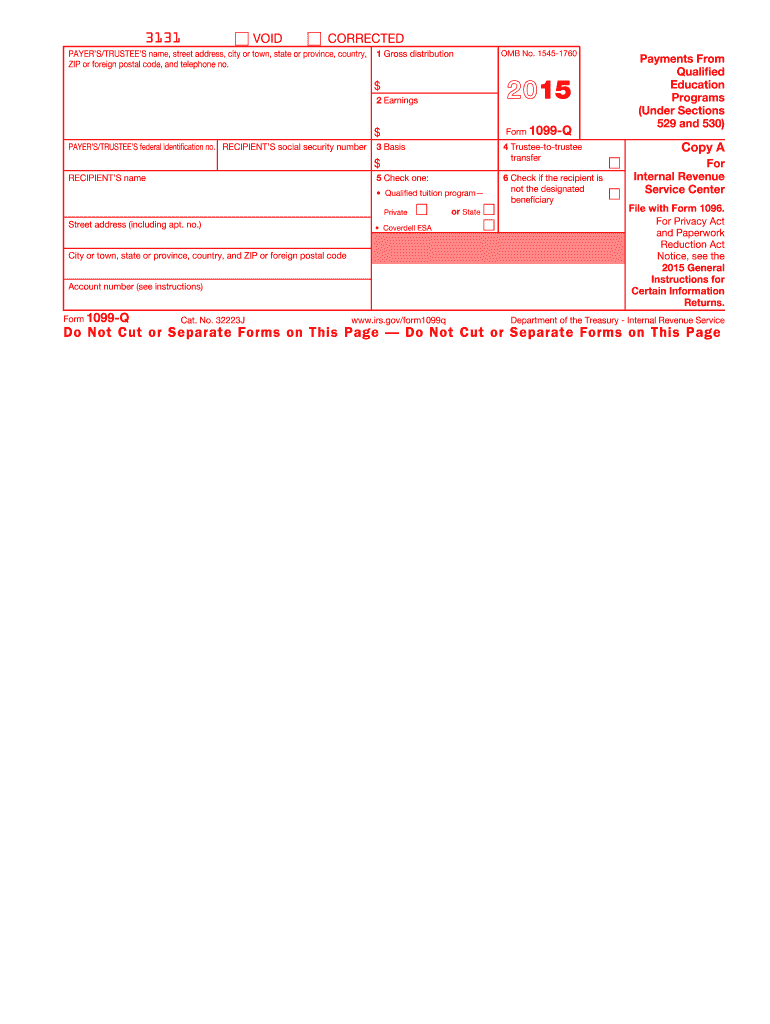

1099 Q Form 2015

What is the 1099 Q Form

The 1099 Q Form is a crucial tax document used in the United States to report distributions from qualified education programs, such as 529 plans and Coverdell Education Savings Accounts. This form is issued by financial institutions to beneficiaries who receive distributions during the tax year. It helps taxpayers understand the amount of funds withdrawn and whether those distributions are taxable. The information on the form is essential for accurately reporting income on tax returns, ensuring compliance with IRS regulations.

How to use the 1099 Q Form

Using the 1099 Q Form involves several steps to ensure proper reporting and compliance. First, review the form for accuracy, checking that your name, Social Security number, and distribution amounts are correct. Next, determine if the distributions are qualified or non-qualified. Qualified distributions, typically used for eligible education expenses, may not be taxable, while non-qualified distributions could incur taxes. Finally, report the relevant amounts on your federal tax return, specifically on Form 1040, to accurately reflect your income and tax obligations.

Steps to complete the 1099 Q Form

Completing the 1099 Q Form involves a systematic approach to ensure accuracy. Follow these steps:

- Gather necessary information, including the beneficiary's details and distribution amounts.

- Fill in the form with accurate data, ensuring all fields are completed correctly.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Legal use of the 1099 Q Form

The legal use of the 1099 Q Form is governed by IRS regulations, which stipulate that accurate reporting of distributions is mandatory. Failure to report distributions correctly can lead to penalties and interest charges. It is essential to retain copies of the form for your records and ensure that all information is disclosed truthfully. The form must be provided to both the IRS and the beneficiary to maintain transparency and compliance with tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Q Form are crucial for compliance. Generally, the form must be submitted to the IRS by the end of January of the year following the tax year in which distributions were made. Beneficiaries should receive their copies by the same deadline. It is important to mark these dates on your calendar to avoid late filing penalties and ensure timely reporting.

Who Issues the Form

The 1099 Q Form is typically issued by financial institutions, such as banks or investment firms, that manage qualified education accounts. These institutions are responsible for reporting the distributions made to beneficiaries during the tax year. It is important for beneficiaries to keep track of these forms as they will need them for accurate tax reporting.

Quick guide on how to complete 2015 1099 q form

Complete 1099 Q Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1099 Q Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric procedure today.

The simplest method to modify and eSign 1099 Q Form with ease

- Obtain 1099 Q Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Craft your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

No more worrying about lost or mislaid files, monotonous form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Alter and eSign 1099 Q Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 q form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 q form

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is a 1099 Q Form?

The 1099 Q Form is used to report distributions from qualified tuition programs, allowing individuals to report earnings and payments related to education savings. Understanding this form is essential for both tax reporting and ensuring compliance with IRS regulations. If you're considering higher education expenses, familiarizing yourself with the 1099 Q Form can help in budgeting and financial planning.

-

How can airSlate SignNow help with the 1099 Q Form?

AirSlate SignNow streamlines the process of filling out and eSigning the 1099 Q Form, making it quick and efficient. Our platform allows users to securely send, receive, and manage their tax-related documents without hassle. By utilizing airSlate SignNow, you can ensure timely submissions and reduce the chances of errors.

-

Is there a cost associated with using airSlate SignNow for 1099 Q Forms?

AirSlate SignNow offers competitively priced plans that cater to various business needs, including those handling 1099 Q Forms. With scalable pricing options, users can choose a plan that fits their budget while benefiting from our features. Investing in our platform can lead to signNow time savings and a streamlined document workflow.

-

What features does airSlate SignNow provide for managing 1099 Q Forms?

AirSlate SignNow offers features such as customizable templates, cloud storage, and an intuitive interface to help you manage 1099 Q Forms effortlessly. The platform also enables real-time tracking of document status, ensuring you stay informed throughout the signing process. These features promote a smoother experience when handling essential tax forms.

-

What are the benefits of using airSlate SignNow for the 1099 Q Form?

Using airSlate SignNow for the 1099 Q Form provides a range of benefits, including enhanced security and compliance with digital signatures. Our platform ensures that your documents are encrypted and securely stored, giving you peace of mind. Additionally, the ease of use allows for faster turnaround times, making tax season less stressful.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Q Forms?

Yes, airSlate SignNow offers integrations with various accounting software to help simplify the management of your 1099 Q Forms. This seamless connection allows you to efficiently sync data and automate workflows, ensuring accuracy and reducing manual errors. By integrating our platform, you can enhance your overall financial management.

-

What types of businesses can benefit from using airSlate SignNow for 1099 Q Forms?

Any business that deals with education-related expenses or manages tuition programs can greatly benefit from using airSlate SignNow for 1099 Q Forms. This includes educational institutions, financial advisors, and companies with employee education benefits. Our tool can simplify the process and improve efficiency across various sectors.

Get more for 1099 Q Form

Find out other 1099 Q Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors