Form 89 350 20 3 1 000 Rev 2020

What is the Mississippi Withholding Form?

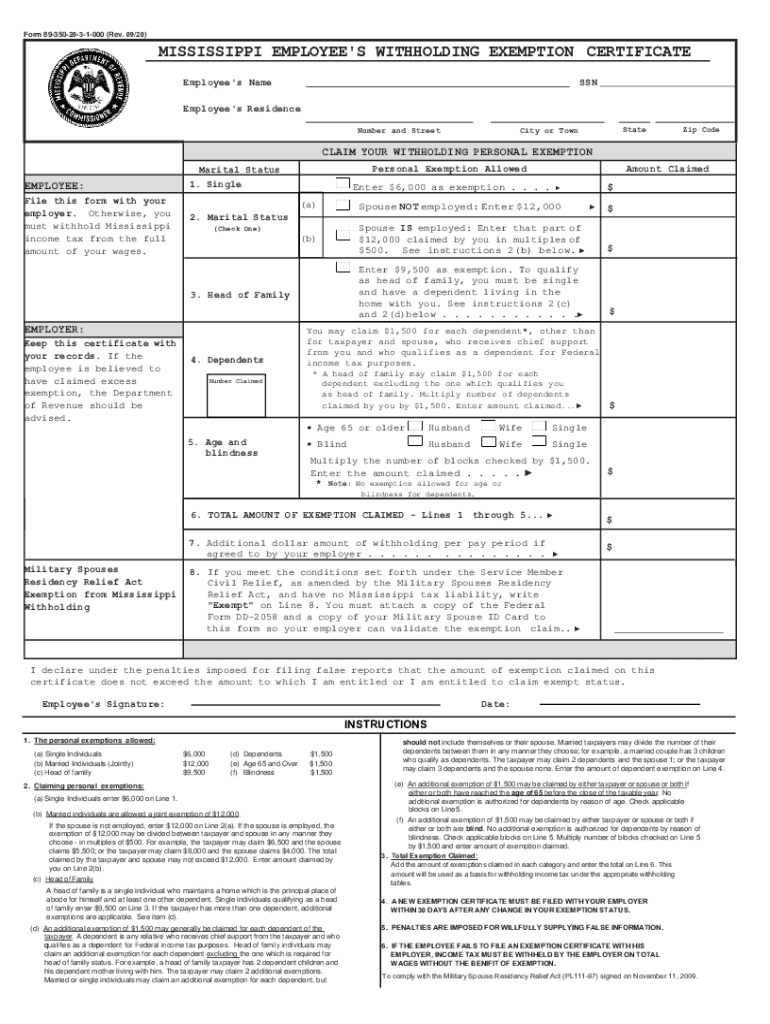

The Mississippi withholding form, officially known as Form 89-350, is a crucial document used by employers to report and withhold state income taxes from employees' wages. This form is essential for ensuring compliance with Mississippi state tax laws and helps employees manage their tax obligations effectively. By accurately completing this form, employers can determine the correct amount of state income tax to withhold based on the employee's earnings and filing status.

How to Use the Mississippi Withholding Form

To use the Mississippi withholding form, employers must first obtain the form from the Mississippi Department of Revenue or through authorized channels. Once in possession of the form, employers should fill it out by providing necessary information such as the employee's name, Social Security number, and the amount to be withheld. It is important to ensure that the information is accurate to avoid issues with tax reporting. After completing the form, employers must submit it to the appropriate state tax authority along with their payroll reports.

Steps to Complete the Mississippi Withholding Form

Completing the Mississippi withholding form involves several key steps:

- Gather employee information: Collect the necessary details, including the employee's full name, address, and Social Security number.

- Determine withholding amount: Use the Mississippi withholding tables to calculate the appropriate amount to withhold based on the employee's earnings and filing status.

- Fill out the form: Enter the collected information and calculated withholding amount accurately on Form 89-350.

- Review the form: Double-check all entries for accuracy to prevent errors that could lead to compliance issues.

- Submit the form: Send the completed form to the Mississippi Department of Revenue along with any required payroll documentation.

Legal Use of the Mississippi Withholding Form

The Mississippi withholding form is legally binding and must be used in accordance with state tax regulations. Employers are required to withhold state income tax from employees' wages and remit these amounts to the state. Failure to comply with these regulations can result in penalties, including fines and interest on unpaid taxes. It is essential for employers to understand their legal obligations regarding the use of this form to avoid potential legal issues.

Key Elements of the Mississippi Withholding Form

Form 89-350 contains several key elements that are critical for accurate completion:

- Employee Information: This section requires the employee's name, address, and Social Security number.

- Filing Status: Employers must indicate the employee's filing status, which affects the withholding amount.

- Withholding Amount: The form includes a space to specify the calculated amount to be withheld from the employee's wages.

- Signature: The form must be signed by the employer or an authorized representative to validate its authenticity.

Filing Deadlines / Important Dates

Employers must be aware of important deadlines related to the Mississippi withholding form to ensure timely compliance. Typically, the withholding amounts must be submitted to the Mississippi Department of Revenue on a monthly or quarterly basis, depending on the employer's total tax liability. Additionally, employers should keep track of any changes in tax laws or deadlines that may affect the filing process. Staying informed about these dates helps prevent penalties and ensures smooth operations.

Quick guide on how to complete form 89 350 20 3 1 000 rev

Effortlessly Prepare Form 89 350 20 3 1 000 Rev on Any Device

Managing documents online has gained traction among businesses and individuals. It offers a superb eco-conscious substitute for conventional printed and signed paperwork, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without complications. Manage Form 89 350 20 3 1 000 Rev on any device via the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The most efficient way to modify and electronically sign Form 89 350 20 3 1 000 Rev with ease

- Find Form 89 350 20 3 1 000 Rev and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight key sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 89 350 20 3 1 000 Rev to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 89 350 20 3 1 000 rev

Create this form in 5 minutes!

How to create an eSignature for the form 89 350 20 3 1 000 rev

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Mississippi withholding form?

The Mississippi withholding form is a document used by employers to calculate and withhold state income tax from employee paychecks. It ensures that the correct amount of taxes is deducted according to Mississippi tax regulations. Utilizing the Mississippi withholding form is essential for compliance with state tax laws and to prevent any penalties.

-

How can airSlate SignNow help with the Mississippi withholding form?

airSlate SignNow simplifies the process of managing the Mississippi withholding form by allowing users to eSign and send documents securely and efficiently. With an easy-to-use interface, you can complete the withholding form quickly, reducing the time spent on paperwork. This ensures that your employees receive their forms promptly and accurately.

-

Is there a cost associated with using airSlate SignNow for the Mississippi withholding form?

Yes, while airSlate SignNow offers various pricing plans, the overall cost is designed to be cost-effective for businesses of all sizes. Costs may vary depending on the features you choose, but using airSlate SignNow for handling the Mississippi withholding form can save time and reduce administrative burden, justifying the investment. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the Mississippi withholding form?

airSlate SignNow offers features such as customizable templates, eSignature capabilities, and secure cloud storage, making it ideal for managing the Mississippi withholding form. These features help streamline the completion and submission of tax forms while ensuring that all signatures are legally binding. Additionally, document tracking and reminders help keep your compliance on track.

-

Can I integrate airSlate SignNow with other software for managing the Mississippi withholding form?

Yes, airSlate SignNow offers integrations with various popular business software, enabling seamless management of the Mississippi withholding form alongside your other business processes. This flexibility enhances productivity and ensures that all documents and data can flow easily between systems. Check our integration page for specifics on which software we support.

-

How secure is the use of airSlate SignNow for the Mississippi withholding form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the Mississippi withholding form. We employ advanced encryption technologies and compliance measures to ensure that your data remains safe throughout the signing process. You can trust that your documents are protected from unauthorized access.

-

What are the benefits of using airSlate SignNow for the Mississippi withholding form?

Using airSlate SignNow for the Mississippi withholding form provides numerous benefits, including faster processing times, reduced paperwork, and improved compliance. By digitizing the signing and submission process, businesses can eliminate errors commonly associated with manual handling. Moreover, the user-friendly interface makes it easy for both employers and employees to complete their tax forms.

Get more for Form 89 350 20 3 1 000 Rev

- Jury instruction 1951 corporation as alter ego of stockholder form

- Subsidiary corporation form

- Jury instruction 10102 debt vs equity form

- Employee contractor tax form

- Gml 239 referral notice onondaga county form

- 1form 20gsee rule 613 2licence to sell stoc

- Usps form 3996

- Residential tenancy agreement rtb 1 form

Find out other Form 89 350 20 3 1 000 Rev

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template