40b fill and sign printable template form

- Disenrollment form wellcare

- End of employment verification form

- Ssn and name on tax form does not match warning while

Find out other State Withholding Forms Mississippi

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form