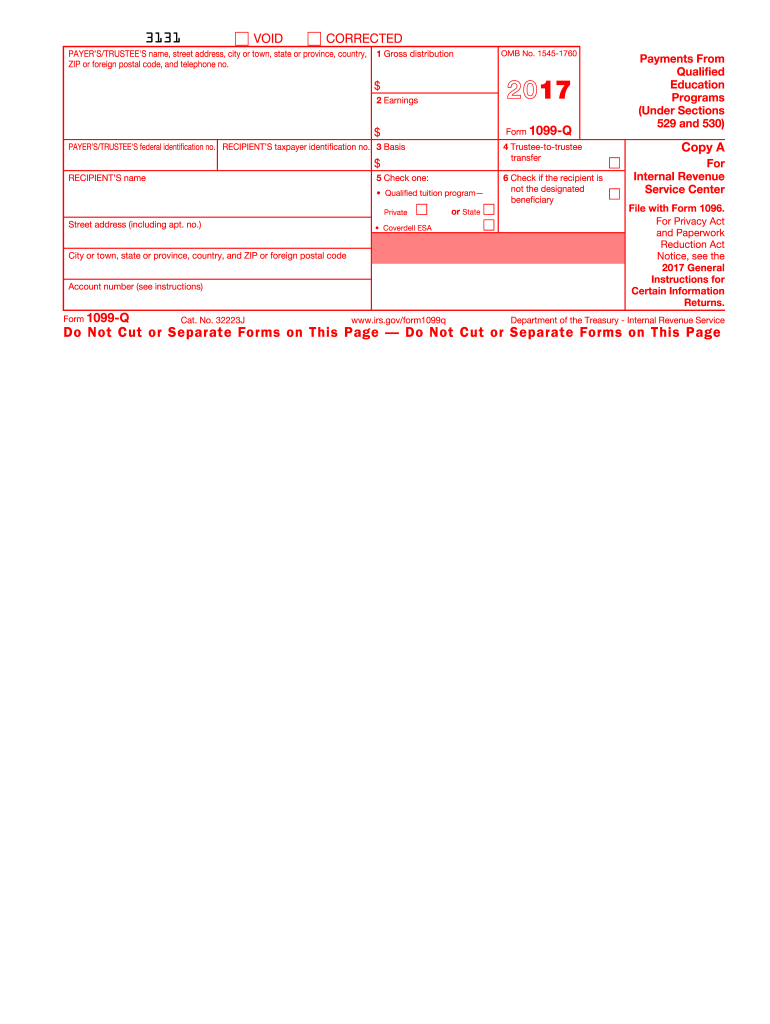

1099 Q Form 2017

What is the 1099-Q Form

The 1099-Q Form is a tax document used in the United States to report distributions from qualified tuition programs (QTPs), also known as 529 plans. This form is essential for individuals who have received payments for education expenses, allowing them to accurately report these distributions on their tax returns. The form includes information about the total amount distributed, the earnings portion, and the basis, which is the amount contributed to the account. Understanding the 1099-Q Form is crucial for ensuring compliance with IRS regulations and for maximizing potential tax benefits associated with education savings plans.

How to Use the 1099-Q Form

Using the 1099-Q Form involves several key steps. First, individuals should verify that they have received the form from the financial institution managing their qualified tuition program. Once in possession of the form, recipients must review the information for accuracy, including the amounts distributed and the beneficiary's details. This form is then used when filing federal income taxes, where the amounts reported must be included on the appropriate tax return forms. It is important to determine whether the distributions were used for qualified education expenses to avoid potential tax penalties.

Steps to Complete the 1099-Q Form

Completing the 1099-Q Form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the recipient's tax identification number and details about the qualified tuition program.

- Fill in the recipient's name and address accurately to ensure proper identification.

- Report the total distribution amount in Box 1, the earnings in Box 2, and the basis in Box 3.

- Ensure that the beneficiary's information is correctly listed, as this is crucial for tax reporting.

- Review the completed form for any errors before submitting it to the IRS and providing a copy to the recipient.

Legal Use of the 1099-Q Form

The 1099-Q Form serves a significant legal purpose in the context of tax reporting. It is essential for compliance with IRS regulations regarding distributions from qualified tuition programs. The form must be filed correctly to avoid penalties and ensure that the tax implications of education savings are accurately reported. Recipients should retain a copy of the form for their records, as it may be required for future tax filings or audits. Understanding the legal implications of this form can help individuals navigate potential tax liabilities associated with education expenses.

Filing Deadlines / Important Dates

Filing deadlines for the 1099-Q Form are crucial for compliance. The form must be provided to recipients by January 31 of the year following the distribution. Additionally, the IRS requires that the form be filed by the end of February if submitted on paper, or by the end of March if filed electronically. It is important to adhere to these deadlines to avoid penalties and ensure that all tax obligations are met in a timely manner. Keeping track of these dates can help individuals manage their tax responsibilities effectively.

Who Issues the Form

The 1099-Q Form is typically issued by the financial institution or organization that manages the qualified tuition program. This could be a state agency, a college or university, or a private financial institution. It is the responsibility of these entities to provide accurate information regarding distributions made during the tax year. Recipients should ensure they receive this form from the issuing organization, as it is essential for reporting income and determining tax obligations related to education expenses.

Examples of Using the 1099-Q Form

There are various scenarios in which the 1099-Q Form is utilized. For instance, if a parent withdraws funds from a 529 plan to pay for their child's college tuition, they will receive a 1099-Q Form detailing the distribution. This form helps the parent report the income on their tax return and determine if any portion of the distribution is taxable. Another example includes a student using funds from their own 529 plan account to cover qualified education expenses, which also necessitates the use of the 1099-Q Form for accurate tax reporting. Understanding these examples can clarify the form's practical applications in real-life situations.

Quick guide on how to complete 2015 1099 q 2017 form

Complete 1099 Q Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without any holdups. Handle 1099 Q Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest method to alter and electronically sign 1099 Q Form with ease

- Obtain 1099 Q Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize crucial parts of the documents or obscure sensitive details using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you prefer. Alter and electronically sign 1099 Q Form to ensure top-notch communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2015 1099 q 2017 form

Create this form in 5 minutes!

How to create an eSignature for the 2015 1099 q 2017 form

How to create an electronic signature for the 2015 1099 Q 2017 Form in the online mode

How to create an electronic signature for the 2015 1099 Q 2017 Form in Chrome

How to generate an eSignature for putting it on the 2015 1099 Q 2017 Form in Gmail

How to make an eSignature for the 2015 1099 Q 2017 Form right from your smartphone

How to create an electronic signature for the 2015 1099 Q 2017 Form on iOS

How to generate an electronic signature for the 2015 1099 Q 2017 Form on Android OS

People also ask

-

What is a 1099 Q Form?

The 1099 Q Form is a tax document used to report distributions from qualified tuition programs, including 529 plans. It is important for taxpayers to understand the details on this form to correctly file their taxes and avoid potential penalties.

-

How can airSlate SignNow help with the 1099 Q Form?

airSlate SignNow provides a seamless platform for creating, signing, and managing your 1099 Q Form electronically. It streamlines the process, ensuring you can easily fill out and send this important tax document without hassle.

-

What features does airSlate SignNow offer for handling 1099 Q Forms?

With airSlate SignNow, you can easily eSign and store your 1099 Q Form securely. Features like templates, automated workflows, and in-platform collaboration make it convenient for businesses to manage their tax documents efficiently.

-

Is airSlate SignNow cost-effective for filing 1099 Q Forms?

Yes, airSlate SignNow is a cost-effective solution for businesses, allowing you to manage your 1099 Q Form requirements without breaking the bank. With flexible pricing plans, it caters to the needs of businesses of all sizes.

-

Are there integration options for using airSlate SignNow with other software for 1099 Q Forms?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and accounting software, allowing easy management of your 1099 Q Form alongside your other financial documents. This integration enhances workflow efficiency.

-

Can airSlate SignNow help ensure compliance when using the 1099 Q Form?

Yes, airSlate SignNow helps ensure compliance by providing templates that meet IRS requirements for the 1099 Q Form. The platform also maintains a secure environment for storing and managing sensitive tax information.

-

What benefits does airSlate SignNow offer for remote teams working with 1099 Q Forms?

airSlate SignNow allows remote teams to collaborate efficiently on the 1099 Q Form using its cloud-based platform. This facilitates easy access to documents, streamlined communication, and faster turnaround times for signatures.

Get more for 1099 Q Form

Find out other 1099 Q Form

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT