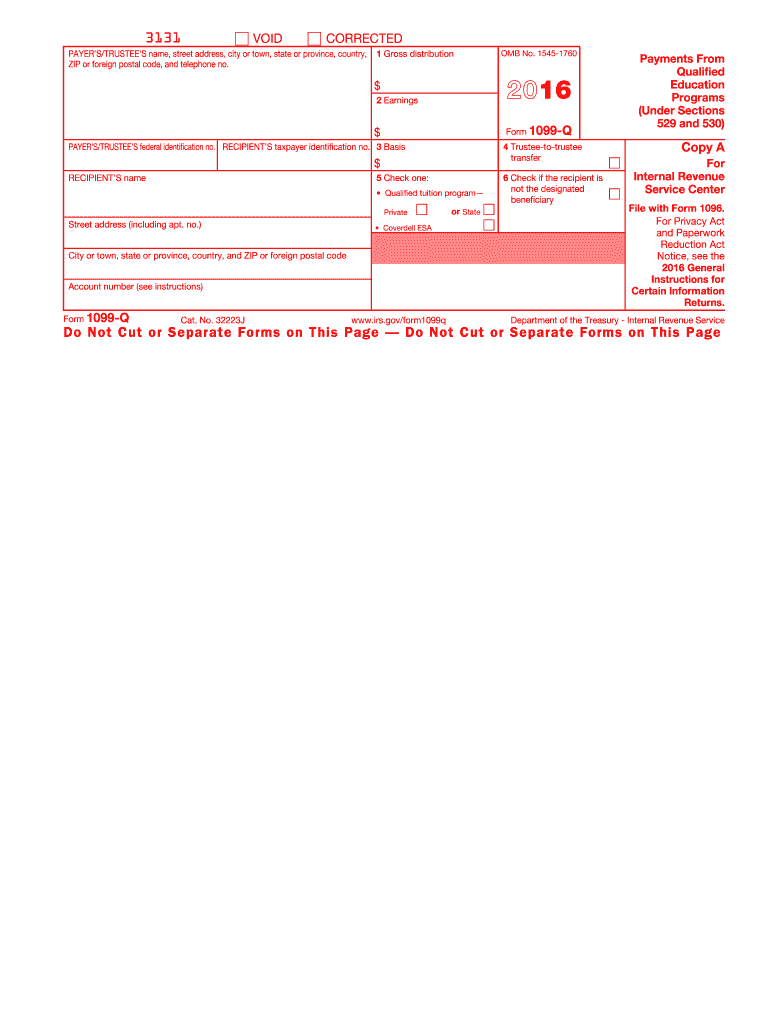

Form 1099 Q 2016

What is the Form 1099 Q

The Form 1099 Q is a tax document used in the United States to report distributions from qualified education programs, including 529 plans and Coverdell Education Savings Accounts (ESAs). This form is crucial for taxpayers who have received funds from these accounts to pay for qualified educational expenses. The information reported on the form helps the IRS determine whether the distributions are taxable or if they qualify for tax-free treatment.

How to use the Form 1099 Q

To use the Form 1099 Q, recipients must review the information provided, which includes the total amount distributed and the earnings portion of the distribution. This information is essential for accurately reporting the income on your tax return. If the funds were used for qualified education expenses, the distribution may not be taxable. It is important to keep this form with your tax records for future reference, especially if you are audited by the IRS.

Steps to complete the Form 1099 Q

Completing the Form 1099 Q involves several key steps:

- Gather Information: Collect all relevant details regarding the education account, including account numbers and distribution amounts.

- Fill Out the Form: Enter the recipient's name, address, and taxpayer identification number, along with the distribution amounts.

- Report Qualified Expenses: Ensure that the amounts reported align with qualified education expenses to avoid tax implications.

- Submit the Form: Send the completed form to the IRS and provide a copy to the recipient.

Legal use of the Form 1099 Q

The Form 1099 Q must be used in accordance with IRS regulations to ensure compliance. This includes accurately reporting distributions and understanding the tax implications of the funds received. Failure to properly report this information can result in penalties or additional taxes owed. It is advisable to consult with a tax professional if there are any uncertainties regarding the legal use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 Q are critical to avoid penalties. Generally, the form must be submitted to the IRS by the end of January of the year following the tax year in which the distributions were made. Recipients should also receive their copies by this date. Staying aware of these deadlines helps ensure compliance and avoids potential issues with the IRS.

Who Issues the Form

The Form 1099 Q is typically issued by financial institutions or educational institutions that manage qualified education accounts. These entities are responsible for providing accurate information regarding distributions made to account holders. It is important for recipients to verify the accuracy of the information on the form, as any discrepancies can lead to complications during tax filing.

Quick guide on how to complete form 1099 q 2016

Complete Form 1099 Q effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Form 1099 Q on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to edit and eSign Form 1099 Q with ease

- Locate Form 1099 Q and then click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and then click on the Done button to preserve your modifications.

- Choose how you would like to submit your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Form 1099 Q and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1099 q 2016

Create this form in 5 minutes!

How to create an eSignature for the form 1099 q 2016

How to make an eSignature for your Form 1099 Q 2016 in the online mode

How to generate an eSignature for your Form 1099 Q 2016 in Google Chrome

How to make an eSignature for signing the Form 1099 Q 2016 in Gmail

How to create an electronic signature for the Form 1099 Q 2016 right from your smart phone

How to generate an eSignature for the Form 1099 Q 2016 on iOS

How to create an eSignature for the Form 1099 Q 2016 on Android OS

People also ask

-

What is Form 1099 Q and why is it important?

Form 1099 Q is a tax form used to report distributions from qualified tuition programs (QTPs). It is crucial for taxpayers to understand this form as it helps ensure accurate reporting of educational expenses and potential tax liabilities. Proper handling of Form 1099 Q can also affect your eligibility for tax deductions and credits.

-

How can airSlate SignNow help with Form 1099 Q?

airSlate SignNow simplifies the process of preparing and signing Form 1099 Q by providing an easy-to-use digital platform. Our solution allows users to securely send, sign, and store documents electronically, making it easier to manage important tax forms like Form 1099 Q efficiently. With airSlate SignNow, you can ensure that your Form 1099 Q is processed smoothly and securely.

-

Is there a cost associated with using airSlate SignNow for Form 1099 Q?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are cost-effective and designed to provide value for features like eSigning and document management, including handling Form 1099 Q. You can choose a plan that fits your budget while ensuring you have the tools necessary to manage your tax forms.

-

Can I integrate airSlate SignNow with my accounting software for Form 1099 Q?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage your Form 1099 Q directly from your existing systems. This integration streamlines your workflow, ensuring that all relevant tax forms are generated and sent efficiently without the need for manual entry.

-

What features does airSlate SignNow offer for managing Form 1099 Q?

With airSlate SignNow, you get features such as customizable templates, easy eSigning, and secure document storage, all tailored for managing Form 1099 Q. Our platform also includes tracking capabilities, so you can monitor the status of sent forms and ensure they are signed on time. These features make it easier to stay compliant with tax regulations.

-

How does airSlate SignNow ensure the security of Form 1099 Q documents?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure cloud storage to protect your Form 1099 Q and other sensitive documents. Additionally, our platform complies with industry standards to ensure that your data is safe and accessible only to authorized users.

-

What types of businesses can benefit from using airSlate SignNow for Form 1099 Q?

Businesses of all sizes can benefit from using airSlate SignNow for managing Form 1099 Q. Whether you are a freelancer, a small business, or a large corporation, our solution provides the flexibility and efficiency needed to handle tax forms effectively. By streamlining the eSigning process, businesses can save time and reduce errors in their tax documentation.

Get more for Form 1099 Q

Find out other Form 1099 Q

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online