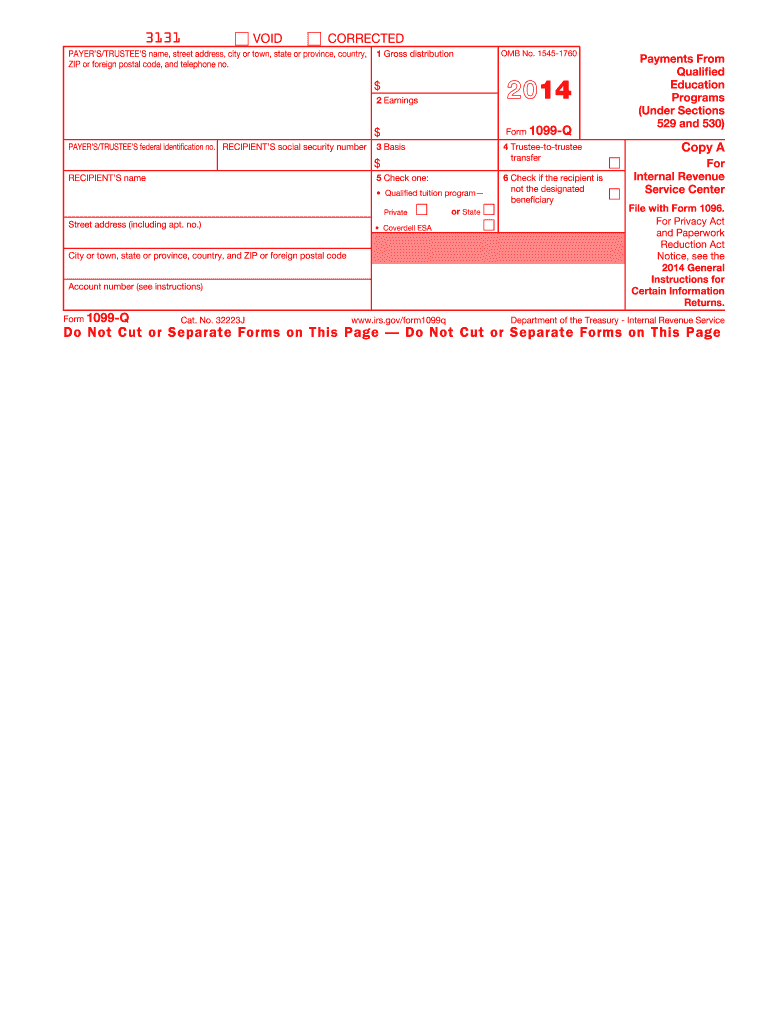

1099 Q Form 2014

What is the 1099 Q Form

The 1099 Q Form, officially known as the "Qualified Tuition Program (QTP) Distribution" form, is used to report distributions from qualified tuition programs, also known as 529 plans. These plans are designed to help families save for future education expenses, including college tuition and related costs. The form provides essential information to the Internal Revenue Service (IRS) regarding the amounts withdrawn from these accounts and the purpose of the distributions.

How to use the 1099 Q Form

To utilize the 1099 Q Form, individuals must first receive the form from the entity managing their 529 plan. Once obtained, it is essential to review the information, which includes the total distribution amount and the portion that may be taxable. Taxpayers should use this information when preparing their federal tax returns to ensure accurate reporting of educational expenses and potential tax liabilities. The form can also assist in determining if any portion of the distribution is subject to penalties or taxes.

Steps to complete the 1099 Q Form

Completing the 1099 Q Form involves several key steps:

- Gather necessary information, including the recipient's name, taxpayer identification number, and details of the qualified tuition program.

- Enter the total distribution amount in the appropriate box on the form.

- Identify and report the taxable portion of the distribution, if applicable.

- Ensure all information is accurate and complete before submitting.

Key elements of the 1099 Q Form

The 1099 Q Form contains several critical elements that taxpayers should be aware of:

- Box 1: Total distribution amount from the qualified tuition program.

- Box 2: The taxable portion of the distribution, which may vary based on the use of the funds.

- Box 3: The portion of the distribution used for qualified education expenses.

- Box 4: The amount of any refunds or adjustments made to previous distributions.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1099 Q Form. Taxpayers must report any distributions from qualified tuition programs on their tax returns. The IRS requires that taxpayers retain documentation of qualified expenses to substantiate the tax-free portion of the distribution. Additionally, any non-qualified withdrawals may incur taxes and penalties, making it essential to understand the rules surrounding these accounts.

Filing Deadlines / Important Dates

Filing deadlines for the 1099 Q Form typically align with the standard tax return deadlines. Taxpayers should expect to receive their forms by January 31 of the year following the distribution. It is important to file the form with the IRS by the established deadlines to avoid penalties. Keeping track of these dates ensures compliance and helps in the timely filing of tax returns.

Who Issues the Form

The 1099 Q Form is issued by the financial institution or entity that manages the qualified tuition program. This could be a state agency or a financial services company that administers 529 plans. Taxpayers should ensure they receive this form annually if they have made withdrawals from their 529 accounts during the tax year.

Quick guide on how to complete 2014 1099 q form

Complete 1099 Q Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle 1099 Q Form on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign 1099 Q Form with ease

- Locate 1099 Q Form and click Get Form to begin.

- Utilize the available tools to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new copies of documents. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign 1099 Q Form and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2014 1099 q form

Create this form in 5 minutes!

How to create an eSignature for the 2014 1099 q form

The way to create an eSignature for a PDF online

The way to create an eSignature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is a 1099 Q Form?

The 1099 Q Form is a tax document used to report distributions from Qualified Education Programs, such as 529 plans. It's important for individuals to understand how this form impacts their taxes and educational expenses. Leveraging airSlate SignNow can simplify the eSigning process for filing your 1099 Q Form.

-

How can airSlate SignNow help with the 1099 Q Form?

airSlate SignNow offers a seamless solution for submitting your 1099 Q Form electronically. With easy-to-use features, you can upload, sign, and send your documents without hassle. This efficiency ensures that you meet deadlines and stay organized during tax season.

-

Is there a cost associated with filing the 1099 Q Form through airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for document signing, fees may vary based on the subscription plan you choose. We offer various pricing tiers to cater to small businesses and larger enterprises. It's essential to review these plans to find the best option for your needs when handling the 1099 Q Form.

-

What features does airSlate SignNow offer for managing the 1099 Q Form?

airSlate SignNow includes features such as document templates, automated workflows, and secure cloud storage for your 1099 Q Form and other important files. These features streamline the process and help ensure that all necessary signatures are collected efficiently. Plus, you can track document status in real-time.

-

Can I integrate airSlate SignNow with other software for managing the 1099 Q Form?

Yes, airSlate SignNow offers integrations with popular software such as accounting tools and CRM systems. This allows you to manage the entire lifecycle of your 1099 Q Form within your existing workflows. Streamlining your processes through integrations can help enhance productivity and reduce errors.

-

What are the benefits of using airSlate SignNow for the 1099 Q Form?

Using airSlate SignNow for your 1099 Q Form provides numerous benefits, including enhanced security, ease of use, and faster processing times. Our platform helps you avoid delays and ensures compliance with tax regulations. Additionally, customers can access their documents anytime, anywhere, increasing flexibility.

-

How secure is the 1099 Q Form when using airSlate SignNow?

AirSlate SignNow prioritizes the security of your 1099 Q Form with industry-standard encryption and compliance with global privacy regulations. Your documents are safely stored, and access is strictly controlled. We take the confidentiality of your sensitive financial information very seriously.

Get more for 1099 Q Form

- Forms with

- Get the building code enforcement addressname change request form

- Student allowance independent circumstances allowance applicationslicaw complete this form if youre applying or independent

- Request for transfer of members pag ibig fund form

- Militarysuper and you are being discharged from the adf as medically unfit for further service form

- Civil works registration procedures department of dpwh form

- March 2018 results of licensure examination for teachers form

- Reference to the chief executive in the land act 1994 form

Find out other 1099 Q Form

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple