1040a Form 2013

What is the 1040A Form

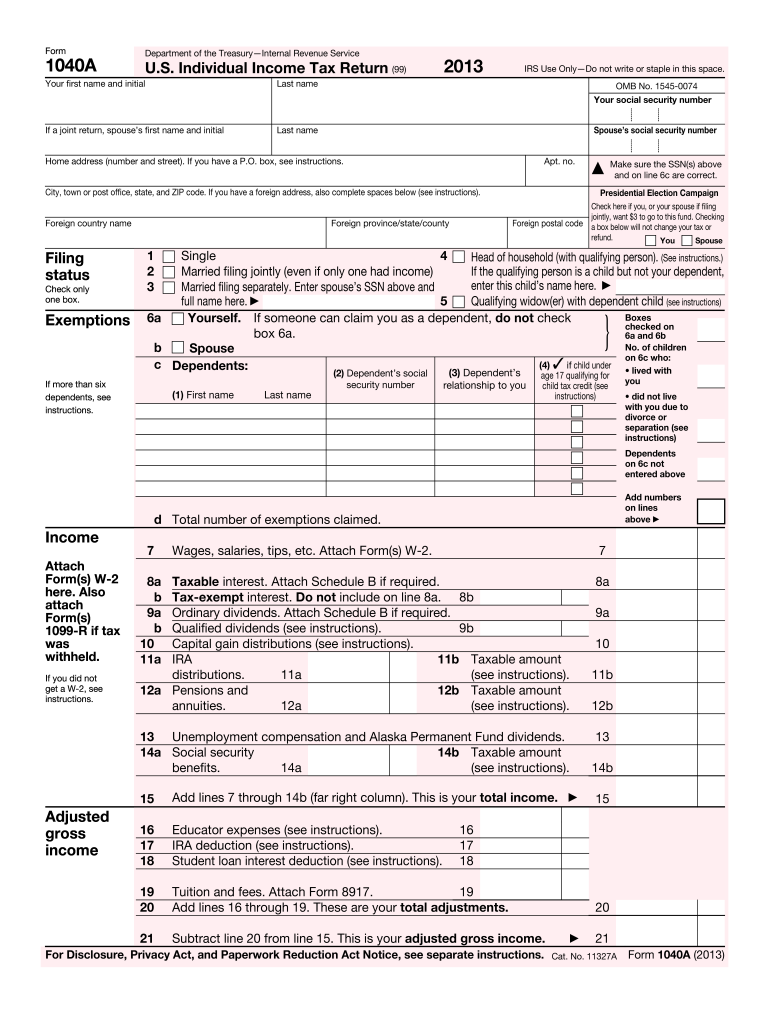

The 1040A Form is a simplified version of the standard IRS Form 1040, used by taxpayers in the United States to file their federal income tax returns. This form is designed for individuals with straightforward tax situations, allowing them to report income, claim certain tax credits, and calculate their tax liability. It is important to note that the 1040A Form is no longer in use after the 2017 tax year, as the IRS has streamlined tax filing processes, encouraging the use of the standard 1040 Form for all taxpayers.

How to Use the 1040A Form

Using the 1040A Form involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. Ensure that all calculations are accurate to avoid potential issues with the IRS. Once completed, the form can be submitted via mail or electronically, depending on your preference and eligibility.

Steps to Complete the 1040A Form

Completing the 1040A Form requires careful attention to detail. Follow these steps for a successful filing:

- Gather all relevant documents, including income statements and previous tax returns.

- Enter your personal information in the designated sections, including your name, address, and Social Security number.

- Report your income by filling in the appropriate lines for wages, interest, and other sources of income.

- Claim any deductions or credits you qualify for, such as the standard deduction or education credits.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy and completeness before submission.

Legal Use of the 1040A Form

The 1040A Form is legally binding when completed accurately and submitted in compliance with IRS regulations. It serves as a formal declaration of your income and tax liability. To ensure its legal validity, it is essential to provide truthful information and maintain supporting documentation for any claims made on the form. Filing the form electronically through a compliant service can enhance security and ensure adherence to legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the 1040A Form typically align with the annual tax filing season. Taxpayers are generally required to file their returns by April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the IRS website for any updates or changes to filing deadlines, as well as for information on extensions if needed.

Required Documents

To complete the 1040A Form, certain documents are essential. These include:

- W-2 forms from employers detailing wages and tax withheld.

- 1099 forms for any additional income, such as freelance work or interest earnings.

- Records of any deductions or credits you plan to claim, such as tuition statements or mortgage interest statements.

- Previous year’s tax return for reference.

Form Submission Methods (Online / Mail / In-Person)

The 1040A Form can be submitted through various methods. Taxpayers may choose to file electronically using IRS-approved tax software, which often provides a more efficient and secure process. Alternatively, the form can be printed and mailed to the appropriate IRS address based on your state of residence. In-person submission is generally not available for the 1040A Form, as most taxpayers file through electronic or mail methods.

Quick guide on how to complete 1040a 2013 form

Accomplish 1040a Form seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the required form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents promptly without interruptions. Manage 1040a Form on any device with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign 1040a Form effortlessly

- Find 1040a Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize critical parts of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a customary wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign 1040a Form to ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040a 2013 form

Create this form in 5 minutes!

How to create an eSignature for the 1040a 2013 form

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is a 1040a Form?

The 1040a Form is a simplified version of the standard IRS tax form designed for individual taxpayers. It allows filers to report their income, calculate the tax owed, and claim various deductions and credits. Using the 1040a Form can expedite the filing process for those eligible.

-

How can airSlate SignNow assist with 1040a Form submissions?

AirSlate SignNow enables users to easily send and eSign the 1040a Form securely online. With its user-friendly interface, you can prepare your tax documents, add signatures, and submit them without any hassle. This streamlined process saves time and reduces the chances of errors.

-

What features does airSlate SignNow offer for handling the 1040a Form?

AirSlate SignNow provides features such as document templates specifically for the 1040a Form, electronic signatures, and cloud storage. Additionally, users can track the status of documents and receive notifications upon signing. These features enhance convenience and efficiency during tax season.

-

Is airSlate SignNow a cost-effective solution for managing tax documents like the 1040a Form?

Yes, airSlate SignNow is an affordable solution for businesses and individuals needing to manage tax documents like the 1040a Form. With flexible pricing plans, users can choose a package that fits their needs without breaking the bank. This cost-effectiveness ensures that you can file your taxes affordably.

-

Can I integrate airSlate SignNow with other applications for filing the 1040a Form?

Absolutely! airSlate SignNow offers integrations with various accounting and document management applications, simplifying the process of filling out and submitting your 1040a Form. This connectivity allows for seamless data transfer and enhances your workflow.

-

What are the benefits of using airSlate SignNow for the 1040a Form?

Using airSlate SignNow for the 1040a Form provides numerous benefits, including security, speed, and ease of use. The platform ensures your documents are encrypted and safe, while its intuitive interface allows for quick completion and signing. This blend of safety and efficiency can signNowly ease your tax preparation.

-

How does airSlate SignNow ensure the security of sensitive information in the 1040a Form?

AirSlate SignNow utilizes advanced encryption protocols to protect sensitive information within the 1040a Form. All data is securely stored in the cloud, while user access is controlled through authentication processes. This focus on security helps ensure your tax-related data remains confidential.

Get more for 1040a Form

- Current hospitalpractice form

- Aaa application form

- Certification of compliance with apa ethical principles american apa form

- Pc perks enrollment form canada rodan fields

- 10 team bracket form

- Tac toe homework form

- Enrollmentauthorization form playworks

- This packet is to be completed in full for any changes or recertification form

Find out other 1040a Form

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple