1040a Form 2016

What is the 1040A Form

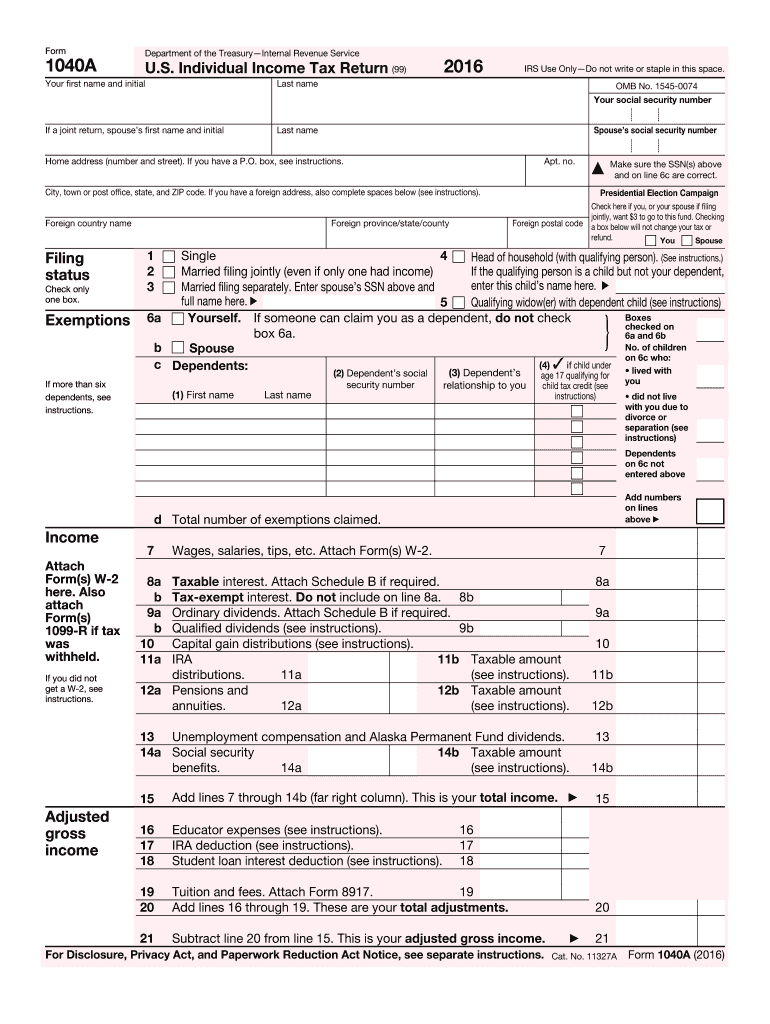

The 1040A Form is a simplified version of the standard 1040 tax return form used by U.S. taxpayers. It allows individuals to report their income, claim certain tax credits, and calculate their tax liability. This form is primarily designed for those with straightforward financial situations, such as individuals who earn wages, salaries, or pensions and do not have complex tax situations like itemized deductions or self-employment income. The 1040A Form streamlines the filing process, making it easier for eligible taxpayers to complete their tax returns efficiently.

How to use the 1040A Form

Using the 1040A Form involves several steps to ensure accurate reporting of income and tax calculations. First, gather all necessary documents, including W-2 forms, interest statements, and any other income documentation. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your income in the designated sections and claim any eligible tax credits. Finally, review the completed form for accuracy, sign it, and submit it by the appropriate deadline. Utilizing electronic tools can simplify this process, allowing for easy eSigning and submission.

Steps to complete the 1040A Form

Completing the 1040A Form involves a systematic approach to ensure all information is accurate. Follow these steps:

- Gather necessary documents, such as W-2s and 1099s.

- Enter your personal information at the top of the form.

- Report your total income in the income section.

- Claim any adjustments to income, if applicable.

- Fill in the tax credits you qualify for.

- Calculate your total tax liability.

- Sign and date the form before submission.

Legal use of the 1040A Form

The 1040A Form is legally recognized by the Internal Revenue Service (IRS) as a valid method for U.S. taxpayers to report their income and calculate taxes owed. To ensure legal compliance, it is essential to follow IRS guidelines when completing the form. This includes accurately reporting income, claiming only eligible deductions and credits, and submitting the form by the established deadlines. Failure to comply with these regulations may result in penalties or audits, making it crucial to maintain accuracy and honesty in all reported information.

Filing Deadlines / Important Dates

Filing deadlines for the 1040A Form align with the general tax filing schedule set by the IRS. Typically, individual taxpayers must submit their forms by April 15 of each year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension, allowing additional time to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. Keeping track of these important dates is essential for a smooth filing process.

Who Issues the Form

The 1040A Form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement of tax laws. The IRS provides the form as part of its annual tax filing requirements for individuals. Taxpayers can obtain the 1040A Form directly from the IRS website or through various tax preparation software that includes the form as part of their services. Ensuring that you are using the most current version of the form is important for compliance with tax regulations.

Quick guide on how to complete 1040a 2016 form

Complete 1040a Form seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage 1040a Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign 1040a Form effortlessly

- Find 1040a Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your edits.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiresome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign 1040a Form while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040a 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 1040a 2016 form

How to generate an eSignature for the 1040a 2016 Form in the online mode

How to make an eSignature for the 1040a 2016 Form in Chrome

How to generate an electronic signature for signing the 1040a 2016 Form in Gmail

How to generate an eSignature for the 1040a 2016 Form right from your smart phone

How to make an eSignature for the 1040a 2016 Form on iOS

How to create an electronic signature for the 1040a 2016 Form on Android OS

People also ask

-

What is a 1040a Form, and why do I need it?

The 1040a Form is a simplified version of the federal income tax form 1040 that allows taxpayers to report their income and claim certain tax benefits. Using the 1040a Form makes it easier for filers with straightforward tax situations to complete their returns. It is essential for those eligible taxpayers looking to maximize their deductions.

-

How can airSlate SignNow help with the 1040a Form?

airSlate SignNow offers an efficient solution for signing and sending the 1040a Form electronically, streamlining the tax filing process. With its user-friendly interface, businesses and individual taxpayers can quickly collect eSignatures and ensure that their forms are submitted securely. You can enhance your overall workflow with our seamless eSignature integration.

-

Is there a cost associated with using airSlate SignNow for 1040a Form?

Yes, while airSlate SignNow offers competitive pricing, the cost will depend on the specific plan you choose. Our pricing is designed to be cost-effective for businesses of all sizes, ensuring access to essential features like eSigning, document storage, and more. You can get started with a free trial to explore our services.

-

What features does airSlate SignNow provide for the 1040a Form?

airSlate SignNow provides a variety of features tailored for working with the 1040a Form, including eSignature collection, document sharing, and customizable templates. These features make it easy to prepare, sign, and submit your tax documents securely online. Additionally, our platform offers real-time tracking of document status.

-

Can I integrate airSlate SignNow with other software for managing the 1040a Form?

Absolutely! airSlate SignNow supports integrations with various software applications to enhance your workflow for the 1040a Form. Popular integrations include CRM systems, cloud storage services, and accounting software. This allows for seamless document management and ensures that your data is always accessible.

-

What are the benefits of using airSlate SignNow for my tax documents, particularly the 1040a Form?

Using airSlate SignNow for your tax documents, like the 1040a Form, provides benefits such as improved efficiency, security, and ease of use. Our platform ensures that your documents are signed and submitted quickly, reducing turnaround times and enhancing compliance. You can also store your documents securely in the cloud.

-

Is there customer support available for issues related to the 1040a Form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any issues related to the 1040a Form or our platform. Our support team is knowledgeable and ready to help you navigate any challenges you may face while using our services. Whether you need technical assistance or have questions about features, we're here to help.

Get more for 1040a Form

- Michigan do not resuscitate order dnr statutory form

- Vermont limited liability company llc operating agreement form

- Oklahoma durable power of attorney effective immediately form

- Georgia cancellation of preliminary lien notice for final payment sect 44 14 362 individual form

- Texas tod form

- Oklahoma legal last will and testament form for widow or widower with minor children

- Nv contract sale form

- Quit deed claim form

Find out other 1040a Form

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement