Form MS DoR 89 350 Fill Online, Printable 2023

What is the MS DoR 89 350?

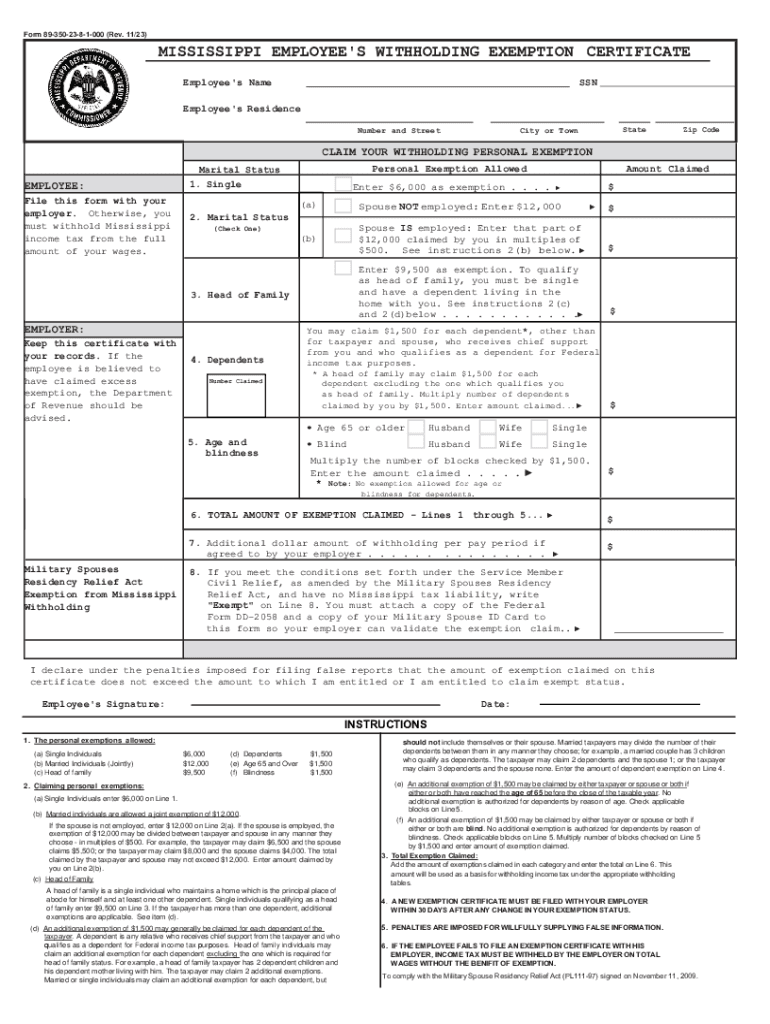

The MS DoR 89 350, commonly referred to as the Mississippi State Withholding Form, is a crucial document for employees and employers in Mississippi. This form is used to determine the amount of state income tax to withhold from an employee's paycheck. It is essential for ensuring compliance with Mississippi tax laws and helps employees manage their tax obligations effectively. By filling out this form, employees can specify their withholding preferences, which can impact their overall tax liability at the end of the year.

Steps to Complete the MS DoR 89 350

Completing the MS DoR 89 350 involves several straightforward steps:

- Obtain the form: Download the latest version of the MS DoR 89 350 from the Mississippi Department of Revenue website or access it through your employer.

- Fill in personal information: Provide your name, address, and Social Security number to identify yourself accurately.

- Claim exemptions: If applicable, indicate any exemptions you qualify for, which may reduce your withholding amount.

- Specify additional withholding: If you wish to have extra amounts withheld from your paycheck, specify this in the designated section.

- Sign and date the form: Your signature confirms the accuracy of the information provided and authorizes your employer to withhold the specified amount.

How to Use the MS DoR 89 350

To effectively use the MS DoR 89 350, employees should submit the completed form to their employer. Employers will then use this information to calculate the appropriate amount of state tax to withhold from each paycheck. It is advisable to review your withholding status periodically, especially after major life changes such as marriage, divorce, or the birth of a child, as these can affect your tax situation. Keeping the form updated ensures that the correct amount is withheld, helping you avoid underpayment or overpayment of taxes.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the MS DoR 89 350. Generally, employees should submit the form to their employer as soon as they start a new job or when there are changes in their tax situation. Employers are required to implement the withholding changes as soon as possible, typically within one pay period. Additionally, the Mississippi tax filing deadline aligns with the federal tax deadline, which is usually April 15 each year. Staying informed about these dates can help ensure compliance and avoid penalties.

Key Elements of the MS DoR 89 350

The MS DoR 89 350 includes several key elements that are important for both employees and employers:

- Employee Information: This section captures the employee's personal details, including name, address, and Social Security number.

- Withholding Allowances: Employees can claim allowances based on their personal circumstances, which directly affect the withholding amount.

- Additional Withholding: Employees have the option to request additional amounts to be withheld, which can be beneficial for those anticipating a tax liability.

- Signature: The employee's signature is required to validate the form and authorize the withholding changes.

Legal Use of the MS DoR 89 350

The MS DoR 89 350 is legally recognized by the Mississippi Department of Revenue as the official form for state income tax withholding. Employers are mandated to use this form to comply with state tax laws. Failure to use the correct form or to withhold the appropriate amounts can result in penalties for both the employer and the employee. It is essential for both parties to understand the legal implications of the information provided on this form to ensure adherence to state regulations.

Quick guide on how to complete form ms dor 89 350 fill online printable

Effortlessly Prepare Form MS DoR 89 350 Fill Online, Printable on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct format and securely store it on the internet. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Handle Form MS DoR 89 350 Fill Online, Printable on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Form MS DoR 89 350 Fill Online, Printable without hassle

- Find Form MS DoR 89 350 Fill Online, Printable and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searches, or errors necessitating the printing of new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Form MS DoR 89 350 Fill Online, Printable to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ms dor 89 350 fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form ms dor 89 350 fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MS state withholding form and why is it important?

The MS state withholding form is a document that allows employers in Mississippi to report and withhold state income taxes from employee wages. It ensures compliance with state tax regulations and helps employees manage their tax responsibilities effectively.

-

How can airSlate SignNow help with the MS state withholding form?

airSlate SignNow simplifies the process of completing and submitting the MS state withholding form. Our platform allows users to easily eSign documents and securely send them, ensuring your withholding forms are submitted on time and accurately.

-

Is there a cost associated with using airSlate SignNow for the MS state withholding form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, providing an affordable solution for handling your MS state withholding form and other documentation. The investment in our platform can save you time and ensure compliance.

-

What features does airSlate SignNow offer for managing the MS state withholding form?

airSlate SignNow offers features such as document templates, electronic signatures, real-time tracking, and secure cloud storage, all of which can be utilized for the MS state withholding form. These tools streamline the documentation process and enhance efficiency.

-

Can I integrate airSlate SignNow with other applications for the MS state withholding form?

Absolutely! airSlate SignNow supports integrations with various business applications, making it easy to incorporate the MS state withholding form into your existing workflows. This integration helps automate the process and improve overall productivity.

-

How secure is the information submitted in the MS state withholding form through airSlate SignNow?

Security is a top priority at airSlate SignNow. All information, including your MS state withholding form, is encrypted and stored securely, ensuring that your data remains protected and confidential throughout the documentation process.

-

What are the benefits of using airSlate SignNow for the MS state withholding form compared to traditional methods?

Using airSlate SignNow for your MS state withholding form offers several advantages over traditional methods, including faster processing times, reduced paper usage, and easier tracking of documents. This digital approach enhances efficiency and minimizes errors.

Get more for Form MS DoR 89 350 Fill Online, Printable

Find out other Form MS DoR 89 350 Fill Online, Printable

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template