Mississippi Employee Withholding Form 2017

What is the Mississippi Employee Withholding Form

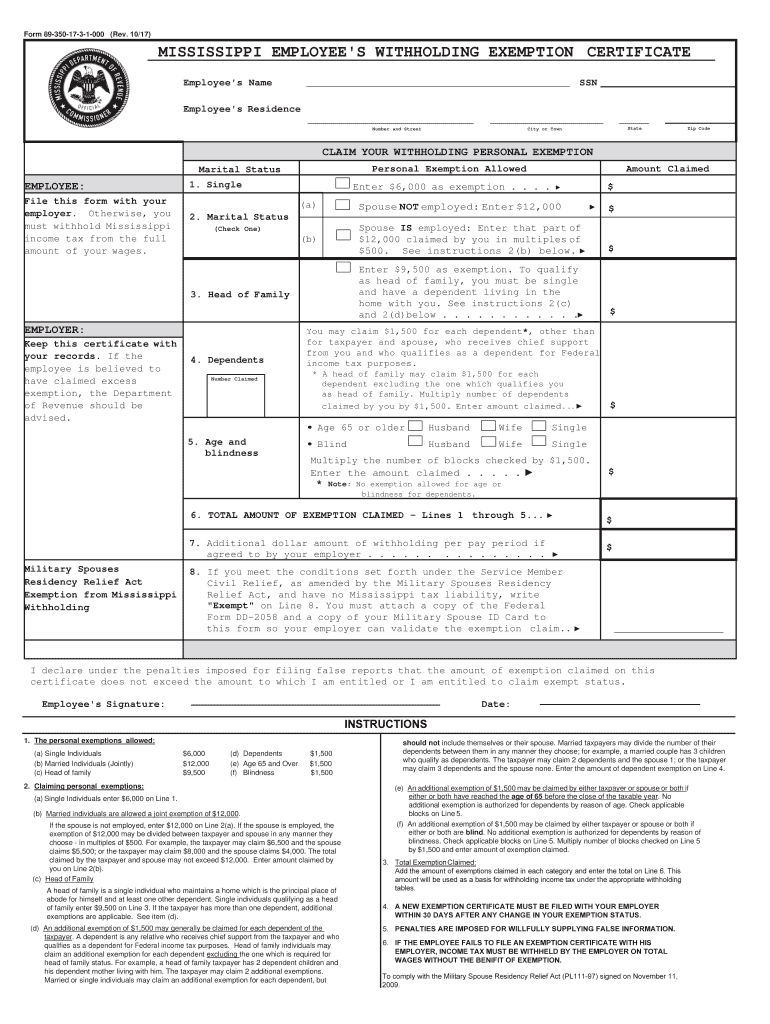

The Mississippi Employee Withholding Form, commonly referred to as the W-4 equivalent for Mississippi, is a crucial document for employers and employees in the state. This form is used to determine the amount of state income tax to withhold from an employee's paycheck. It ensures that the correct amount is deducted, helping both the employee avoid underpayment penalties and the employer comply with state tax regulations.

How to use the Mississippi Employee Withholding Form

To effectively use the Mississippi Employee Withholding Form, employees must accurately complete the form by providing personal information, including their name, address, Social Security number, and filing status. Additionally, employees can indicate any additional amount they wish to withhold or claim exemptions. Employers should keep this form on file and use it to calculate the appropriate withholding amount for each pay period.

Steps to complete the Mississippi Employee Withholding Form

Completing the Mississippi Employee Withholding Form involves several straightforward steps:

- Obtain the form from your employer or download it from a trusted source.

- Fill in your personal details, including your full name, address, and Social Security number.

- Select your filing status, which may include options such as single, married, or head of household.

- Indicate any additional withholding amounts or exemptions you wish to claim.

- Sign and date the form to validate your information.

Legal use of the Mississippi Employee Withholding Form

The legal use of the Mississippi Employee Withholding Form is essential for compliance with state tax laws. Employers are required to withhold state income tax based on the information provided by employees on this form. Failure to use the form correctly can lead to penalties for both the employer and the employee, making it crucial to ensure accuracy and completeness when filling it out.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the Mississippi Employee Withholding Form is vital for both employers and employees. Typically, employees should submit their completed forms to their employer before the first paycheck of the tax year. Employers must ensure that they update their payroll systems accordingly to reflect any changes in withholding as soon as they receive the form.

Form Submission Methods (Online / Mail / In-Person)

The Mississippi Employee Withholding Form can be submitted in various ways, depending on employer policies. Generally, employees can hand in the completed form directly to their HR department or payroll administrator. Some employers may also provide an online portal for digital submission, while others may allow mailing the form to a designated address. It's important to confirm the preferred method with your employer.

Quick guide on how to complete ms state tax forms 2017 2019

Complete Mississippi Employee Withholding Form seamlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Mississippi Employee Withholding Form on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign Mississippi Employee Withholding Form easily

- Locate Mississippi Employee Withholding Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Mississippi Employee Withholding Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ms state tax forms 2017 2019

Create this form in 5 minutes!

How to create an eSignature for the ms state tax forms 2017 2019

How to generate an electronic signature for your Ms State Tax Forms 2017 2019 in the online mode

How to generate an eSignature for your Ms State Tax Forms 2017 2019 in Google Chrome

How to generate an electronic signature for signing the Ms State Tax Forms 2017 2019 in Gmail

How to create an electronic signature for the Ms State Tax Forms 2017 2019 from your smartphone

How to create an electronic signature for the Ms State Tax Forms 2017 2019 on iOS devices

How to create an electronic signature for the Ms State Tax Forms 2017 2019 on Android OS

People also ask

-

What is the Mississippi Employee Withholding Form?

The Mississippi Employee Withholding Form is a tax document that allows employers to withhold state income tax from employees' paychecks. This form is essential for businesses operating in Mississippi to ensure compliance with state tax laws. By using the Mississippi Employee Withholding Form, employers can accurately calculate the necessary withholding amounts based on employee earnings.

-

How does airSlate SignNow simplify the completion of the Mississippi Employee Withholding Form?

airSlate SignNow streamlines the process of completing the Mississippi Employee Withholding Form by providing an easy-to-use platform for electronic signing and document management. Users can fill out, sign, and send the form directly from their devices, making the process faster and more efficient. This reduces paperwork and helps businesses save time during tax season.

-

Are there any costs associated with using airSlate SignNow for the Mississippi Employee Withholding Form?

Yes, airSlate SignNow operates on a subscription-based pricing model, which offers various plans to suit different business needs. The cost may vary depending on the features you choose, but the investment is often outweighed by the time and resources saved when managing documents like the Mississippi Employee Withholding Form. You can explore our pricing options on our website to find the best fit for your organization.

-

What features does airSlate SignNow offer for managing the Mississippi Employee Withholding Form?

airSlate SignNow provides a range of features for managing the Mississippi Employee Withholding Form, including customizable templates, secure e-signature capabilities, and document tracking. These features help ensure that the form is accurately completed and submitted on time. Additionally, users can easily collaborate with team members to streamline the approval process.

-

Can I integrate airSlate SignNow with other software for payroll processing?

Yes, airSlate SignNow offers integrations with various payroll processing software, allowing for seamless data transfer and management. This means you can easily incorporate the Mississippi Employee Withholding Form into your existing payroll system. Integrating these tools helps ensure that employee tax information is accurately reflected and managed.

-

How secure is the information submitted via the Mississippi Employee Withholding Form on airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize industry-leading encryption and compliance measures to protect all information submitted through the Mississippi Employee Withholding Form. This ensures that sensitive employee data remains confidential and secure throughout the signing and submission process.

-

Can I store my completed Mississippi Employee Withholding Forms electronically with airSlate SignNow?

Absolutely! airSlate SignNow allows you to store completed Mississippi Employee Withholding Forms electronically in a secure cloud environment. This not only helps with organization but also ensures that you can access these documents anytime, anywhere, which is essential for maintaining accurate records for your business.

Get more for Mississippi Employee Withholding Form

Find out other Mississippi Employee Withholding Form

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template